Despite the macro uncertainty, the S&P 500 Index (SPX) has been able to hold on to its gains so far this year. The SPDR S&P 500 ETF Trust (SPY), a top ETF (Exchange Traded Fund) that tracks the S&P 500 Index, has increased about 7.4% year-to-date. Further, based on technical indicators, SPY is a Buy near its current levels.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

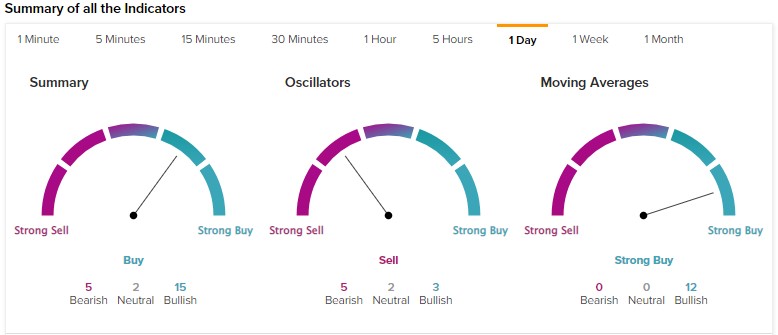

According to TipRanks’ technical analysis tool, the SPDR S&P 500 ETF Trust’s 50-Day EMA (exponential moving average) is 398.49, while its price is $409.19, making it a Buy. Further, the short duration EMA (20-day) also signals a Buy.

While the moving averages indicate a Buy, its RSI (Relative Strength Index) is 61.03, implying a Neutral signal. Notably, the SPY could face immediate resistance near $419 (based on Pivot Points) levels, which is also near its recent swing high (refer to the graph below).

Is SPY a Buy, Hold, or Sell?

Overall, SPY is a Buy based on our easy-to-read summary signals (which combine the moving averages and the technical indicators into a single, summarized call).

Meanwhile, the SPY has approximately another 13% upside based on the consensus of over 6K analysts. Per the recommendations of 6,303 analysts, the 12-month average SPDR S&P 500 ETF Trust price target of $462.60 implies 13.05% upside potential.

The ETF has a Moderate Buy consensus rating on TipRanks. Among the 6,303 analysts providing ratings on 505 holdings of SPY, 57.62% have given a Buy rating, 36.74% have assigned a Hold rating, and 5.63% have given a Sell rating.

SPY has delivered an average annualized return of 12.11% in the past decade. Impressively, it has a low expense ratio of 0.09%, which is attractive.