Shares of Snowflake (NYSE: SNOW) soared 12.4% on Thursday to close at $143.11 after J.P. Morgan analyst Mark Murphy upgraded the stock to a Buy from a Hold and kept a price target of $165 on the stock. The analyst’s price target implies an upside potential of 15.3% at current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Snowflake is a cloud computing company whose customers use “the Data Cloud to unite siloed data, discover and securely share data, and execute diverse analytic workloads.”

Murphy upgraded the stock based on his survey that polled 142 Chief Information Officers (CIOs) who controlled around $100 billion of information technology spending. In this survey, Snowflake was ranked #1 when it comes to its spending intentions, beating out other technology stalwarts like Microsoft (MSFT).

Murphy commented, “The pent-up demand for its solutions has allowed Snowflake to exhibit a very rare level of growth at scale with best-in-class growth-plus-margin profile. We expect Snowflake to continue to grow revenue at a rapid scale.”

This bullish sentiment was also echoed by Rosenblatt Securities analyst Blair Abernethy after the analyst came away “encouraged” following Snowflake’s Investor Day earlier this month.

The analyst pointed out that “despite near term macroeconomic concerns, new and existing customer interest (1,000’s were in attendance) in Snowflake’s platform remains at a high level, is broad-based and continues to grow rapidly.”

On its Investor Day, Snowflake underlined the rapid development of its platform, its automation, data monetization capabilities, and “native data-driven application development”. The company also pointed out that it was expanding its data platform’s capabilities “to reach on-premise storage.”

Analyst Abernethy views this as “an important step in broadening data access for the platform as most customers still have significant on-prem [on-premise] data stores yet want these to inter-operate with their Snowflake data.”

The analyst is also positive about SNOW’s objectives to generate product revenues of $10 billion by FY29 and an operating margin of 20%.

As a result, Abernethy remains upbeat with a Buy rating and a price target of $255 on the stock. The analyst’s price target implies an upside potential of 78.2% at current levels.

Other Wall Street analysts also side with Murphy and Abernethy and are bullish about the stock with a Strong Buy consensus rating based on 22 Buys, five Holds, and one Sell. The average SNOW price target of $194.50 implies an upside potential of 35.9% at current levels.

Bottom Line

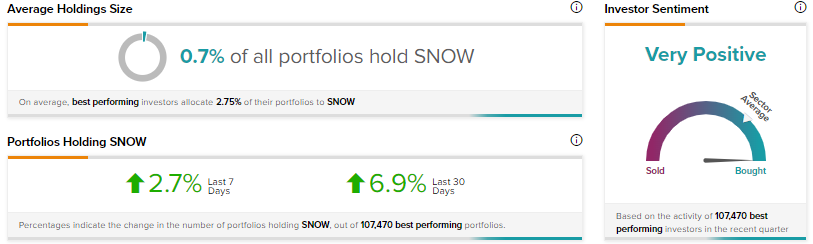

As cloud computing takes off, SNOW seems poised to take advantage of this wave with its cloud-native data platform. Besides Wall Street analysts, investors on TipRanks are also very positive about the stock, as indicated by the TipRanks Crowd Wisdom tool.

This tool indicates that 6.9% of the Best Performing portfolios on TipRanks have upped their exposure to SNOW stock in the last 30 days.