The SPDR S&P 500 ETF Trust (NYSEARCA:SPY), which tracks the S&P 500 Index (SPX), allows an investor to hold a diversified portfolio without having to buy individual stocks. SPY stock has advanced about 16% year-to-date, partly thanks to the rally in artificial intelligence (AI) stocks. Moreover, based on technical indicators on TipRanks, SPY is a Buy near its current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SPY ETF’s Technical Indicators

According to TipRanks’ technical analysis tool, the SPY ETF stock’s 50-Day EMA (exponential moving average) is 425.76, while SPY’s price is $438.55, making it a Buy. Further, the moving average convergence divergence (MACD) indicator also signals a Buy.

Meanwhile, its RSI (Relative Strength Index) is 59.50, implying a Neutral signal. At the same time, the SPY ETF’s Williams %R points to a bullish trend.

Overall, in the one-day time frame, the SPY ETF stock is a Buy, according to TipRanks’ easy-to-read technical summary signals. This is based on 12 Bullish, six Neutral, and four Bearish signals.

Is SPY a Buy, According to Analysts?

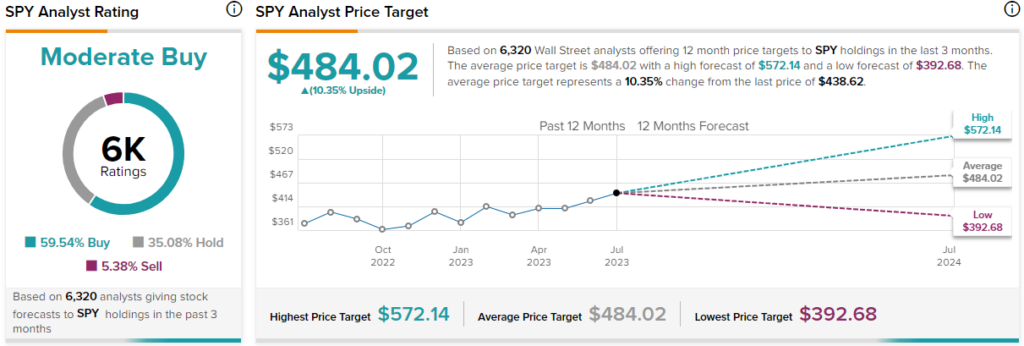

SPY has a Moderate Buy consensus rating on TipRanks, and the average SPY stock price target of $484.02 implies 10.35% upside potential. Among the 6,320 analysts providing ratings on SPY’s 500+ holdings, 59.54% have given a Buy rating, 35.08% have assigned a Hold, and 5.38% have given a Sell.

It’s also worth noting that SPY has a low expense ratio of 0.09%, which is one of the major factors that makes the ETF attractive. Moreover, according to TipRanks’ Smart Score System, SPY has a Smart Score of 8 out of 10, which indicates that the ETF could outperform the broader market from here.