Spotify Technology (NYSE: SPOT) has a leading presence in the growing music streaming industry and generates predictable revenues backed by its subscription model.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nevertheless, its razor-thin margins make it challenging for the company to generate meaningful profits. This issue has not gone unnoticed by the market, leading to a substantial drop in the company’s stock price. Shares are down about 63.8% over the past year and down nearly 77% over the past two years from their all-time-high level in February 2021.

Given that the company has not been making notable progress in addressing this issue and hasn’t laid out a clear roadmap for growing its profitability, there could be more room for the stock to fall, particularly in the current economic climate.

For this reason, I can’t be too optimistic about Spotify moving forward, and thus, I am neutral on the stock.

Why Can’t Spotify Make Money?

The problem with Spotify’s profitability lies in the very nature of its own business model. It’s a low-margin business model that has merit for consumers and artists but certainly not for shareholders.

The bulk of Spotify’s cost of sales consists of royalties paid to artists and record labels, which eats away the majority of the company’s top line, leading to very slim gross profits.

Spotify’s most recent results once again illustrated this problem. In Q3, its gross profit margin fell to 24.7%, down from 26.7% in the prior-year period. From this figure alone, you can tell there will be almost no room left for profits to be reported once the company’s additional costs are taken into account.

In fact, the company’s expenses for research and development, marketing, and administrative costs totaled a staggering €978 million, even exceeding gross profits. Thus, Spotify posted an ugly operating loss of €228 million for the quarter.

Can Losses be Reversed Through Scaling Economics?

A valid question to ask is whether Spotify will be able to reverse its money-losing trend by scaling its operations, thus expanding its margins. My answer to that question would be a pessimistic “no way.”

To start with, Spotify has already scaled enough. The company boasts more than 456 million monthly active users (MAUs), including 195 million active premium subscribers.

Also, a growing user base, in the case of Spotify, can’t really help margins expand due to the nature of the company’s business model, as mentioned earlier. With each additional user, the additional royalties Spotify has to pay corresponding to this user’s listening hours increase its costs in line with its current margins.

It’s not like Spotify can pay a fixed amount of royalties and then enjoy all the upside that comes with declining costs as a percentage of revenues as its user base grows. Whereas Netflix, for instance, can produce a TV show once and then have its user base enjoy it “forever” with no additional costs. Spotify doesn’t get to enjoy such a basic yet essential benefit.

Can the Ad-Supported Model Help Boost Profits?

Another potential catalyst for Spotify that could help grow its profits revolves around its ad-supported model (i.e., the users who have not subscribed and are presented with ads when they listen to music).

In Q3, ad-supported revenues rose by an impressive 19% year-over-year, now accounting for 13% of total revenues. Double-digit ad-supported revenue growth was seen across all regions (with the exception of Europe), which is indeed encouraging.

Nevertheless, ads can hardly translate to the potential for improving profits for the company. The company’s ad-supported segment posted a gross margin of 1.8% in Q3, down 902 bps compared to last year. In other words, ad revenue barely covered the underlying royalties paid to artists and labels related to its freemium user base. This segment is certainly losing money for the company when accounting for its additional operating costs.

Therefore, the fact that the ad-supported segment is growing fast and capturing a larger percentage of total revenues could actually suggest that Spotify’s losses are going to widen further, moving forward.

Is SPOT Stock a Buy, According to Analysts?

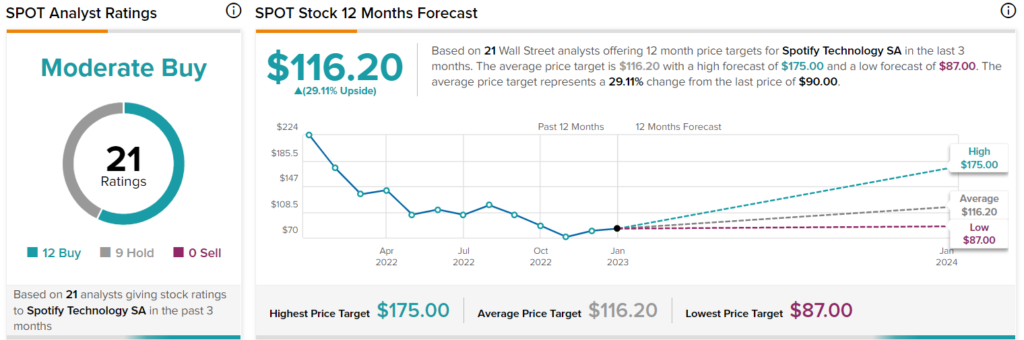

Turning to Wall Street, Spotify Technology has a Moderate Buy consensus rating based on 12 Buys and nine Holds assigned in the past three months. At $116.20, the average Spotify stock price target suggests 29.1% upside potential over the next 12 months.

The Takeaway: Spotify Will Have a Hard Time

All in all, it seems that despite its prominent presence in the music streaming industry and predictable revenues, Spotify’s low-margin business model and high costs make it incredibly challenging for the company to generate profits.

The company has not made notable progress in combatting these issues and lacks an unambiguous plan for improving profitability. Given the current situation, it is doubtful that the company will be able to reverse its money-losing trend through scaling economics or its ad-supported model. Thus, I would avoid the stock for now.