Splunk (SPLK) provides a software platform that allows users to interact with machine data. The software monitors and analyzes data and delivers it in a useful form to the user.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Machine data is cumbersome and difficult to utilize in its raw form. Splunk software is the tool that solves this problem for companies.

I am neutral on SPLK stock. (See Analysts’ Top Stocks on TipRanks)

Splunk Stock Price Decline

Splunk stock currently trades under $114. The stock is down nearly 32% year-to-date and 27% over the past 30 days. Growth stocks have seen a sharp reversal over the past week as investors weigh multiple market conditions.

First, the Federal Reserve has begun the process of tapering its asset purchases. Investors are also concerned that inflation may cause the Federal Reserve to raise interest rates sooner and faster than previously thought. Finally, there seems to be some sentiment change from “growth at any cost” to a more nuanced approach to valuations.

All of this adds up to a difficult market for Splunk stock.

Revenue Growth Returns, Caution Warranted

For fiscal year ended January 31, 2020, Splunk grew revenues at a brisk rate of 31%. The next year, fiscal 2021, revenues declined 5% in what was largely attributed to a pandemic influenced slowdown, coupled with changing to a subscription model.

In the current fiscal year, which will end January 31, 2022, revenues are expected to grow 14% year-over-year. This is very tepid growth, especially considering the drop in the previous year.

Gross profit over the trailing 12 months has actually declined compared to fiscal 2020, even though revenues are higher. This is concerning and shows that much of the top-line growth is simply Splunk paying higher prices which are passed on to the customer, rather than organic growth. Because of this, operating income and operating margins are much lower than in recent years.

Over the last 12 months, Splunk has lost over $1 billion from operations and posted an operating margin of -43%. In fiscal 2020, Splunk’s best year on record, the company lost just $263 million from operations on a -11% margin, and appeared to be headed in the right direction in terms of profitability. That no longer appears to be the case.

There are many bright spots for Splunk as well. The company claims a dollar-based net retention rate of 130% at last report. This means that current customers are upping their spend with Splunk substantially more than customer churn.

The company is also transitioning to a subscription model which is preferable as it provides for annual recurring revenues. Splunk’s base of large customers is also increasing, with 635 who provide over $1 million annual recurring revenues reported in Q3 of fiscal 2022. This is up from 444 one year prior.

Splunk stock currently trades at a P/S ratio over 6.2x on a forward basis. Considering the widening losses and decrease in gross profit, this is a hefty premium for the stock despite the recent declines.

Wall Street’s Analysis

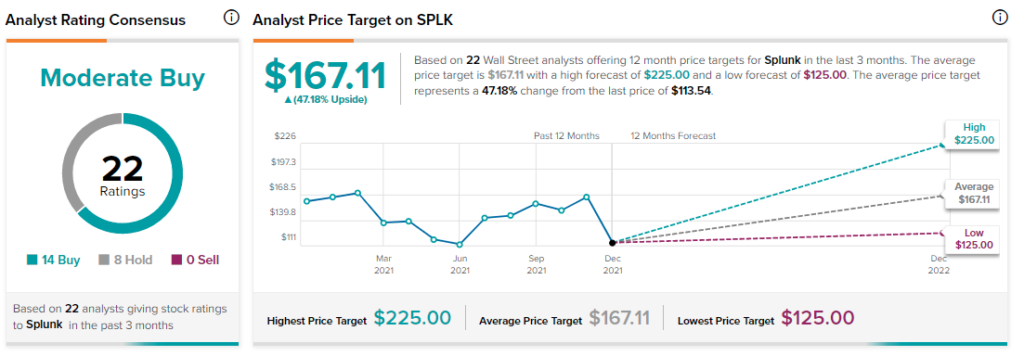

Turning to Wall Street, analysts give Splunk a Moderate Buy consensus rating. Fourteen analysts have Buy ratings and eight have Hold ratings.

The average Splunk price target of $167.11 implies 47.2% upside from the current price.

Summary on Splunk

Splunk stock has struggled mightily this year and the decline is likely to continue without a strong catalyst to move the stock higher.

Macroconditions for growth stocks are unfavorable and this could continue for some time. The transition to a subscription model is a positive, however the decreasing profitability is troubling.

Top-line revenue growth appears more related to higher prices than organic growth, due to the decline in gross profits. The valuation remains high even after the recent slide. Splunk’s management must post a strong Q4 2022 to give investors a reason to reverse the downward trend in this stock.

Disclosure: At the time of publication, Bradley Guichard did not have a position in securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >