Consumer spending may be in a bit of a funk, but the tides could turn higher as expectations and estimates become easier to beat. Even in the face of macro uncertainty, the following at-home entertainment stocks boast Strong Buys for the analyst community right now. As broader markets flirt with all-time highs again, it may be worth entertaining your portfolio with the following names while they’re still relatively out of favor among investors.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Undoubtedly, the lockdown tailwind is long over for the broader basket of at-home entertainment plays. Still, analysts are bullish on the following names while they look to break out of their post-lockdown hangovers. Therefore, let’s check in with the incredibly useful TipRanks Comparison Tool to get a better grasp of the following Strong-Buy-rated stocks in the at-home entertainment space.

Spotify Technology (NASDAQ:SPOT)

Up first, we have Sweden-based streaming music company Spotify, which has seen its shares more than double from the depths of late last year. The company has faced stiff competition from the likes of Apple (NASDAQ:AAPL) Music and other rivals in big tech.

Moving ahead, the music streaming market is about to become much more crowded, with social media sensation TikTok looking to get in on the music streaming action. Undoubtedly, TikTok has gobbled up the lunch of many firms in the social media space. As the video-based social media platform gets into music streaming, I fear Spotify may lose some of its competitive edge. As a result, I’m staying neutral on SPOT stock for now in light of industry uncertainties.

Like video streaming, music streaming is quickly becoming commoditized, with many firms looking to get a slice of the market. Apple is just one big-tech company that can include music streaming as part of an entertainment services bundle. Spotify may have Joe Rogan, but it doesn’t have a diversified basket of entertainment services that can enable it to create a bundle that’s competitive against a company like Apple.

Now, Spotify has a pretty loyal fanbase, but their loyalty will be tested following Spotify Premium subscription price hikes while TikTok enters the market. My guess is that it’ll be an uphill battle for the firm as it also grapples with looming macro headwinds.

What is the Price Target for SPOT Stock?

Spotify’s a Strong Buy on Wall Street, with 20 Buys and five Holds assigned in the past three months. The average SPOT stock price target of $178.48 implies 18.3% upside potential from here.

Take-Two Interactive Software (NASDAQ:TTWO)

Take-Two is a video game stock that really looks like a compelling takeover target amid ongoing industry consolidation. Still, investors shouldn’t buy any stock just because they expect it’ll eventually be acquired. Fortunately, Take-Two has catalysts that could extend its rally going into the second half. Its much-awaited Grand Theft Auto VI (GTA VI) title could be released at some point in 2024. If the latest iteration in the series can match its predecessors, the stock could be in for a potential breakout in two years.

At writing, TTWO stock is up more than 60% from its August 2022 low but off around 29% from its 2021 all-time high of nearly $215 per share. Despite the hot run, I’m staying bullish on TTWO stock, as I view it as having one of the widest moats in the entertainment space today. GTA VI is a big deal, and anticipation for the title may have already helped the stock ricochet off multi-year lows.

The stock trades at 48.1 times forward price-to-earnings, which may seem elevated. However, factor in the earnings jolt that a blockbuster like GTA VI can provide, and the multiple becomes more than palatable.

In the meantime, I expect takeover rumors and GTA excitement to keep the good times going.

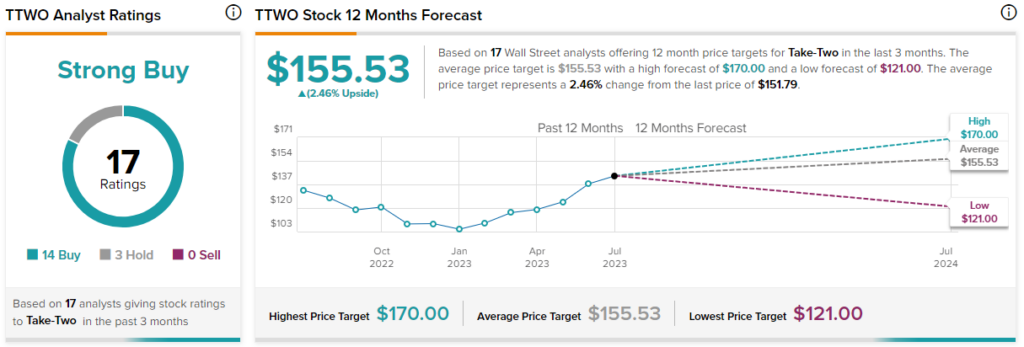

What is the Price Target for TTWO Stock?

Take-Two’s a Strong Buy, with 14 Buys and three Holds assigned by analysts in the past three months. Nonetheless, the average TTWO stock price target of $155.53 entails a modest 2.5% gain from here.

Turtle Beach (NASDAQ:HEAR)

If you’re looking for a high-risk/high-reward way to play both gaming and audio, Turtle Beach may be an intriguing option as it looks to recover from its 84% plunge off its 2021 high. Turtle Beach is a gaming tech company that makes high-quality peripherals, most notably headsets.

Demand really boomed during the lockdown days, only to go bust in the years that followed. With a new line in the sand drawn at below $12 per share, I do view HEAR stock as an intriguing small-cap ($190 million market cap) stock that could experience sizeable upside once consumer trends gradually shift.

Indeed, Turtle Beach is more of a discretionary play than the likes of other entertainment tech companies like Spotify. That may be a good thing, given where we stand in the current business cycle. A recession hasn’t begun yet (if it even ends up happening), but Turtle Beach stock has already gone bust in a big way. However, with Cris Keirn stepping in as interim CEO just weeks ago, I do think Turtle Beach has the tools to break out of its shell.

At 0.8 times price-to-sales and 2.1 times price-to-book, HEAR stock trades at a significant discount to the computer hardware industry averages of 1.6 and 5.8, respectively. It’s a deep-value play that’s almost guaranteed to be a choppy ride. If you’re young and brave, though, I think the stock’s intriguing.

What is the Price Target for HEAR Stock?

Turtle Beach is a Strong Buy, with four unanimous Buy ratings. The average HEAR stock price target of $14.00 implies 30.9% upside.

Conclusion

Entertainment tech plays look intriguing, according to Wall Street analysts. Of the three names mentioned, though, the analyst community expects the most upside from Turtle Beach.