SoundHound AI (NASDAQ:SOUN) and BigBear.ai Holdings (NYSE:BBAI) are two interesting AI (Artificial Intelligence) stocks trading under $5. These penny stocks (learn more about penny stocks here) are worth keeping an eye on as analysts see significant upside potential in them from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s delve deeper.

What is the Future of SoundHound Stock?

SoundHound specializes in Voice AI solutions. It distinguishes itself by developing advanced voice and conversational AI technologies with little investment and forming strategic partnerships with top players. Its technology powers numerous electronic devices, automobiles, and IoT devices.

A notable addition to its portfolio is the SoundHound Chat AI platform, tailored for the automotive sector. The company has also unveiled Smart Answering, an AI customer service solution for restaurants and other businesses. The adoption of its AI restaurant solutions has been robust. Further, SoundHound Chat AI made history by becoming the first voice assistant with generative AI capabilities to go live in European vehicles.

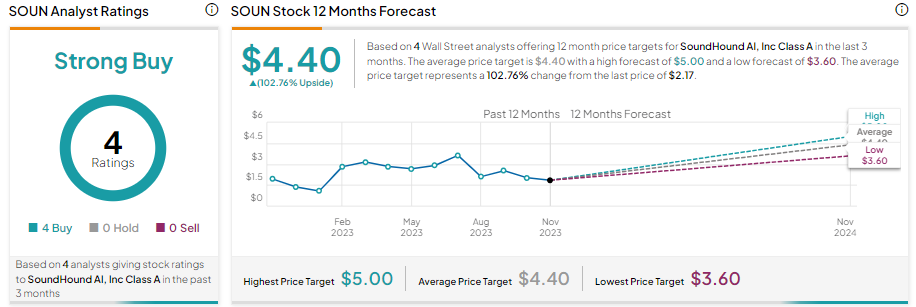

Overall, the company’s focus on innovation, new product offerings, and a robust channel partner ecosystem solidify its competitive positioning in the Voice AI market. Moreover, solid demand for AI and its improving financial performance augur well for growth and are reflected in analysts’ bullish outlook. With four unanimous Buy recommendations, SOUN stock has a Strong Buy consensus rating. Further, the average SOUN stock price target of $4.40 per share implies 102.76% upside potential.

What is the Prediction for BigBear AI Stock?

BigBear.ai offers AI-powered decision-intelligence solutions. Its products have applications in supply chains & logistics, cybersecurity, and autonomous systems markets. Further, the company boasts the U.S. Intelligence Community, the Department of Defense, and the U.S. Federal Government as its customers.

BBAI’s exposure to the Defense and intelligence market and a growing commercial portfolio support its bull case. In addition, the company achieved positive net income and cash flows for the first time in Q3. The company also announced the acquisition of Pangiam, a leader in Vision AI. This will enable the company to create a comprehensive Vision AI portfolio.

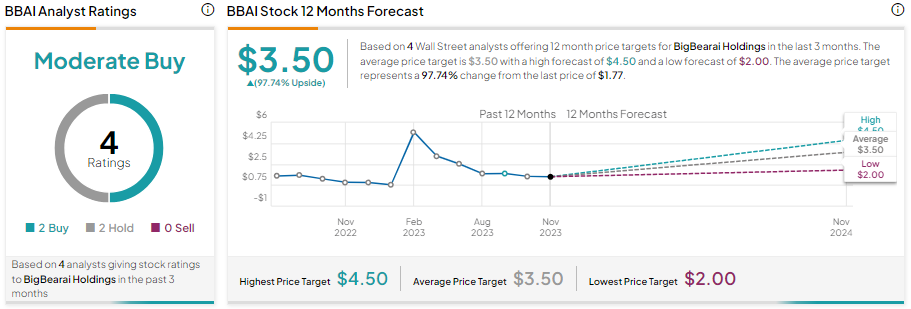

While BigBear.ai is poised to benefit from AI-led demand, macro headwinds keep analysts cautiously optimistic about its prospects. With two Buys and two Holds, BBAI stock has a Moderate Buy consensus rating. Further, the average BBAI stock price target of $3.50 per share implies 97.74% upside potential.

Bottom Line

The solid demand and unique capabilities of SoundHound and BigBear.ai position them well to deliver solid financials, which could drive their share price higher. This is reflected in the analysts’ average price target, which shows significant upside potential from current levels. However, Penny stocks are risky investments. Thus, one should exercise caution before investing in them.