SoFi Technologies (NASDAQ:SOFI) hasn’t sold any sizeable personal loans in the last six months and hasn’t sold any ABS (asset backed securities) in over a year. This has raised concerns regarding the company’s aggressive account strategy, which leans towards fair value (FV) accounting rather than cost accounting.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The main difference is that with cost accounting, SoFi would have to earn the income gradually over the life of the loan, while with FV accounting, they recognize it upfront.

“This does inflate NT book value vs. peers using cost accounting,” notes Oppenheimer’s Dominick Gabriele.

Considering these factors, the bearish arguments have primarily centered around concerns regarding potential unrealistic fair value (FV) assumptions, the impact of FV marks, and the recent imposition of cost accounting on the company.

Looking into the matter, to design a composite index to follow movements in the underlying market, Gabriele collected all personal loan ABS transactions (38) in Bloomberg from 2021 onwards and came away with some good news for the bulls.

“This composite combined with other SOFI benchmarks for discount rates on cash flows, supports SOFI’s coupon rates, prepayment and discount rate assumptions changes. Thus, SOFI’s balance sheet implied GOS margins mirror market movement.” Essentially, says Gabriele, the gathered industry data “suggests SOFI’s FV mark methodology is sound.”

Having said that, Gabriele notes that if investors correct SoFi’s TBV (tangible book value) to make it more akin to peers, as per his calculations, there is a ~$1.67 billion impact to TBV, meaning SOFI’s near-term potential valuation may decrease by 68% vs. the current level.

“That said,” Gabriele reassuringly added, “we think SOFI’s stock price already reflects most of this impact, in our view.”

The analyst makes the point that SoFi will probably restart selling personal whole loans and/or ABS. Given the company’s focus on deposits, which on average lead to less funding costs, it is understandable that the company hasn’t made much use of the ABS market. “Companies still likely to use all funding sources for diversity,” Gabriele further noted.

All told, then, Gabriele reiterated an Outperform (i.e., Buy) rating on SOFI shares, along with a $7 price target, suggesting the shares have room for 28% growth over the next year. (To watch Gabriele’s track record, click here)

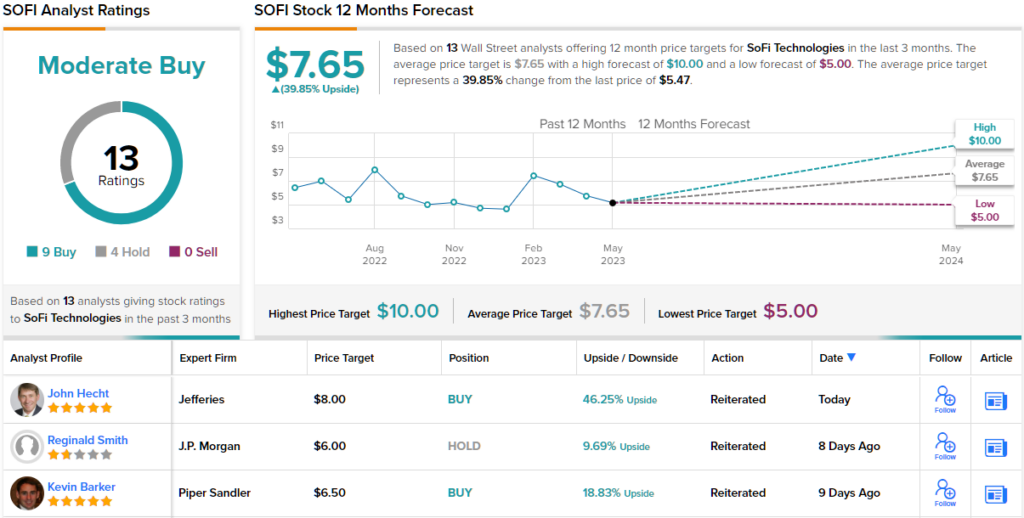

Most analysts agree. With 9 Buys against 4 Holds, the stock claims a Moderate Buy consensus rating. At $7.65, the average target implies shares will appreciate ~40% over the 12-month timeframe. (See SoFi stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.