For a while, special purpose acquisition companies (SPACs) were all the rage on Wall Street, but those times are gone, as evidenced by the shuttering of two SPAC exchange-traded funds in one month. But what about the companies that have already gone public via a SPAC merger? In this piece, we compare the stocks of two of those companies. With SoFi Technologies (NASDAQ: SOFI) in fintech and Lucid Group (NASDAQ: LCID) in electric vehicles, these two couldn’t be more different. However, this comparison flags some key issues with SPAC companies that remain long after the merger is complete.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

SoFi Technologies (SOFI)

SoFi Technologies is an interesting company. On the one hand, it’s a high-growth company, and its net losses have been trending lower slowly over the last few quarters. On the other hand, SoFi remains wholly unprofitable, and Wall Street has been severely punishing unprofitable companies this year. However, I’m giving the stock a bullish view for a few reasons — with the caveat that this is an ultra-high-risk investment not suitable for every investor.

One of the big issues with SPAC stocks is that most of the companies gave extraordinary projections they couldn’t possibly achieve when merging with their SPAC. However, in SoFi’s case, it projected adjusted net revenue of about $1 billion in 2021, and it managed to meet that projection, reporting $1.01 billion in adjusted net revenue.

The company also projected adjusted EBITDA of $27 million in 2021, which it also managed, coming in at around $30.2 million. SoFi’s ability to meet the projections it made when announcing its SPAC merger makes it a standout among SPAC stocks. The robust growth of its many segments also suggests the company could be worth considering.

Additionally, insiders have been loading up on the company’s stock since it went public, demonstrating their faith in the company. Unfortunately, President Biden’s cancellation of student loan debt is taking a bite out of SoFi Technologies.

However, its other segments are growing so much that this concern seems overblown. Further, attorney Stanley Tate of Tate Law suggests most of SoFi’s student loans aren’t even eligible for forgiveness, with the exception being only certain loans refinanced during the pandemic.

While SoFi Technologies is down 62.6% year-to-date, it’s only down 15% for the last six months and is up 15% in the last month, suggesting stabilization in its shares.

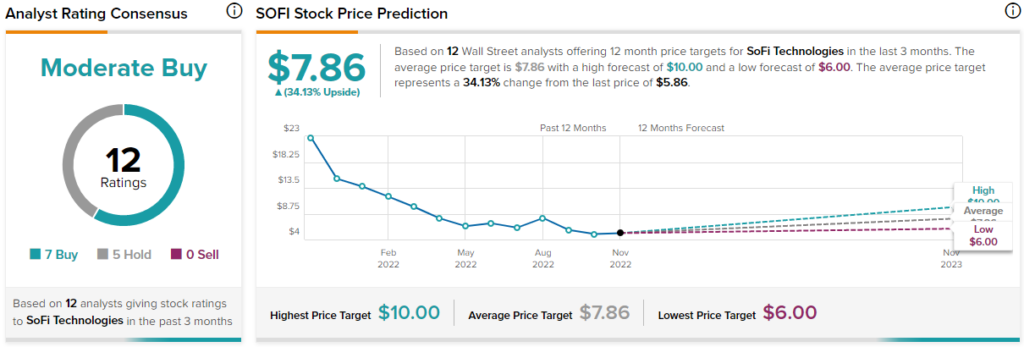

What is the Price Target for SOFI stock?

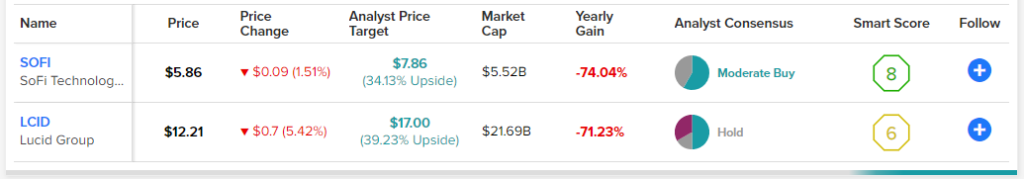

SoFi Technologies has a Moderate Buy consensus rating based on seven Buys, five Holds, and zero Sell ratings assigned over the last three months. At $7.86, the average price target for SoFi Technologies implies upside potential of 34.1%.

Lucid Group (LCID)

Unlike SoFi, Lucid Group is one of the many SPAC stocks guilty of giving projections they couldn’t possibly meet. The company said it expected to deliver 20,000 vehicles in 2022, but its most recent guidance now suggests it’s on track to deliver only 6,000 to 7,000 cars this year. Other concerns lead me to a bearish view of Lucid, although this will change if things turn around.

Lucid also said during its SPAC merger presentation that it would reach a production rate of 500,000 vehicles by 2030, amounting to a 4% share of the market. It’s hard to see how that’s possible now, but investors are clearly seeking the next Tesla (NASDAQ: TSLA).

In its early days, when it was burning through extraordinary amounts of cash every year, it looked like Tesla would never survive, but the bears ended up being spectacularly wrong. However, it’s far too early to make this determination about Lucid, as more volatility is likely in the near term.

Additionally, Lucid insiders shifted from buying to selling shares about three months ago, which could be a red flag, and it continues to raise billions in cash.

What is the Price Target for LCID stock?

Lucid has a Hold consensus rating based on three Buys, one Hold, and two Sells assigned over the last three months. At $18.80, the average price target for Lucid Group implies upside potential of 39.2%.

Conclusion: Bullish on SOFI, Bearish on LCID

Lucid’s story is the same as that of other SPAC stocks: pie-in-the-sky projections it could not meet aimed at wooing investors into approving the merger and a lack of profits with no clear path to profitability. However, SoFi appears to have real promise, although this risky bull thesis will take some time to play out – if it does at all.

Finally, both have high short interest, with Lucid at 22.4% of the float and SoFi at 12.6%, suggesting a short squeeze might be possible, but investors shouldn’t bet on that. Additionally, Lucid looks expensive at a trailing P/S of 54.4x versus SoFi’s 4.0x.