The iShares Semiconductor ETF (NASDAQ:SOXX) is up a scorching 56.8% over the past year, but this powerhouse ETF could have plenty of additional upside ahead.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m bullish on SOXX based on its strong portfolio of highly-rated semiconductor stocks, the long-term growth prospects of the semiconductor industry, its market-beating performance over the long term, and the fact that many of its components are less expensive than one might expect, given their strong performances.

What Is the SOXX ETF’s Strategy?

SOXX is an index ETF from BlackRock’s (NYSE:BLK) iShares that, according to BlackRock, gives investors “exposure to U.S. companies that design, manufacture, and distribute semiconductors.”

Is It Too Late to Invest in Semiconductors?

With SOXX’s impressive gain over the past year and the momentum that semiconductor stocks have had in general, many investors may wonder if they are too late to invest in the semiconductor sector. The good news is that while the space has run up quite a bit, the entire industry has plenty of runway for growth ahead. Analysts from McKinsey believe the market could grow by 80% over the course of this decade and reach $1 trillion by 2030.

While the growth of generative AI is arguably the most exciting field driving this growth, it’s important to remember that other promising areas like self-driving cars, high-performance computing, and the Internet of Things (IoT) will drive further demand for semiconductors as well.

SOXX’s Holdings

As a directional bet on U.S. semiconductor stocks, SOXX isn’t particularly diversified, and that’s alright. It holds 30 stocks, and its top 10 holdings account for 60.1% of its portfolio. Below is an overview of SOXX’s top 10 holdings using TipRanks’ holdings tool.

SOXX has large positions in its top holdings like Nvidia (NASDAQ:NVDA), Advanced Micro Devices (NASDAQ:AMD), and Broadcom (NASDAQ:AVGO). This isn’t necessarily a bad thing, as these stocks are up 239.7%, 121.5%, and 113.9%, respectively, over the past year, helping drive SOXX’s red-hot performance.

It’s interesting to note that while these are large positions, SOXX’s exposure to Nvidia is actually quite a bit lower than that of its largest competitor in the semiconductor ETF space, the VanEck Semiconductor ETF (NASDAQ:SMH), which features a massive 24.7% position in the AI chip leader. This isn’t necessarily a good thing or a bad thing, but it does take some risk off the table for SOXX compared to SMH in the event that Nvidia’s stock pulls back.

Beyond these leaders in generative AI chips, I like the fact that SOXX includes stocks from all facets of the semiconductor value chain, including semiconductor fabricators and the companies that make the complex equipment and machinery used in the semiconductor manufacturing process, such as Applied Materials (NASDAQ:AMAT), Lam Research (NASDAQ:LRCX), ASML Holding N.V. (NASDAQ:ASML), and Taiwan Semiconductor (NYSE:TSM).

I like this for a few reasons. First, it adds to SOXX’s diversification by bringing in different parts of the semiconductor supply chain to its portfolio.

Second, these are great stocks that have generated outstanding returns for shareholders over the past year. Applied Materials is up 74.5% over the past year, Lam Research is up 89.1%, ASML is up 43.6%, and Taiwan Semiconductor is up 42.8%.

Furthermore, while these stocks have surged, they aren’t egregiously priced and offer better value than one might expect at first glance. For example, Taiwan Semiconductor trades at 20.2 times consensus 2024 earnings estimates, while Applied Materials trades at 24.5 2024 earnings estimates. While these numbers aren’t cheap, they are roughly in line with the broader market, which is pretty attractive for stocks performing this well.

Lam Research and ASML are a bit more expensive, with Lam Research trading at 31.2 times 2024 earnings estimates and ASML trading at 45.6 times estimates.

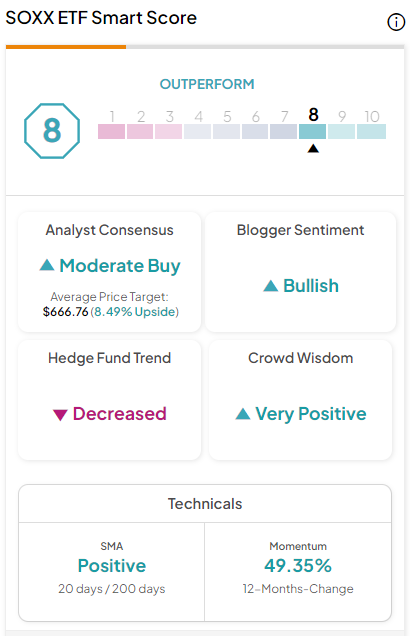

Lastly, these stocks are collectively viewed very favorably by TipRanks’ Smart Score system. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. ASML and Taiwan Semiconductor feature ‘Perfect 10’ Smart Scores, Applied Materials features an Outperform-equivalent Smart Score of 9, and Lam Research has a Neutral-equivalent Smart Score of 7.

Looking at the rest of SOXX’s portfolio, an impressive nine of its top 10 holdings feature Outperform-equivalent Smart Scores of 8 or higher. Advanced Micro Devices, Broadcom, Marvell Technology (NASDAQ:MRVL), and the aforementioned ASML all feature 10 out of 10 Smart Scores.

The Smart Score system also takes a favorable view of SOXX itself, giving it an outperform-equivalent ETF Smart Score of 8 out of 10.

Scintillating Long-Term Performance

To put it simply, SOXX’s long-term performance has blown the doors off of the broader market, and it’s not even particularly close. As of January 31, SOXX posted outstanding annualized returns of 16.0% over the past three years, 31.1% over the past five, and 24.5% over the past 10.

For comparison, as of January 31, the Vanguard S&P 500 ETF (NYSEARCA:VOO) returned 11.0% over the past three years, 14.2% over the past five years, and 12.6% over the past decade.

Meanwhile, the tech-centric Nasdaq (NDX), as represented by the Invesco QQQ Trust (NASDAQ:QQQ), has returned 20.7% over the past five years and 18.1% over the past 10.

To be clear, it hasn’t always been a smooth ride, as SOXX has experienced plenty of volatility along the way, but the long-term trend is clearly “up and to the right.” For example, SOXX lost 35.1% of its value in 2022 but followed this up by bouncing back with a 67.1% return in 2023.

What Is SOXX’s Expense Ratio?

SOXX’s expense ratio of 0.35% means that an investor in the fund will pay $35 in fees on a $10,000 investment annually. This is the same expense ratio that other popular ETFs like the aforementioned SMH and the SPDR S&P Semiconductor ETF (NYSEARCA:XSD) charge, which is probably not coincidental as these funds are all competitors.

Is SOXX Stock a Buy, According to Analysts?

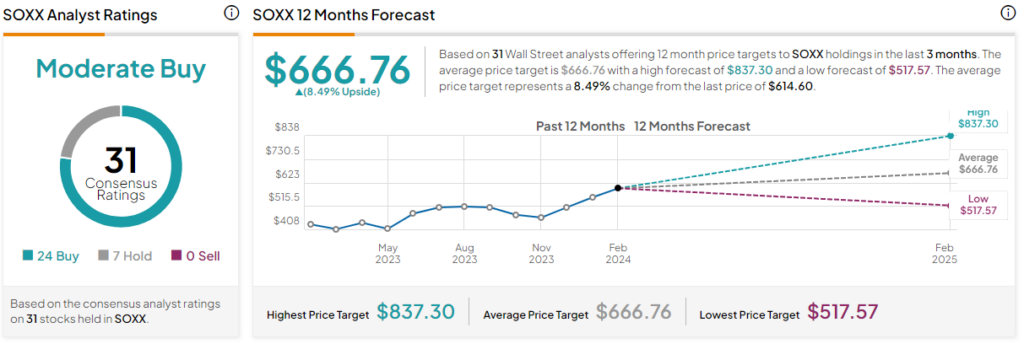

Turning to Wall Street, SOXX earns a Moderate Buy consensus rating based on 24 Buys, seven Holds, and zero Sell ratings assigned in the past three months. The average SOXX stock price target of $666.76 implies 8.5% upside potential.

Investor Takeaway

In conclusion, I’m bullish on SOXX based on its market-beating performance over the past decade, its portfolio of highly-rated stocks from across the semiconductor value chain, and the long-term growth prospects of the semiconductor industry. While the ETF has been on a tear, it’s not too late to consider investing in SOXX, and there is room for more upside ahead, as its holdings have strong growth prospects, and many are less expensive than one would expect.