Spotify Technology (NYSE:SPOT) is currently marching on a path through which it appears impossible for the company to ever reach profitability. Nevertheless, the music streaming behemoth’s stock has been consistently reaching new 52-week highs, reflecting the unwavering optimism of investors who may be overlooking the potential roadblocks that lie ahead. Specifically, while shares of Spotify have rallied by approximately 84% year-to-date, the company’s most recent results were arguably concerning, with revenues lagging and losses steepening.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In my view, Spotify investors will eventually have to wake up from any delusion that’s currently fueling shares higher and confront the undeniable truth regarding the company’s inability to achieve profitability. Accordingly, I am bearish on the stock.

The Issue That Spotify Investors Are Ignoring

The core issue that Spotify investors seem to be ignoring is the company’s lack of profitability prospects from the very essence of its business model. Although Spotify’s streaming model provides value for both consumers and (to a lesser extent) artists, it falls short when it comes to satisfying shareholders’ financial interests due to its narrow profit margins.

The primary component of Spotify’s cost of sales revolves around the substantial royalties paid to artists and record labels, significantly eroding the company’s revenue and leaving only meager gross profits. In the most recent Q1 results, Spotify once again demonstrated this challenge, as its gross profit margin declined slightly to 25.2%, down from 25.3% in the preceding quarter. This single figure alone indicates that there is hardly any breathing space for profits once the company factors in additional costs.

In fact, when considering Spotify’s hefty expenses for research and development, marketing, and administrative costs, which amounted to an astounding €922 million, it becomes evident that they surpassed the company’s gross profit of €766 million for the period. Consequently, Spotify reported a disheartening operating loss of €156 million for the quarter.

The Growth Case Doesn’t Appear Promising, Either

A compelling argument for Spotify bulls revolves around the company’s growth case, suggesting that as the platform and its subscriber base expand, there is potential for improved margins. This, in turn, could reverse the negative trend of Spotify’s financials.

However, this argument proves exceedingly difficult to endorse. Primarily, it is worth noting that Spotify has already achieved significant scalability. With over 515 million monthly active users (MAUs), including 210 million premium subscribers, the company’s user base exhibited marginal sequential growth of only 5% and 2% in Q1, respectively. Consequently, Spotify is on the cusp of reaching a user plateau that will present substantial challenges in terms of further expansion.

Yet, even in the event of continued user base growth, Spotify’s business model renders it incapable of capitalizing on expanded margins, as previously mentioned. Each additional user incurs corresponding royalty costs based on their listening hours, further burdening Spotify’s expenses and aligning them with its current margins.

In stark contrast to other streaming-on-demand platforms like Disney+, Hulu, or HBO Max, which can produce a TV show once and milk the incremental benefits from their user base without incurring additional costs, Spotify is deprived of such a fundamental perk. Unlike the inherent stability enjoyed by most services, Spotify’s financial outlook is set to remain hindered by the constant rise in royalties that parallel its growing user base.

The Ad Business Does Not Add Any Incremental Value

Another potential positive catalyst for Spotify’s investment case that could address the limitations of its current business model lies within its ad business. This segment refers explicitly to users who have not yet subscribed and are exposed to ads while enjoying their music. Unfortunately, the company’s ad segment appears to be growing into another pillar of disappointment.

In particular, Spotify’s ad-supported revenue declined by 27% quarter-over-quarter, leading to a sequential decline of 4% in total revenues from Q4 of last year. Sure, ad-supported revenues can be affected by seasonality between quarters. However, given the stable nature of Spotify’s subscribers, such a decline sequentially is almost unacceptable. It certainly doesn’t appear to be an avenue through which Spotify can grow sustainable profitability.

Is SPOT Stock a Buy, According to Analysts?

Turning to Wall Street, Spotify Technology has somehow retained a Moderate Buy consensus rating based on 16 Buys and seven Holds assigned in the past three months. At $157.17, the average Spotify stock price prediction suggests 3.7% upside potential.

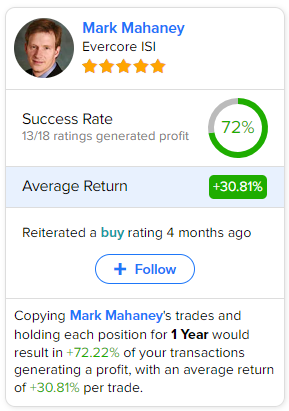

If you’re wondering which analyst you should follow if you want to buy and sell SPOT stock, the most profitable analyst covering the stock (on a one-year timeframe) is Mark Mahaney from Evercore ISI, with an average return of 30.81% per rating and a 72% success rate.

The Takeaway

In conclusion, Spotify’s current market performance seems to be driven by unfounded optimism rather than a realistic assessment of the company’s financial prospects. The core issue lies in Spotify’s inability to achieve profitability due to its narrow profit margins and substantial royalties paid to artists and record labels.

Despite the company’s significant user base, further expansion poses challenges without the ability to capitalize on expanding margins. Additionally, Spotify’s ad business, which could potentially add value, has shown disappointing growth. Considering these factors, it may be wise for investors to pay attention to Spotify’s bear case, which implies notable downside potential following the stock’s extended rally.