After a strenuous few months, SoFi (SOFI) shareholders finally received some good news.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Keep in mind that SOFI stock is one that’s nearly halved from its November peak. For investors bullish on this company’s near-term future, it’s been a rough go.

However, the recent announcement from regulators that SoFi will be allowed to become a national bank, via its much-awaited Golden Pacific Bancorp acquisition, is music to investors’ ears.

This fintech company currently provides an online app to provide various banking products such as loans, debit cards, and cash accounts to under-banked customers.

However, until now, SoFi has not been a bank, technically. Like other fintech companies, SoFi has relied on FDIC-insured banks for much of its operations.

Accordingly, this news is very bullish for investors looking forward at the company’s potential cash flows. Without intermediary assistance, SoFi’s expected future cash flows get a big boost from this deal.

The combined SoFi/Golden Bancorp is expected to have $5.3 billion in assets as a result of the deal, with SoFi planning to capitalize its Golden Bancorp business with $750 million.

Despite the recent bearish trend SOFI stock has been on, this is a fintech company I remain bullish on.

What Deal Indicates

Becoming a bona fide bank is no small undertaking. Sure, SoFi scurried around regulators, to some extent, choosing to acquire its way to bank status.

In some ways, a reverse SPAC merge (which SoFi undertook), is a similar way companies like SoFi are able to tap capital markets sooner than expected.

That said, a bank charter is a bank charter. This charter is big news, because it allows SoFi to more aggressively go after its target market’s business.

Banks can offer better lending rates, as well as a range of products such as high-yield interest accounts, and savings and checking accounts that other fintech companies are not easily able to provide.

Additionally, by cutting out the middlemen which were previously necessary in SoFi’s business model, SoFi’s margins should improve.

This deal is likely to have a direct impact on the company’s cash flows, and provides certainty to investors who bought SOFI stock with the understanding this acquisition would go through.

Simplified Operations

As per SoFi’s recent regulatory filing, the company’s funding sources include warehouse funding and debt scrutinization. It pays interest on this funding at 1.6% and 4%, respectively.

With the bank charter, SoFi could transfer all of its deposits in SoFi Money. The account of SoFi Money reached $1.16 billion during the December quarter. This further allows SoFi to pursue cheaper funding sources, providing more growth capital for further expansion.

By becoming a chartered bank, SoFi’s operations become simplified. The company will be able to hold loans on its balance sheet, rather than selling them immediately.

Doing so provides operational flexibility, as well as the potential to earn above-average returns on certain loans. Holding a diversified loan book could provide substantial revenue to offset other business endeavors, such as the aforementioned products like high-yield savings accounts, and the like.

Above all, the increased clarity investors receive from a regulatory perspective is a big boost for investors bullish on the long-term trajectory of this company.

As a bank, SoFi may become a trustworthy lending institution, currying favor among the clientele this company is chasing after.

Wall Street’s Take

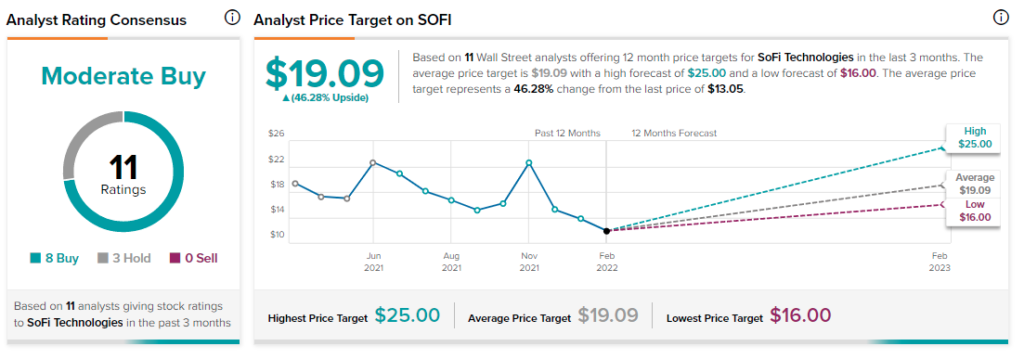

As per TipRanks’ analyst rating consensus, SoFi is a Moderate Buy. Out of 11 analyst ratings, there are eight Buy recommendations and three Hold recommendations.

The average SoFi price target is $19.09. Analyst price targets range from a high of $25 per share to a low of $16 per share.

Bottom Line

This recent news is great for investors thinking about the potential of SOFI stock. That said, a lot of work needs to be done to capitalize on this acquisition.

In many ways, SoFi is a company that looks like it’s heading in the right direction. However, the company’s recent trajectory is one that has other investors disappointed. Right now, this is a difficult stock to assess.

That said, I think on balance, SOFI stock looks attractive here. On this interest rate-driven selloff, SoFi could be a company to think about adding while there’s blood in the streets.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure