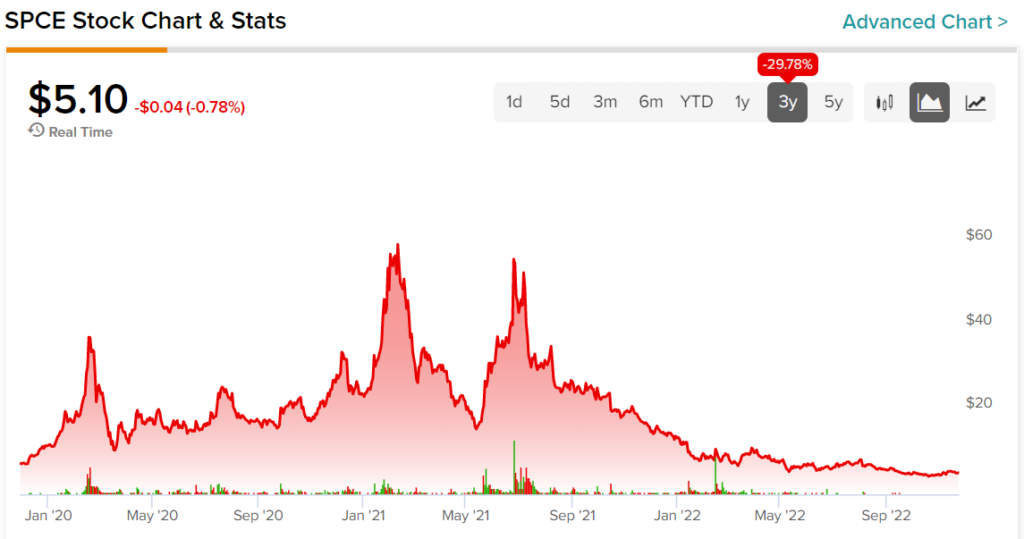

Virgin Galactic (NYSE:SPCE) was the first space tourism business to debut on the stock exchange. It enjoyed a stellar first year on the back of the tall claims by its management in ushering in a novel space economy. Consequently, its stock surged over 96% in its first year. However, subsequent delays, regulatory roadblocks, and the incompetence of its management have made its stock price tank to new lows. Currently, it’s a speculative play at best, with an iffy future ahead. Therefore, we are bearish on SPCE stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The original launch date was postponed due to technical difficulties, and a series of lousy management decisions caused subsequent delays. The company has wasted millions of dollars on flawed prototypes, and its current crop of engineers is woefully incompetent. As a result, Virgin Galactic is nowhere close to achieving its goals, and it is unlikely that it ever will be. The company’s failure is a testament to the ineptitude of its management, and it serves as a warning to other would-be space travelers.

Virgin Galactic is a leading spaceflight company owned by Maverick entrepreneur Richard Branson who plans to dominate the budding space tourism market. The company plans to offer $450,000 per person tickets, entitling the purchaser to a 90-minute suborbital spaceflight.

This would make Virgin Galactic the first company to offer such flights to the general public. Virgin Galactic is confident that there is significant demand for its services and its waiting list backs up its strong claims. Indeed, it boasts an 800+ person backlog. Moreover, analysts believe in the long-term potential of a multi-billion dollar industry down the road.

Virgin Galactic is Burning Through Cash at an Alarming Pace

Virgin Galactic recently released its atrocious third quarter results, where it lost $0.55 per share on revenues of just $767,000. Though it exceeded expectations on the sales front, its loss was significantly more than expected. It lost more than three times the amount it did in the same period last year.

The firm is still far behind schedule in its efforts to carry space tourists into space, even after going public via a SPAC IPO three years ago. The company is still investing heavily in research and development, including upgrades to its Unity and Mother Ship Eve for tourism flights. Moreover, it is also preparing to build its fleet of next-generation Delta spaceplanes. However, the company’s track record suggests that it may be some time before these plans come to fruition.

Cash burn in the quarter totaled $107 million, twice the amount it burned in the same quarter last year. Furthermore, Virgin Galactic CFO, Douglas Ahrens, states its cash burn will rise to $120 million or more in the upcoming quarter.

Virgin Galactic Faces an Uphill Battle in a Recession

Inflation and interest rates have soared to new heights this year, weighing down profitability for virtually every business. Businesses will have to spend more money on essential items, and they will also have to pay more in interest on loans. As a result, they will have less money to invest in new products or expansion. They may also be forced to lay off workers to save money. This will lead to slower economic growth and could eventually trigger a recession. Such a scenario bodes horribly for consumer discretionary stocks such as SPCE.

The recession’s most obvious consequence is Virgin’s pricey flight tickets. It’s tough to imagine even the upper-class paying $450,000 in flight tickets during a financial crisis. Therefore, expect a significant slowdown in demand for the firm.

The other aspect relates to its valuation. In a bull market, naturally, investors throw money at virtually every business with a solid outlook. However, in the current downturn, cash is king, which makes it tough to bet on stocks such as SPCE that have no clear pathway toward profitability. Share prices for cash-burning firms are likely to tank even further in the current market conditions.

Is SPCE Stock a Buy?

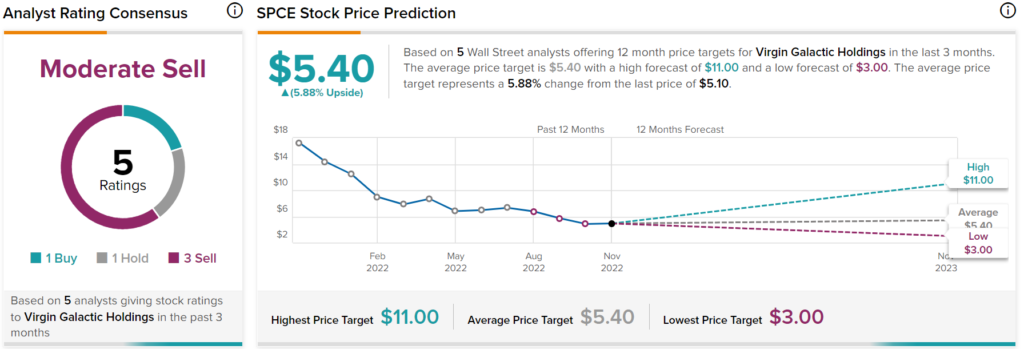

Turning to Wall Street, SPCE stock maintains a Moderate Sell consensus rating. Out of 5 total analyst ratings, one Buys, one Holds, and three Sells were assigned over the past three months. The average SPCE price target is $5.40, implying 5.88% upside potential. Analyst price targets range from a low of $3 per share to a high of $11 per share.

Virgin Galactic Doesn’t Have the Track Record to Inspire Confidence

Virgin Galactic has been promising space tourism for over seven years but has yet to deliver on its promises. An incompetent team is leading the company with a horrible track record of delays. Moreover, it’s been burning through cash at an alarming pace and will have to raise financing soon in a recession. Though its space tourism idea isn’t bad, we believe that the company is not in a great position to succeed in what is shaping up to be a highly competitive industry.