2022 was a rough year for financial firms and tech companies, and SoFi Technologies (NASDAQ: SOFI) fits into both of those categories. Still, even after a deep drawdown, I am bullish on SoFi Technologies stock, as an eventual U-turn in monetary policy (if inflation comes down) could potentially drive a huge move higher in SOFI stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SoFi Technologies is based in San Francisco and provides a broad variety of personal financial services. Through an app-based platform, SoFi’s customers can manage their savings and investments and start or refinance student, personal, and home loans.

The company basically provides an all-in-one app to help people manage their money. It’s a timely suite of services that should appeal to younger users, and SoFi Technologies might threaten big banks someday. That didn’t happen in 2022, though, and some SOFI stock investors threw in the towel after a bruising year. Yet, there are reasons to try out a “buy-low, sell-high” strategy with this beaten-down fintech name if you dare.

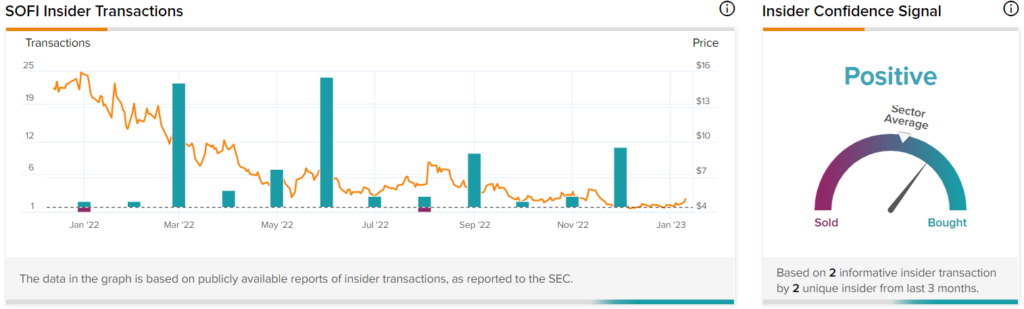

SOFI’s CEO Keeps Buying Shares

How much consideration should you give to insider purchases? That’s a question only you can answer, but it’s certainly encouraging when executives with intimate knowledge of a company are personally invested in that company. SoFi Technologies is a case in point, as a high-level executive can’t seem to stop buying SOFI shares.

I invite you to visit SoFi Technologies’ Insider Trading Activity page and click/tap on “Show More Transactions” a couple of times. You’ll see the name Anthony Noto again and again, alongside reported purchases of SOFI stock.

This is significant because Noto is the CEO of SoFi Technologies. Granted, most of his listed transactions were probably related to exercises of stock options. However, one transaction stands out: Noto bought $5,005,414 worth of SOFI stock, most likely with personal funds.

A filing indicates that Noto bought approximately 1.13 million shares of SoFi Technologies stock from December 9 through 13, 2022.

There’s an old saying in the financial markets: An insider will sell shares of a company with personal funds for many reasons (tax-loss harvesting, making room for other investments, etc.) but only buys because he/she believes the stock will go up. As the CEO, does Noto know something about SoFi Technologies that the rest of us don’t? It’s hard to know for certain, but Noto’s stake is growing, and this should give discouraged investors some hope that 2023 will be a lucrative year.

A Federal Reserve Pause or Pivot Could Catalyze SOFI Stock

In 2022, there was one problem after another for SoFi Technologies. For one thing, the government extended the pause on required federal student loan repayments. That was bad news for SoFi because the company generates revenue from refinancing student loans. There were also recession fears last year, as well as multiple interest-rate hikes enacted by the Federal Reserve.

Despite these headwinds, SoFi Technologies’ earnings managed to meet or exceed consensus estimates throughout 2022. That’s admirable, given the circumstances. Yet, recession fears haven’t disappeared in early 2023, and the Federal Reserve is likely to continue raising interest rates. That’s a problem for financial companies because higher interest rates tend to discourage borrowing and lending activity.

These challenges aren’t meant to last forever, though. The moratorium on required federal student loan repayments is supposed to provide temporary relief. It doesn’t seem likely to continue throughout all of 2023.

As for the Federal Reserve’s interest rate hikes, those aren’t meant to continue forever, either. The anticipated terminal federal funds rate is between 5% and 5.25%; the current rate range is already between 4.25% and 4.5%. So, unless something completely unexpected happens, there’s only so much more hiking to be done this year.

In other words, there’s likely to be some relief, and therefore a relief rally, in store for financial businesses like SoFi Technologies. It’s difficult to time the move, but substantial share-price appreciation appears to be on the horizon, sooner or later.

Is SOFI Stock a Buy, According to Analysts?

Turning to Wall Street, SOFI stock is a Moderate Buy, based on seven Buys and four Hold ratings. The average SoFi Technologies price target is $7.18, implying 40.2% upside potential.

Conclusion: Should You Consider SoFi Technologies Stock?

You don’t have to load up on SOFI stock like the company’s CEO did. Feel free to consider a long position that’s appropriate for your account size. Only do that, however, if you expect the problems of 2022 to wane this year. If the Fed eventually pauses or reverses course, things would look better for SOFI stock once again.