In this piece, I evaluated two artificial intelligence (AI) stocks, SoundHound AI (SOUN) and C3.ai (AI), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a neutral view of SoundHound and a bearish view of C3.ai.

SoundHound AI provides conversational intelligence via its independent voice-AI platform, which enables businesses to provide conversational experiences to their customers. Meanwhile, C3.ai is an enterprise AI company that provides software-as-a-service applications enabling customers to develop, deploy, and operate large-scale enterprise AI applications across infrastructures.

SoundHound AI stock has surged 128% year-to-date, bringing its 12-month return into the green at 97%. On the other hand, C3.ai shares are off 6.5% year-to-date and have tumbled 35% over the last year.

With such a dramatic difference in their share-price performances year-to-date, the sizable gap between their valuations is no surprise. Since neither company is profitable, we’ll use their price-to-sales (P/S) ratios to gauge their valuations against each other.

We can also compare them to the broader application software industry, which is trading at a P/S of 8.7x, in line with its three-year average.

SoundHound AI (NASDAQ:SOUN)

At a P/S of 32x, SoundHound AI is certainly not cheap, trading at a sizable premium to the application software industry, although the fact that it’s an AI stock suggests some premium is warranted. However, based on this valuation and other factors, a neutral view seems appropriate.

First, SoundHound AI is not profitable, which should give investors pause, especially with a market capitalization of $4.5 billion. The company’s net income margins aren’t very encouraging either, standing at -186% for the last 12 months and -194% for 2023. While they’re trending in the right direction each year, caution seems warranted for now.

What’s particularly worrisome is that the company projected profitability in 2023 but came up short, posting a net loss of $88.9 million and an adjusted loss of 40 cents per share for the year.

In fact, company insiders appear to have been taking profits, as SoundHound AI stock has climbed this year. The roughly $737,000 in Informative Sell transactions are only part of the story, as quite a few Auto Sell transactions also suggest insiders might not expect the stock to rise more in the near term.

On the other hand, SoundHound AI is expanding its partnership with top-10 automaker Stellantis (STLA), which owns many well-known vehicle brands like Dodge, Ram, and Jeep. The company’s voice AI technology is being added to more of the company’s vehicle brands in Europe, which bodes well for the long term. In fact, SoundHound’s AI voice assistant is already live and in production in Stellantis’ Peugeot, Vauxhall, and Opel vehicles in 11 markets.

However, the lack of profits suggests that such a high valuation and premium versus the application software industry might not be warranted, at least for now. SoundHound AI looks like a company that has yet to grow into its current valuation, and it could be some time before that happens at current levels.

What Is the Price Target for SOUN Stock?

SoundHound AI has a Strong Buy consensus rating based on four Buys, one Hold, and zero Sell ratings assigned over the last three months. At $7.50, the average SoundHound AI stock price target implies upside potential of 55.3%.

C3.ai (NYSE:AI)

At a P/S of 11.4x, C3.ai looks much more reasonably valued than SoundHound. However, its profitability prospects look even worse than SoundHound’s, so a bearish view seems appropriate.

On a net-income-margin basis, C3ai actually looks better than SoundHound, given that its margin improved from -101% in the fiscal year that ended in April 2023 to -90% in the latest fiscal year.

However, the company’s net losses are widening, growing from $268.8 million to $279.7 million year-over-year. Meanwhile, despite its extremely negative net income margins, SoundHound’s net losses have narrowed from $116.7 million in 2022 to $88.9 million in 2023.

Additionally, there seem to be no projections for when C3.ai will become profitable. Thus, a key question is whether the company can ever be profitable. The fact that it serves the enterprise market is encouraging, but whether its services are unique remains to be seen.

C3.ai does have strategic partnerships with Microsoft (MSFT) via Azure and Adobe (ADBE), but such partnerships are not unusual in the AI space. It will be interesting to see whether Microsoft continues this partnership in light of its close and growing ties with OpenAI.

Thus, C3.ai remains a bit of a show-me story for now, although this could change.

What Is the Price Target for AI Stock?

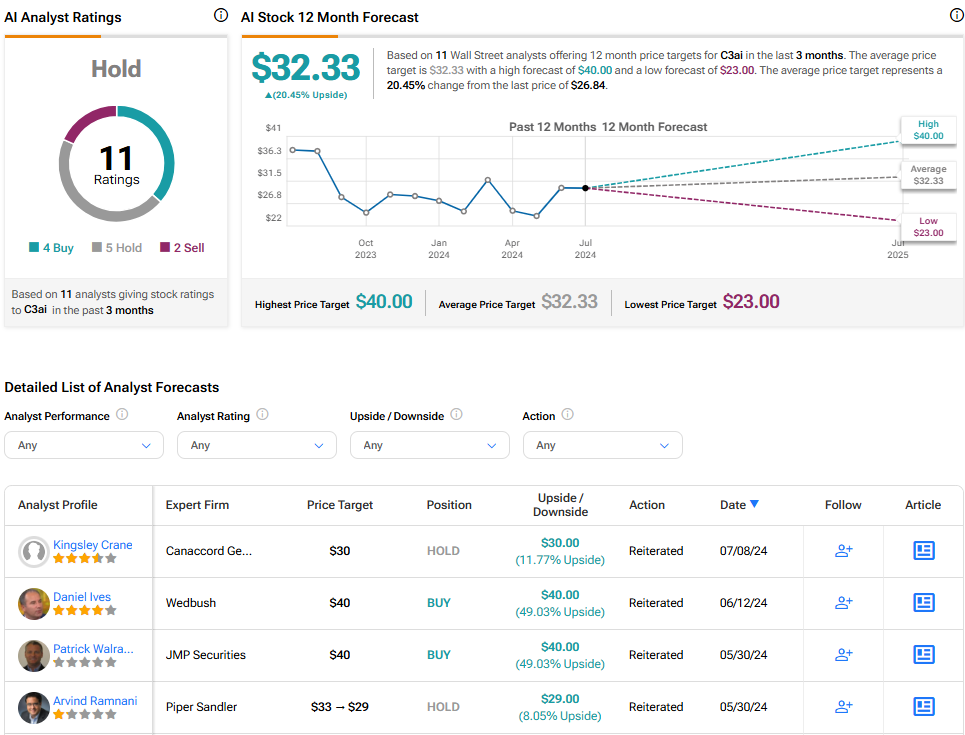

C3.ai has a Hold consensus rating based on four Buys, five Holds, and two Sell ratings assigned over the last three months. At $32.33, the average C3.ai stock price target implies upside potential of 20.5%.

Conclusion: Neutral on SOUN, Bearish on AI

Both SoundHound AI and C3.ai have the potential for long-term excellence, but it just feels a bit early to take a dive into these stocks. I’d like to see more progress toward profitability before becoming more constructive on either of them.