It’s been a rough start to 2024 for the tech sector, with the Nasdaq 100 (NDX) falling 2.4% in the year’s first three trading days. Undoubtedly, there’s a lot of profit-taking at play when it comes to tech stocks, some of which may have run up too far, too fast. That said, the long-term fundamentals and AI tailwinds still seem in play. So, don’t let this sell-off cause you to panic. Many Wall Street analysts stand bullish on high-growth firms (such as SNPS, MDB, and ANET), even if their valuations are a tad on the lofty end.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

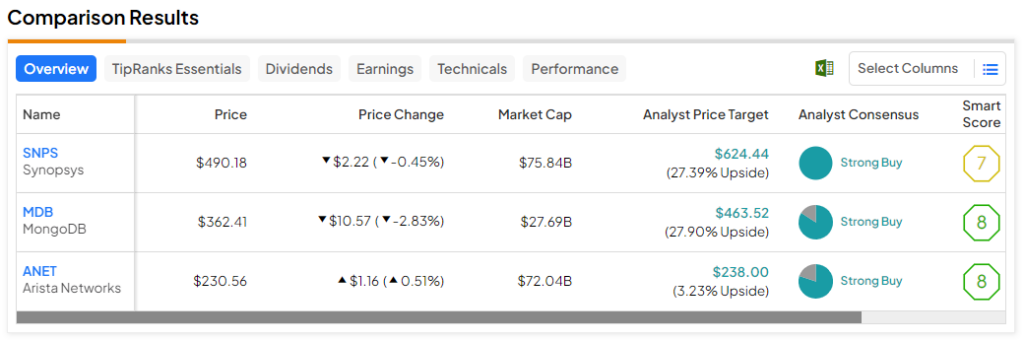

At the end of the day, secular growth warrants higher multiples. Therefore, let’s check TipRanks’ Comparison Tool to see how the trio of analyst-approved tech bets stand for this new year.

Synopsys (NASDAQ:SNPS)

Shares of electronic design automation software (EDA) developer Synopsys are off to an ugly start to the year, with shares now down more than 4% year-to-date, or around 14% from their late-2023 highs. Undoubtedly, 2023 was a big year for Synopsys, which clocked in some robust quarters.

Still, the party was drawn short as the firm fell on the back of news of potential plans to acquire engineering simulation software developer Ansys (NASDAQ:ANSS) in a deal that could be worth “over $400 per share.” Clearly, the market didn’t like the price of admission. As you may know, M&A is not always value-creative. Overpay or overestimate synergies from a deal, and an acquisition can be a destroyer of value.

Could it be that Ansys is actually worth more in the hands of Synopsys, or the crowd is missing the true value of the firm? Perhaps. Simulation with a bit of artificial intelligence (AI) sprinkled may be the wild card value driver that most are missing.

Indeed, EDA is hard to “get” on its own, let alone AI capabilities alongside EDA. Either way, KeyBanc Capital Markets’ Jason Celino is bullish on the firm’s prospects in the AI age, going as far as to call “AI-enabled design” as the biggest “breakthrough” in several decades. I’m inclined to be bullish as well. The hefty price tag on Ansys may prove to be a bargain when you view it through an AI lens.

At 62.1 times trailing price-to-earnings (P/E), SNPS stock trades at a rich premium to the infrastructure software industry average of 40.3 times. I believe the premium is warranted, given the EDA play’s potential AI edge.

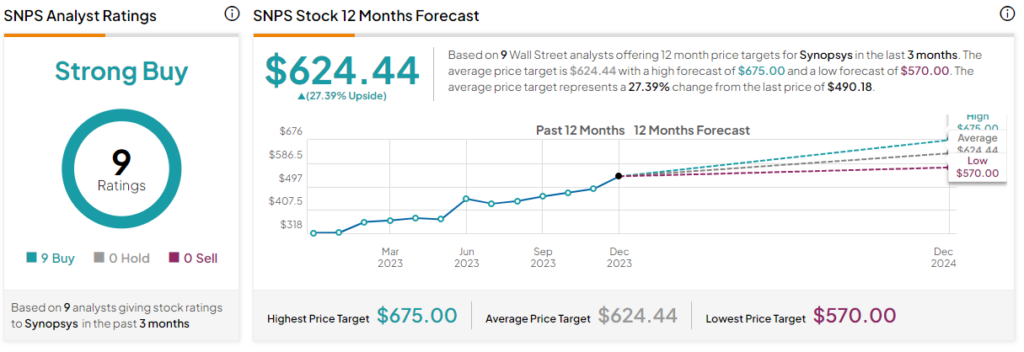

What is the Price Target of SNPS Stock?

Synopsys stock is a Strong Buy, according to analysts, with nine unanimous Buys assigned in the past three months. The average SNPS stock price target of $624.44 implies 27.4% upside potential.

MongoDB (NASDAQ:MDB)

MongoDB is another big 2023 winner that’s waning in the first few days of 2024, off more than 11%. The NoSQL database software firm recently reported spectacular third-quarter numbers, with revenue soaring by a whopping 29.8%. Despite the solid results, it’s been tough to nudge the stock higher after an incredible run in 2023 that saw shares more than double. Indeed, after such a move, great numbers are already a given, making it tougher to move the needle higher.

Though 2023 was a fantastic year, the stock’s been consolidating since its early June surge. And it could stay range-bound if the tech sector continues selling off to start the year. A continued dip in MDB ought to be viewed as an opportunity to buy, at least according to many analysts covering the firm.

Investment firm Baird went as far as to name MongoDB one of its top picks for 2024. The rise of generative AI stands out as firms poised to gain from its continued rise as we enter year two of the “AI boom.” After such upbeat comments, it’s hard not to be bullish.

At more than 117 times forward P/E (that’s above and beyond the infrastructure software industry average), MDB is not for the everyday value investor. The company is in growth mode, and any hiccups could pave the way for a plunge. That said, it’s hard to bet against a firm that seems to have a front-row seat to the rise of AI.

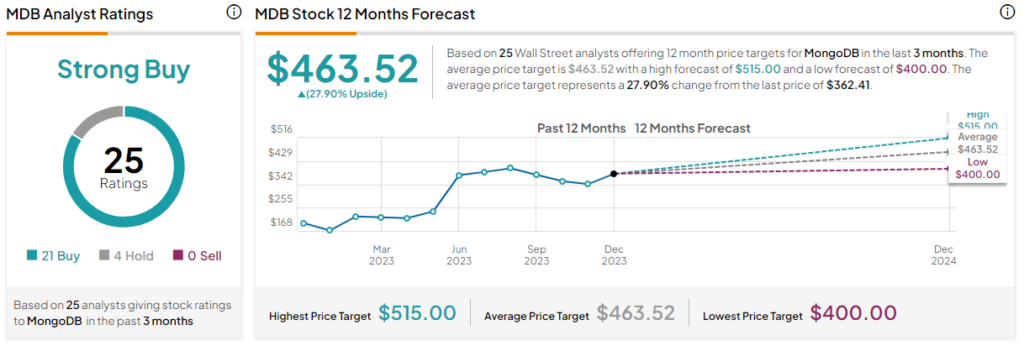

What is the Price Target of MDB Stock?

MongoDB stock is a Strong Buy, according to analysts, with 21 Buys and four Holds assigned in the past three months. The average MDB stock price target of $463.52 implies 27.9% upside potential.

Arista Networks (NASDAQ:ANET)

Arista Networks stock is another tech firm that more than doubled last year but finds itself in a bit of a hole to start 2024. Like MongoDB, Arista also stands to get a shot in the arm from the rise of AI. Just ask Citi’s Atif Malik, who hiked his price target by a whopping $80 just last month to $300 from $220, also naming ANET stock one of Citi’s top tech picks. Malik’s new price target entails more than 30% upside from current levels. That’s a solid gain that has me staying bullish.

It’s not just the AI boom that has Malik pounding the table; it’s his belief that the firm’s growth is “sustainable.” I think there’s a high chance he’ll be proven spot-on in 2024.

If AI is going to take off, networks are going to have to be up to speed, and that’s why Arista is not a company to count out as AI hype shifts from chips to other corners of the tech scene.

At 38.1 times trailing price-to-earnings, the stock is also trading at a hefty premium to the hardware industry average of 27.1 times. Given the AI opportunity, it’s a well-earned premium to the peer group, in my view.

What is the Price Target of ANET Stock?

Arista stock is a Strong Buy, according to analysts, with 12 Buys and three Holds assigned in the past three months. The average ANET stock price target of $238 implies 3.2% upside potential.

The Takeaway

Don’t let the weak start to 2024 fool you. infrastructure tech stocks with AI exposure could remain robust through the new year. Of the trio, analysts see the most upside from MDB (27.9%).