The week will kick off with a bang for SoFi Technologies (NASDAQ:SOFI). Before Monday’s market action begins, the fintech company will announce fourth quarter and full year 2022 results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Driven by a moderate 5% year-over-year drop in loan originations – compared to the Street at a 7% decrease – J.P. Morgan’s Reginald Smith expects adjusted revenue to climb 50% year-over-year (Street has 52%) and up “modestly sequentially.” That will bring Q4 revs to $421 million vs. Street expectations of $426 million.

As per the company’s guidance, Smith expects notional contribution profit and EBITDA to decline a tad sequentially, calling for adj. EBITDA of $36 million, below consensus at $43 million.

That said, anticipating “strong member and deposit growth,” Smith notes that the company has a “track record” of beating Street Rev/ EBITDA estimates.

Key items for investors to watch include, “(1) FY23 guidance (we are meaningfully below the Street on difficult interest rate hedge compares and the potential for negative fair value adjustments to its loan portfolio) and underlying assumptions, (2) HFS loan book growth and credit trends, and (3) qualitative commentary around personal loan demand and the whole loan sale and ABS (asset-backed securities) funding environments.”

Smith notes that despite consumer credit metrics still deteriorating, banks showed “better-than-feared” metrics in 4Q22, with the majority stipulating a “gradual” return to pre-pandemic loss rates, and not the abrupt and immediate increase the market seems to be readying for.

That said, Smith also notes that leading personal loan originator, Lending Club, offered a more “conservative” stance on its 4Q earnings call and on account of the “rapid change in economic environment,” did not provide annual guidance.

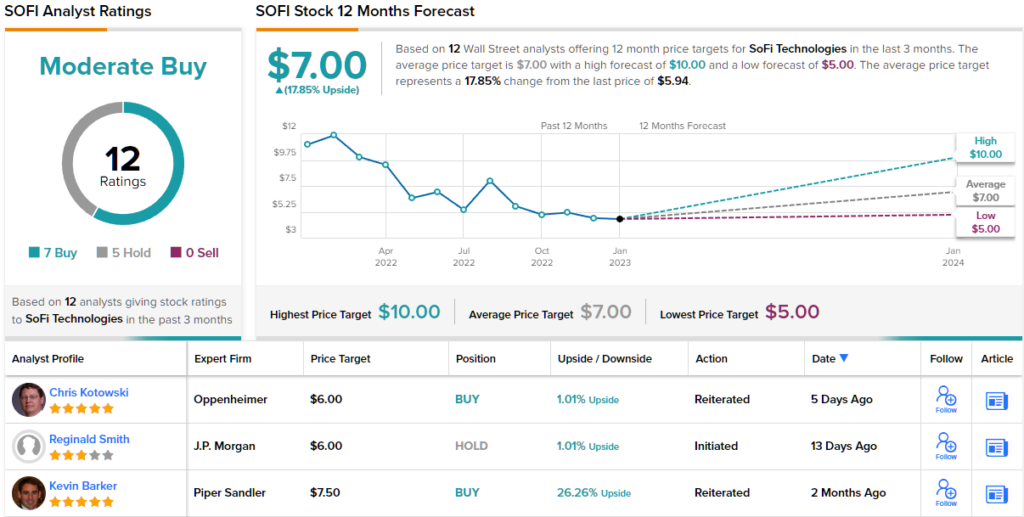

So, how does this all translate to investors? Smith remains on the sidelines for now with a Neutral rating and a $6 price target. This suggests the shares will stay rangebound for the foreseeable future. (To watch Smith’s track record, click here)

Elsewhere on the Street, 4 other analysts join Smith on the fence yet with an additional 7 Buys, the analyst consensus views this stock a Moderate Buy. Going by the $7 average price target, investors will be sitting on returns of 18% a year from now. (See SoFi stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.