The SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust (QQQ) are among the widely-discussed ETFs (exchange-traded funds) on the popular social media platform Reddit. While these ETFs are buzzing on Reddit and have significantly gained mentions, their recent rallies give them limited upside potential (based on analysts’ price targets on their holdings).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But before we dig deeper into these buzzing Reddit ETFs, let’s understand how TipRanks determines the ratings and price targets on ETFs.

How Does TipRanks Determine Analyst Ratings on ETFs?

TipRanks leverages its proprietary technology to calculate the consensus analyst forecast and price targets for ETFs by taking all their underlying assets into consideration. At a glance, you will see the overall analyst rating, analyst price target, and upside or downside on an ETF.

Innovatively, TipRanks calculates a weighted average number based on the combination of all the ETFs’ holdings. For instance, the average price forecast for an ETF is calculated by multiplying each holding’s price target by its weight (allocation) in the ETF.

Is SPY ETF Good to Buy Now?

SPY is one of the most popular ETFs to diversify risk and earn steady returns. For instance, the SPDR S&P 500 ETF has the S&P 500 Index (SPX) as the benchmark and aims to provide similar returns.

Impressively, the ETF is highly diversified, offers exposure to 24 separate industry groups, and primarily focuses on large-cap stocks. Meanwhile, it has delivered an average annualized return of 12.72% in the past decade with a low expense ratio of 0.09%, which makes it a compelling long-term investment.

While SPY is an attractive investment, investors can wait for a better entry point. SPY has gained about 20% year-to-date. Thanks to the recent gains, SPY is trading at a forward price-to-earnings multiple of 20.74, which appears expensive given the estimated EPS growth forecast of 12.48% over the next three to five years.

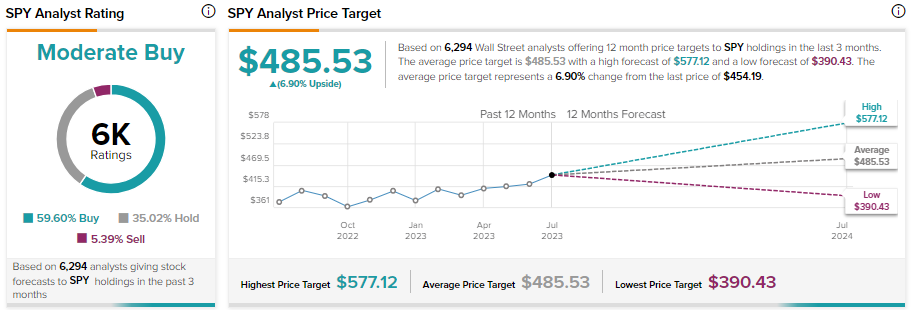

Yes, the SPY ETF has an Outperform Smart Score of 8 out of 10 on TipRanks. However, per the recommendations of 6,294 analysts giving stock forecasts for SPY’s holdings, the 12-month average SPY price target of $485.53 implies limited upside potential of 6.9% from current levels. Also, the SPY ETF carries a Moderate Buy consensus rating on TipRanks.

Among the analysts providing ratings on its holdings, 59.60% have given a Buy rating, 35.02% have assigned a Hold rating, and 5.39% have given a Sell rating.

Is QQQ Stock a Buy or Sell?

The recovery in mega-cap technology companies has led to significant growth in the QQQ ETF. For instance, QQQ has gained over 45% on a year-to-date basis, led by the rally in the shares of its top five holdings, which are Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), Amazon (NASDAQ:AMZN), and Tesla (NASDAQ:TSLA).

Together, its top five holdings account for 43.53% of its total holdings, implying that its performance is highly dependent on them. While these tech giants are poised to deliver strong growth in the long term, their recent rallies and valuation concerns could restrict their upside potential in the short term. This is well reflected in analysts’ price forecast for QQQ over the next 12 months.

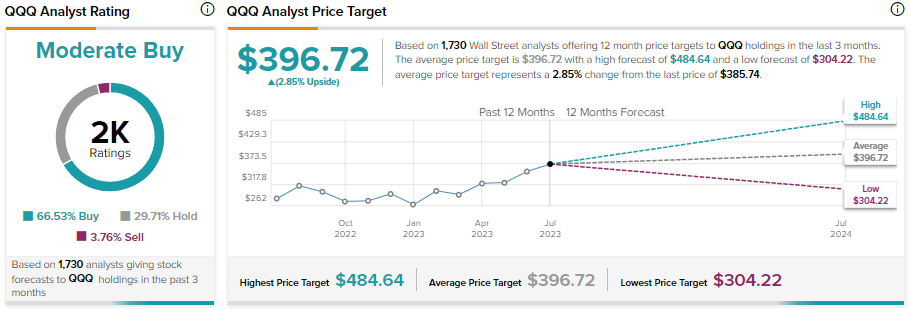

According to the recommendations of 1,730 analysts giving stock forecasts for QQQ’s holdings, the 12-month average QQQ price target of $396.72 implies a mere 2.85% in upside potential from current levels.

Nonetheless, QQQ ETF, which has the Nasdaq-100 index (NDX) as its benchmark, sports an Outperform Smart Score of 8 out of 10 on TipRanks. It has consistently outperformed the broader markets and delivered solid returns. However, the recent run in its price is keeping analysts cautiously optimistic.

QQQ ETF has a Moderate Buy consensus rating. Among the analysts providing ratings on its holdings, 66.53% have given a Buy rating, 29.71% have assigned a Hold rating, and 3.76% have given a Sell rating.

The Bottom Line

Both these buzzing Reddit ETFs look like solid long-term investments for investors seeking exposure to top companies with relatively lower risk. SPY and QQQ offer diversification and consistently deliver attractive returns. However, both these ETFs have gained quite a lot, which limits their upside potential.