SolarEdge Technologies (NASDAQ:SEDG) investors have waited patiently for the stock to finally break out, but they’ve been rejected again and again. However, SolarEdge’s breakthrough moment could be right around the corner in 2023. I am bullish on SEDG stock, as it doesn’t seem to fully reflect SolarEdge Technologies’ record-breaking quarterly performance, along with the company’s ambitious but realistic current-quarter outlook.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Headquartered in Israel, SolarEdge Technologies manufactures and installs microinverter systems for solar photovoltaic (PV) installations. The company also provides monitoring systems, power optimizers, and other components and enhancements for solar systems.

Clean energy systems could be a hyper-growth category in the coming years, and SolarEdge’s microinverters will likely be an integral part of the infrastructure build-out in global solar energy. So, if you’re serious about international solar market investing, now is a great time to take a closer look at SolarEdge Technologies.

SEDG Stock Doesn’t Look Cheap, but It Can Still Break Out

To be fair and balanced, I’ll start off with a fact that bothers me about SolarEdge Technologies. As it turns out, SolarEdge’s GAAP trailing 12-month price-to-earnings (P/E) ratio of 86.5x is substantially higher than the sector median P/E ratio of 22.1x. Also, SolarEdge Technologies’ trailing price-to-book (P/B) and price-to-sales (P/S) ratios are significantly higher than their respective sector medians.

This may be a deal-breaker for some financial traders, and I understand that sentiment. On the other hand, the price chart of SEDG stock practically screams, “imminent breakout.”

Three different times, SolarEdge Technologies stock approached the $340-$350 level but was then rejected. As the old saying goes, resistance levels are meant to be broken. There are no guarantees here, but SEDG stock looks poised to break above $350, and this would be fully justified by the company’s recently released quarterly results.

While SolarEdge Technologies hasn’t always beaten analysts’ EPS forecasts (though we could say that about almost all publicly-listed companies), SolarEdge has been consistently profitable. Anyone who would assume that all solar companies are inherently risky should think about SolarEdge Technologies’ track record of consistent profitability.

Besides, even if SEDG stock might look pricey at first glance, SolarEdge Technologies CEO Zvi Lando made a couple of great points about the company’s future value proposition. First, SolarEdge Technologies possesses a “diverse geographic and segmental footprint” that enables the company to “continue to grow revenues without being overly dependent on any single market or segment.” Additionally, looking ahead, Lando sees “supply chain challenges gradually improving,” and SolarEdge remains “focused on execution and efficiencies to drive up margins and profitability.”

SolarEdge Technologies Breaks Multiple Quarterly Records

Mind you, Lando’s not just spouting empty words here. SolarEdge Technologies has a slew of encouraging data points from its first quarter of Fiscal Year 2023. It’s hard to keep track of all the quarterly company records that SolarEdge Technologies broke, so here’s a rundown.

All of the following are record quarterly results for SolarEdge Technologies: $943.9 million in revenue (versus Wall Street’s forecast of $931.85 million), revenues from the company’s solar segment of $908.5 million, $144.2 million in GAAP operating income, and GAAP net diluted EPS of $2.35 (analysts had called for $1.94). There are actually several more broken quarterly records listed in the press release, but I’m sure you get the idea by now.

For the current quarter, SolarEdge Technologies anticipates generating revenue of $970 million to $1.01 billion. This would represent a decent quarter-over-quarter improvement, and it’s not an impossible task. The same thing could be said regarding SolarEdge’s current-quarter guidance for revenue from its solar segment, which the company anticipates to increase to a range of $930 million to $980 million.

Is SEDG Stock a Buy, According to Analysts?

Turning to Wall Street, SEDG stock comes in as a Strong Buy based on 18 Buys and six Hold ratings. The average SolarEdge Technologies stock price target is $379.17, implying 25.6% upside potential.

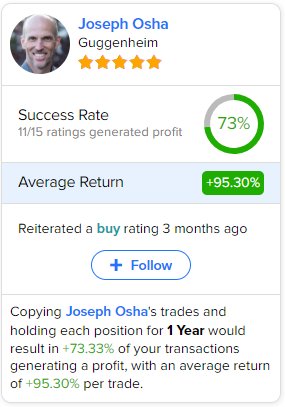

If you’re wondering which analyst you should follow if you want to buy and sell SEDG stock, the most profitable analyst covering SEDG stock (on a one-year timeframe) is Joseph Osha of Guggenheim, with an average return of 95.3% per rating and a 73% success rate. See below.

Conclusion: Should You Consider SEDG Stock?

SolarEdge Technologies is a premier solar market business with an international scope and an ambitious outlook for the near future. It’s a shame that more U.S.-based financial traders aren’t aware of this company and its stock.

If that’s the case, though, then you can let SolarEdge Technologies be a secret weapon in your clean-energy-friendly portfolio. So, I wouldn’t worry too much about whether SEDG stock looks cheap or pricy. Instead, I’d take note of the company’s record-breaking quarterly results and consider taking a long position in the stock.