Everyone seems to have an opinion about climate change; the subject usually raises disputes. Among the variance of opinions, one thing is quite certain: the transition to clean energy is a secular global trend, expected to accelerate further. As global governments strive to decarbonize the economies, clean energy receives financial backing and policy support, swiftly followed by private financing. Astute investors can recognize economic and market currents and capitalize on them, riding the trend to maximize their profits.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Sunshine is Free

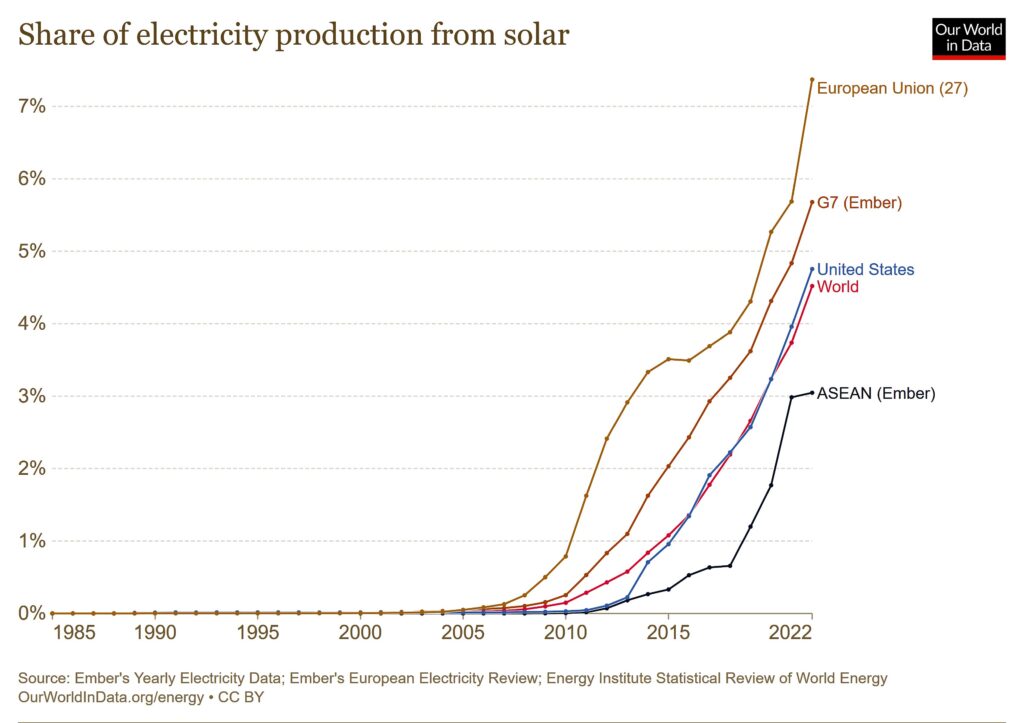

Solar energy development is an important part of the secular clean energy trend. While the industry is still in its adolescence, it has made significant strides in recent years. This ascent is being helped by technological advancement, thanks to which the cost of solar energy production has declined by almost 90% in the past decade. Battery storage, an integral part of solar and wind power supply, is now 85% cheaper than ten years ago, with much of the change coming thanks to a rapid advancement in electric vehicle technologies.

In addition to technological innovation, which makes producing and storing clean energy more efficient, government investment and tax credit initiatives help companies working in the field expand their production faster. Economies of scale help clean energy companies become more cost effective, also lowering prices. Wright’s Law, which states that there is a significant fixed cost reduction for each doubling of manufacturing volume, applies to the solar generation industry, as well as to all other industries.

Source: Our World in Data

Live By the Sun

Oil and gas will certainly stick around for a few decades, but it won’t be solely because of the costs. While it is still cheap to run an existing fossil fuel plant, building a new one is far more expensive now than starting from scratch with solar. Building new solar capacity is even cheaper now than adding capacity to existing fossil power plants.

Of course, the whole infrastructure that is built around oil and gas power generation will not be easy to replace. However, given the level of governmental support, and with more than 80% of global private investment in new energy capacity being now routed to renewables, significant advancement is expected in this sphere in the next years.

Even without accounting for subsidies, the cost of energy from new power plants is the lowest for onshore wind and solar. With production and storage becoming more and more cost-effective and efficient, some researchers suggest that the world’s entire energy consumption could be completely covered by solar technology and other renewables by 2050.

Source: Our World in Data

That might sound too optimistic, given that at the moment, renewable energy sources account for about 29% of global energy production (and solar is responsible for just 4.5%). However, we should humbly remember that every major technological advancement is met with a high level of skepticism. For example, shortly after the Internet had become available to the general public, Bill Gates himself reportedly said, “I see little commercial potential for the Internet for the next 10 years.”

To the Sun and Back

While renewable energy, including solar, is probably the future, it doesn’t imply that all solar energy companies will make it to that future.

The solar energy sector isn’t risk-free, to say the least. Longer term, as costs continue to drop with a prolonged increase in installed capacity, sale prices should fall further, undercutting profitability. On the other hand, the increased competitiveness of solar production should allow the industry to expand at a fast pace, gaining significant market share, public interest, and private investment. Does that mean that solar is on track to become a “normal” industry, similar to, for example, software or electronics?

Yes and no. Solar isn’t constrained anymore by availability of government subsidies; storage capacity constraints are also diminishing with technological advancements. From this point of view, the industry is now able to sustain its ongoing development, just like all others.

However, producing solar energy isn’t akin to making software. Solar power is a capital-intensive production; it can take a very long time for a company to see any profit. The high rate of cash burn at solar companies is an especially acute problem now, when financing is scarce, while high interest rates make debts very expensive to service and refinance.

Sunny Side Up

So, while renewables in general, and solar in particular, may be good long-term investing bets, investors are advised to choose specific stocks based on their fundamentals, such as their sources of revenues, amount of debt, cash-generation abilities, etc. Beside the financials, it would be wise to have a look at the companies’ business models, end-customers, and competitive advantages.

There are several different types of companies in the industry. Some companies design photovoltaic solar power systems, others supply solar panels to households or large projects; some offer periphery technological solutions to solar tech, and others provide energy storage products and services. Each business type has its advantages and its risks.

For example, the residential solar panels installation business is more profitable, but also much more cyclical in nature than utility companies and independent producers. As households are now watching the economy weaken, they might not want to invest in solar panels; meanwhile, large, long-term projects are far less dependent on current conditions.

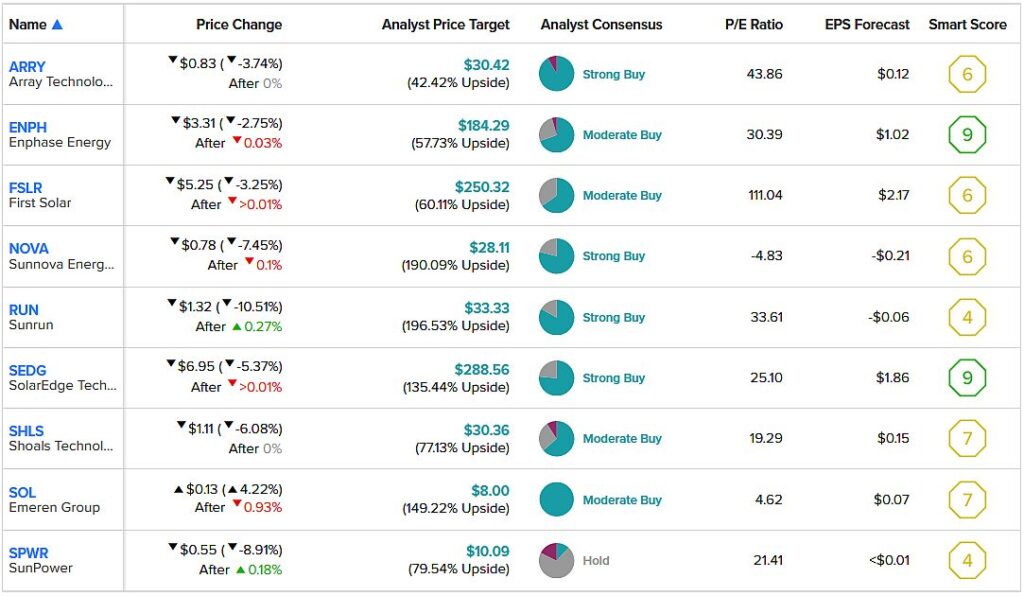

Investors are strongly encouraged to do their own research, but they can also find vast amount of data and analysis of solar industry stocks, in the interactive TipRanks screener specifically dedicated to the solar companies’ stocks: