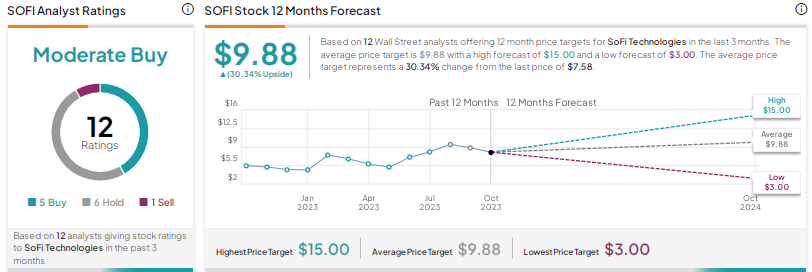

Fintech company SoFi Technologies (NASDAQ:SOFI) reported better-than-anticipated third-quarter results and raised full-year guidance, with management expecting GAAP net income profitability in the fourth quarter. While the risks related to a high interest rate environment and macro pressures remain, analysts’ sentiment for the stock has improved following the upbeat performance. Wall Street’s consensus rating for the stock has moved from Hold to a Moderate Buy following the results, with the average price target indicating strong upside potential.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q3 Results Drive Improved Sentiment

SoFi’s GAAP revenue increased 27% year-over-year to $537.2 million in the third quarter, driven by strong performance across its Financial Services, Lending, and Technology Platform segments. It is worth noting that the company’s student loans business saw its origination volume double year-over-year and grow notably sequentially to $919 million in the September quarter, ahead of the resumption of payments.

The company witnessed 717,000 net new member additions and ended the quarter with 6.9 million members, up 47% year-over-year. SoFi, which secured a banking charter last year, grew its total deposits by 23% during the quarter to $15.7 billion.

Moreover, the company’s adjusted loss per share came in at $0.03, better than a loss per share of $0.09 in the prior-year quarter. However, it should be noted the company’s GAAP net loss jumped to $0.29 from $0.09 in Q3 2022 due to a goodwill impairment charge of $247 million. That said, management is confident about delivering positive GAAP net income in Q4 2023.

On Tuesday, Morgan Stanley analyst Jeffrey Adelson upgraded SoFi stock to Hold from Sell, while maintaining the price target at $7. The analyst said that the stock’s risk-reward looks more balanced now. He added that he is slightly more positive about SoFi’s near-term outlook.

Adelson noted that SoFi’s Q3 net interest income exceeded expectations, driven by faster loan growth, solid deposit flows, and the company’s ability to originate loans even at higher-than-expected yields. He also highlighted that student loan refinancing originations were stronger than anticipated. He thinks that potential loan sales for Q4 could lower the risk of the company raising additional capital in the near term.

Meanwhile, BTIG analyst Lance Jessurun lowered his price target for SoFi Technologies stock to $9 from $13 and reiterated a Buy rating on October 31. The analyst noted that the stock’s reaction has been lackluster despite the company reporting record revenue and raising guidance.

Nonetheless, Jessurun remains positive on SoFi’s platform and long-term growth potential, although he acknowledged the presence of near-term headwinds like concerns over the company’s use of fair value accountability and the ability to sustain loan origination growth over the next 12 months.

Is SoFi a Good Investment?

Wall Street’s consensus rating on SoFi stock moved to Moderate Buy from Hold following the Q3 results. The Moderate Buy consensus rating is based on five Buys, six Holds, and one Sell. The average price target of $9.88 implies 30% upside potential. Shares have risen over 64% year-to-date. The stock ended at $7.58 on November 1, up more than 10% compared to the closing stock price of $6.87 prior to the announcement of Q3 results.

Conclusion

SoFi Technologies delivered impressive results, which indicated strength across key areas despite macro pressures. While the sentiment for the stock has improved with the solid Q3 results, there are concerns about a high interest rate backdrop and macro pressures adversely impacting the company over the near term.