Cloud-based data warehouse company Snowflake (NYSE:SNOW) is scheduled to announce its fiscal third-quarter results after the financial markets close on November 30. Snowflake’s revenue has been growing at an incredible rate. The company has solid growth potential in the cloud market. Nonetheless, investors are concerned about the impact of macro challenges on Snowflake as enterprises are reducing their budgets amid fears of an economic downturn.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Analysts’ Expectations from Snowflake’s Q3 Results

Snowflake smashed analysts’ revenue expectations for the fiscal second quarter but reported a larger-than-anticipated loss. Q2 revenue surged 83% to $497 million, but loss per share expanded to $0.70 from $0.64 in the prior-year quarter. The company guided for Q3 product revenue growth in the range of 60% to 62%.

Jefferies analyst Brent Thill opines that Snowflake is the strongest among its software peers based on its solid fundamentals. The analyst noted that the company “has guided fairly prudently and has left room to beat the high end of their quarterly outlook.”

Thill feels that while Snowflake’s product revenue has room to grow, macro uncertainty does raise apprehensions about deteriorating market conditions in the second half of 2022. Thill has a Buy rating on Snowflake stock and a price target of $200.

Meanwhile, Monness, Crespi, Hardt analyst Brian White has concerns about Snowflake’s slowing growth. The analyst highlighted several near-term issues, including margin pressures, intense competition, and persistent economic weakness.

White noted that the company’s larger rivals Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure, have painted a “darker picture” for the public cloud as well as the software space, mainly for companies that have a consumption-based revenue model like Snowflake. White, who has a Hold rating on SNOW stock, expects Snowflake’s Q3 revenue to rise 71% to $573.5 million.

Overall, Wall Street expects Snowflake’s revenue to grow 61% to nearly $539 million and adjusted earnings per share to rise 25% to $0.05.

Is Snowflake a Good Buy Now?

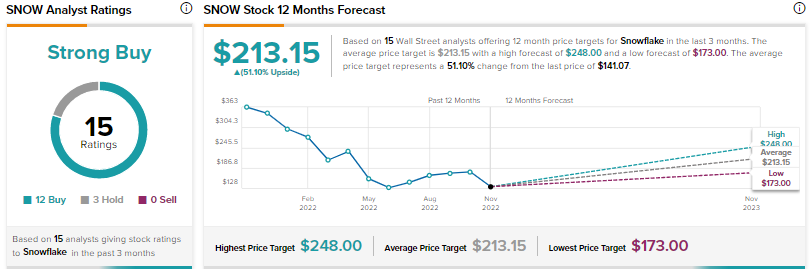

Snowflake stock scores the Street’s Strong Buy consensus rating based on 12 Buys and three Holds. The average SNOW stock price target of $213.15 implies 51.1% upside potential from current levels. Shares have plunged 58.4% year-to-date.

Conclusion

Snowflake’s revenue has been growing at a solid rate, but there are concerns that macro headwinds might slow down the company’s growth rate. While most analysts are optimistic about Snowflake, investors remain wary of growth stocks, especially the ones which are unprofitable, amid rising interest rates. Snowflake’s outlook could give us more insights into the company’s direction.