Just 10 days from now, chips ‘n’ AI star Nvidia (NASDAQ:NVDA) is scheduled to report its latest batch of financial results. Analysts are exuberant over the news Nvidia might report, forecasting as much as 5x growth in quarterly profit, from $0.58 per share a year ago, to $3.16 per share today. And yet, one analyst in particular deviated from the herd to publish a think-piece that’s less obsessed with the dollars and cents that Nvidia will report for its fiscal Q3 2024 later this month, and more concerned with how Nvidia could earn even more money in the future.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Titling his report an abbreviation-heavy “NVDA: DGX Cloud + AI Enterprise (Software) Monetization = $30/Sh+ Value Creation Ahead?”, Wells Fargo’s Aaron Rakers, a 5-star analyst rated in the top 1% of Wall Street’s stock pros, mused about Nvidia’s ability to monetize its software to power the “next phase” of its growth story. And specifically, he wondered aloud whether Nvidia might, over just the next few years, build a software-only business that could generate $4 billion to $5 billion in annual revenue — and earn $2 billion to $3 billion in operating profit from it.

If he’s right in his predictions, this would imply anywhere from 50% to 60% operating profit margins from this new business segment — both on top of and far superior to the already robust 33% operating margin than Nvidia gets from selling computer chips.

As Raker observes, software is a relatively new business for chipmaker Nvidia, and this “next phase” in the company’s growth story is currently “in very early innings” — but he expects the potential to become “increasingly visible” and in very short order.

As the report’s title suggests, Raker thinks the new software will include (1) AI Enterprise Software, as well as software to run cloud-based AI supercomputing services, (2) Omniverse Enterprise software (so virtual reality), and also (3) NVIDIA DRIVE software used in electric and autonomous vehicles, in particular EVs from Mercedes-Benz and Jaguar Land Rover. According to Raker, the inflection point at which these three revenue streams become visible (and material) to investors could arrive as early as 2025. But already in 2023 we could see software revenues top a pretty material $1 billion, and scale quickly thereafter.

Investors are likely to gain insight into this development when Nvidia reports its Q3 earnings on November 21, along with guidance for the remainder of fiscal 2024. If the number “$1 billion” pops up as Nvidia turns the discussion to software, that will be a pretty big clue that Raker is onto something here.

It’s worth pointing out that Raker bases this recommendation on estimates of future Nvidia earnings that are actually conservative relative to consensus estimates on Wall Street — 3% below estimates for fiscal 2024 earnings (at $10.95 per share) and 20% below estimates for fiscal 2025 earnings ($17.50 per share). If he’s right about these numbers generally, but wrong on the contribution that software sales will make to Nvidia’s profits — then everyone else on Wall Street is going to turn out looking very wrong indeed.

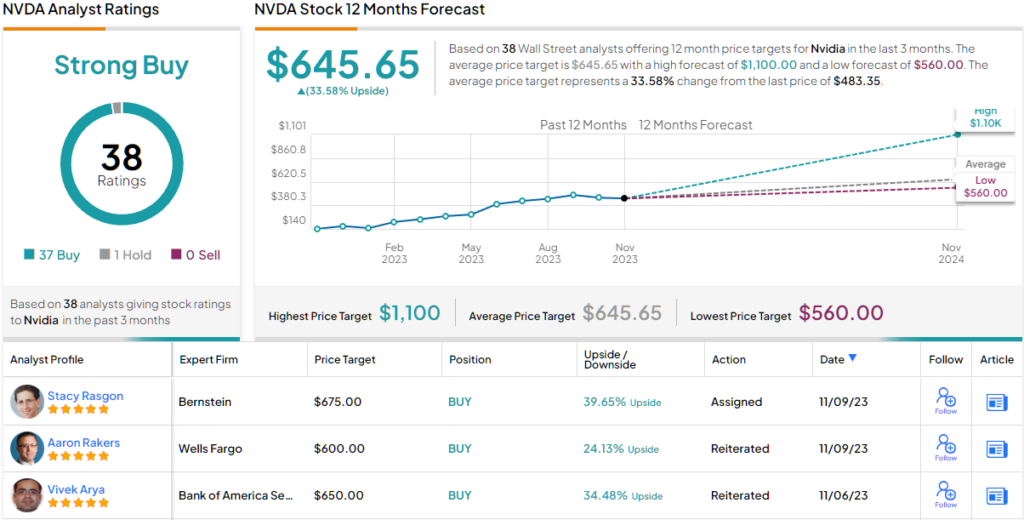

In the meantime, Raker is rating Nvidia stock an Overweight (i.e. Buy) with a $600 price target, which implies a 24% upside from current levels. (See Raker’s track record)

Almost no one is arguing with that take on Wall Street. The stock’s Strong Buy consensus rating is based on 37 Buys and a single Hold. The forecast calls for one-year gains of ~34%, considering the average target stands at $645.65. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.