Fintech giant SoFi (NASDAQ: SOFI) may seem like a stock to avoid on paper. It made its stock market debut last year and currently trades 83% below its all-time high price. Moreover, its link to the student loan business has impacted its near-term outlook amid the moratorium on debt payments effective for the rest of the year. However, its bull case is underpinned by two facts; its incredibly robust growth rates and low valuation. Hence, we are bullish on SOFI stock over the long haul.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SoFi Technologies is one of the most talked-about fintech firms, which started a little over a decade ago as a student loan lender. Over the years, its business has evolved, and it spread its tentacles in multiple profitable verticals, including mortgages, personal loans, direct deposits, and personal finance tools.

Growth rates for its business have been nothing short of spectacular. In its most recent quarter, it registered an impressive 50% in revenue growth with membership growth of almost 70%. Despite its amazing performances, it trades under 3x forward sales while top-line growth estimates for the next three years range from 23% to 37%. Hence, it’s a stock that is tough to ignore at this point and one you should have on your radar.

Interestingly, SOFI stock has a ‘Perfect 10’ Smart Score rating, implying that it can outperform the market, going forward.

Two Massive Acquisitions

A couple of acquisitions effectively changed the game for SoFi in the past couple of years. The first was the acquisition of a banking-as-a-service platform called Galileo in 2020. The platform allows various financial businesses to build their own digital banking services effectively. Moreover, it allows the firm to cross-sell its investment and banking products and services effectively.

Another massive acquisition, and arguably an even bigger one, was the acquisition of Golden Pacific Bancorp. With the Californian bank’s acquisition, the firm obtained a bank charter, giving it a major edge over its peers.

There had been much chatter about the bank charter from SoFi’s management, and many had thought it was an unlikely feat. However, SoFi has effectively cut out the intermediaries and can now hold deposits and set its own interest rates.

Consequently, its deposits shot up to $2.7 billion in its second quarter and set a record for personal loan originations, boasting 135% year-over-year expansion. With higher quality deposits, SoFi is benefiting from a lower cost of funding and has increased its flexibility to capture additional net margins and effectively optimize returns.

The banking charter will continue to play a major part in its expansion over the next few years. It’s already leveraging its bank charter to build a huge deposit base with a 1.8% annual yield. Moreover, it has grown its deposits at much faster rates than other banks with its ability to cross-sell products effectively to other customers. The move seems to be paying off a great deal, with the member count rising by 69% from last year.

SoFi’s Push Towards Profitability

SoFi isn’t profitable, and it’s been made aware of that fact. It continues to grow members and products, though, with an amazing surge in revenue growth rates over the past few years. Its net loss for the quarter came in at $96 million, significantly lower than the $165 million net loss in the same period last year. It adjusted its sales and EBITDA guidance for the full year and is gradually progressing toward profitability.

Furthermore, its financial services division has grown at an accelerated pace, but that growth has come at a major cost. The segment saw a substantial cash burn of $53.7 million, most of which came from credit card losses. In a potential recession, these losses should grow.

Nevertheless, the future is bright for SoFi, with it recently bumping its guidance for the second quarter, unlike most companies in the current environment. It indicated that its full-year sales would fall in the $1.508 billion to $1.513 billion range, up a fair bit from its previous guidance.

Also, it expects its adjusted EBITDA to be in the $104 million to $109 million range, a slight improvement from the prior guidance of $100 million to 105 million.

What is SoFi Stock’s Target Price?

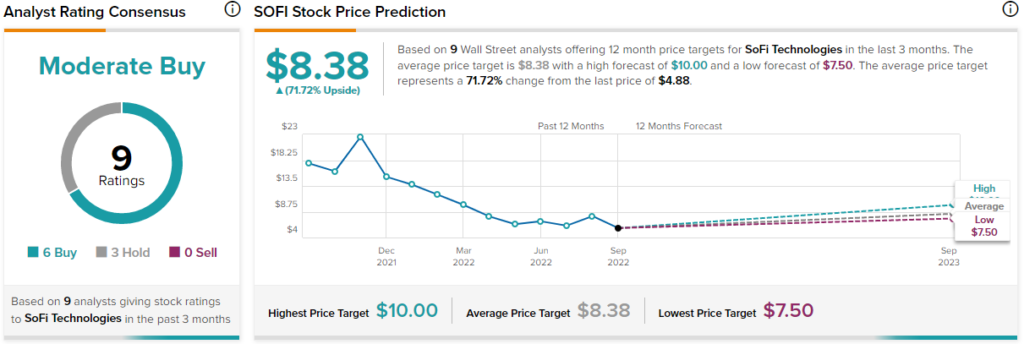

Turning to Wall Street, SOFI stock maintains a Strong Buy consensus rating. Out of nine total analyst ratings, six Buys, three Holds, and zero Sell ratings were assigned over the past three months. The average SOFI price target is $8.38, implying 71.7% upside potential. Analyst price targets range from a low of $7.50 per share to a high of $10 per share.

Conclusion: SoFi Stock Has Solid Potential

SoFi has done a tremendous job of expanding its business through its recent acquisitions and attracting new customers with higher interest rates on deposits. Moreover, its Galileo offering continues to gain traction, adding new customers at a breathtaking pace each quarter. The two catalysts put it on a solid footing at this time, which should help move its price northward again.

It is yet to turn a profit, but it looks like that might change soon. Its strong growth plans make it an exciting fintech offering with the potential for exponential growth in the foreseeable future. The market correction has the stock trading near all-time lows, which makes it a highly-attractive long-term pick.