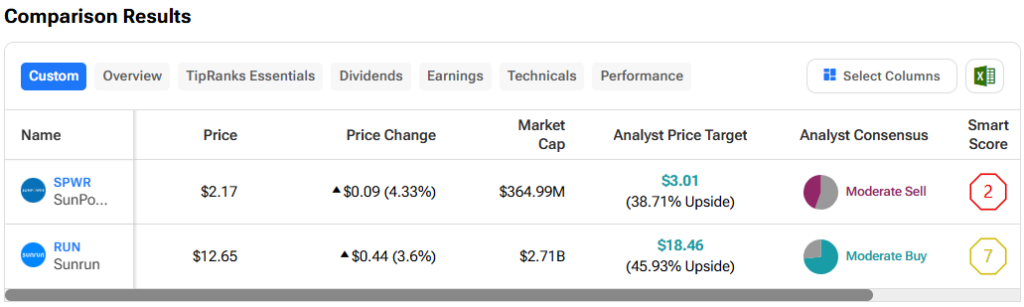

In this piece, I evaluated two solar-energy stocks, SunPower (NASDAQ:SPWR) and Sunrun (NASDAQ:RUN), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a bearish view of SunPower and a neutral view of Sunrun.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SunPower designs, manufactures, and delivers solar panels, systems, and services, while Sunrun designs, develops, installs, sells, and maintains residential solar energy systems.

Shares of SunPower have plunged 45% year-to-date and 72% over the last year, while Sunrun stock has tumbled 35% year-to-date, dragging its one-year return into the red at -29%.

The fact that both stocks are down by similar percentages this year is indicative of the wider issues affecting solar energy stocks specifically. High interest rates have hit the industry hard, making it difficult for people and businesses to finance solar energy systems.

In response, solar energy stocks have plummeted, as evidenced by the 27% drop in the Invesco Solar ETF (NYSEARCA:TAN). Let’s see if a closer look at SunPower and Sunrun surfaces any buy-the-dip opportunities.

Unfortunately, neither company is profitable currently, so we’ll compare their price-to-sales (P/S) ratios to gauge their valuations against each other and that of their industry. For comparison, the renewable energy industry is trading at a P/S of 1.8x, slightly lower than the three-year average of 2x.

SunPower (NASDAQ:SPWR)

At a P/S of 0.22x, SunPower is trading at an extremely depressed valuation, and its higher forward P/S of 0.31x suggests analysts are expecting the company’s sales to decline. A closer look at the company’s financial situation suggests that a bearish view may be appropriate.

In the fourth quarter of 2023, SunPower swung to a GAAP (generally accepted accounting principles) net loss of $115.6 million from continuing operations compared to net income of $5.1 million in the year-ago quarter. The company did not report per-share numbers, perhaps because more shares could be issued soon due to new financing terms (more on this below), and it has yet to report the latest quarter.

In fact, SunPower received a notification of deficiency from the Nasdaq for delaying its latest quarterly report. In its press release, SunPower stated that it “can provide no assurances as to timing” but is “working diligently to finalize” its Form 10-K for 2023 and 10-Q for Q1 2024.

The company announced a $50 million draw on its previously announced second-lien loan, issuing warrants to Sol Holding in exchange. Those warrants grant the company the right to purchase 33.4 million shares at an exercise price of one cent per share. These financing terms alone indicate a company in decline, especially when included with the widening losses.

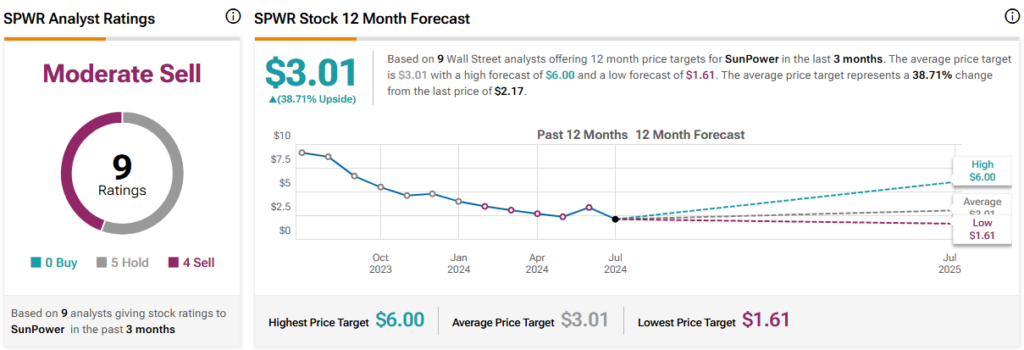

What Is the Price Target for SPWR Stock?

SunPower has a Moderate Sell consensus rating based on zero Buys, six Holds, and four Sell ratings assigned over the last three months. At $3.01, the average SunPower stock price target implies upside potential of 38.71%.

Sunrun (NASDAQ:RUN)

At a P/S of 1.25x, Sunrun is trading at a discount to its industry, which is warranted because it hasn’t been profitable on a full-year basis since 2022. While this company also isn’t in a great financial position, some green shoots suggest a neutral view might be appropriate, pending any changes for the better.

For example, Sunrun has adopted a storage-first mentality to increase its ticket sizes by adding storage capacity to the solar panel systems it sells. In fact, storage-attachment rates hit 50% in the first quarter, which is a sign of potential life.

Additionally, Sunrun’s “net earning assets” rose by $487 million sequentially in the fourth quarter, hitting $5.6 billion and including $953 million in total cash. Annual recurring revenue has surpassed $1 billion, with an average remaining contract life of 17.6 years. Sunrun also reported 5.7 gigawatts of networked solar energy capacity.

Other signs of potential include a partnership with Ford (NYSE:F) to serve as the preferred installer of its Intelligence Backup Power and for installations of the 80-amp Ford Charge Station Pro and Home Integration System. Sunrun will also help Puerto Rico rebuild its energy system by developing a 17-megawatt virtual power plant that will be the first large-scale, distributed storage program on the island.

Unfortunately, the company still faces an uphill battle to recovery. Even when the company has been profitable, its margins haven’t been great. In 2022, its net income margin was 7.5%, and before that, the company was last profitable in 2019, with a net income margin of 3.1%. Thus, I would suggest caution until these green shoots start to sprout.

What Is the Price Target for RUN Stock?

Sunrun has a Moderate Buy consensus rating based on 11 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $18.46, the average Sunrun stock price target implies upside potential of 45.9%.

Conclusion: Bearish on SPWR, Neutral on RUN

While both SunPower and Sunrun have entered a depressed period alongside other solar-energy companies, Sunrun is the clear winner here. When a company accepts financing terms that involve handing out shares at an exercise price of a penny per share, it’s usually a sign of desperation that suggests it might be swirling the drain.

On the other hand, Sunrun could be in a better position for the long term, but it remains a show-me story.