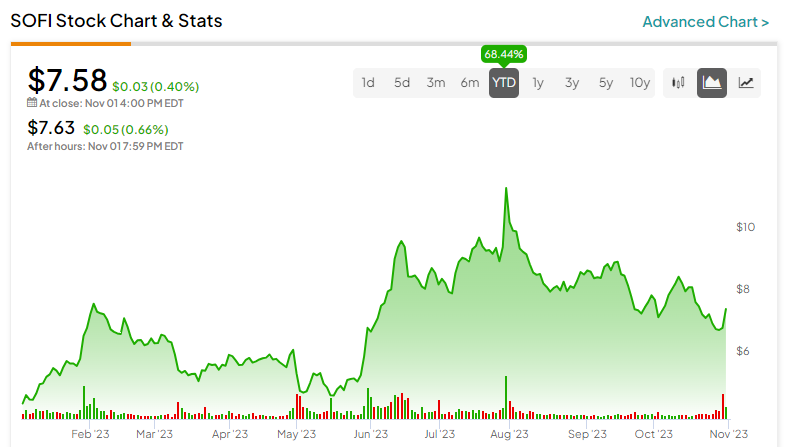

Fintech company SoFi Technologies (NASDAQ:SOFI) has been a notable winner this year. Its stock has surged 68% year-to-date, outperforming the S&P 500’s (SPX) gain of 10%. While the rising interest rate environment is a headwind for SoFi, the company is growing at a tremendous pace. Its ability to overcome hurdles while adapting to changes in the industry and setting new benchmarks in the fintech space has drawn investors’ attention to this growth stock. Hence, I am bullish on SOFI stock now.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Rapid Growth amid Tough Economic Conditions

Despite the challenging macro-environment, SoFi’s growth pace is striking. By capitalizing on the shift toward digital finance and catering to evolving customer needs, the company distinguished itself from the numerous players in the financial industry. This is apparent in its revenue growth, as revenue grew from $443 million to $1.6 billion between 2019 and 2022.

Moreover, its technology-driven solutions and user-friendly platforms have quickly gained traction, attracting a substantial customer base. SoFi stands out by offering competitive interest rates, streamlined application processes, and personalized financial advice. SoFi added 717,000 new members in Q3, while total members grew by 47% year-over-year to over $6.9 million at the end of the quarter.

Its growing customer base is the reason its adjusted net revenue grew by 27% year-over-year to $531 million in Q3. Also, adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) climbed by 121% to $98 million.

Moreover, SOFI expanded its services beyond lending to providing investment, insurance, and banking products to customers. CEO Anthony Noto stated that 67% of the increase in adjusted net revenue in the quarter came from its Non-Lending Segments.

For context, its Financial Services segment grew 142% year-over-year, while the Technology Platform Segment reported growth of 6%. Meanwhile, continued growth in personal loan and student loan products drove 15% revenue growth in the Lending segment in Q3.

Lastly, SoFi added 1,047,000 new products in the quarter, bringing the Total Products figure to over 10.4 million at the end of Q3.

Resumption of Student Loan Payments Paints a Rosy Outlook for SoFi

SoFi is not profitable yet, but its losses are narrowing, which came in at $0.03 per share compared to a loss of $0.09 per share in the prior-year quarter. Analysts expect the company to be profitable by Fiscal 2024. Meanwhile, SoFi’s management is confident that it will post a GAAP (generally accepted accounting principles) profit in Q4. With the resumption of federal student loan payments, refinancing opportunities for the company will rise. Therefore, I believe this is an achievable goal.

Furthermore, with AI integration, SoFi remains committed to staying ahead in the game by offering cutting-edge financial solutions to its customers. From risk assessment in lending to personalized financial advice and fraud detection, AI plays a significant role in boosting SoFi’s services.

Looking ahead, the upbeat quarterly results encouraged management to raise its Fiscal 2023 outlook. The company now forecasts adjusted net revenue in the range of $2.04 billion to $2.06 billion, up from its previous estimate of $1.97 million to $2.03 billion range. Meanwhile, analysts predict growth of 33.3% to $2.05 billion in Fiscal 2023. Meanwhile, the stock trades at 3.5 times forward sales, which seems reasonable based on its revenue growth forecasts.

The company also anticipates full-year adjusted EBITDA in the range of $386 million to $396 million, compared to the prior estimate of $333 million to $343 million, indicating a healthy adjusted EBITDA margin of 48%.

On October 31, Morgan Stanley (NYSE:MS) analyst Jeffrey Adelson revised his rating for SOFI to Hold from Sell with a price target of $7 (although this is still a bit lower than the current price). After positive developments in the third quarter, such as higher expected revenue for the full fiscal year and student loan refinancing opportunities, the analyst is now more optimistic about SOFI’s near-term future.

Is SOFI Stock a Buy, According to Analysts?

According to TipRanks, Wall Street has a Moderate Buy consensus rating for SOFI stock based on five Buys, six Holds, and one Sell rating assigned in the past three months. The average SOFI stock price target is $9.88, implying about 30.3% upside potential.

The Bottom Line on SoFi Stock

With economic uncertainties impacting the lending and financial markets, SoFi’s resilience will continue to be tested. But with the resumption of student loan repayments, SoFi’s near-term outlook looks hopeful. Overall, the company’s reasonable valuation relative to its growth potential and its ability to adapt to the ever-changing fintech industry make SOFI a compelling growth stock now.