Artificial intelligence (AI) stocks have been all the rage over the past few months, thanks to OpenAI’s ChatGPT. Indeed, it’s hard to remember the last time a new technology made its mark felt so suddenly. Perhaps the Apple (NASDAQ:AAPL) iPhone was the last gadget to give that “like magic” feel.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Just because Microsoft (NASDAQ:MSFT) is hogging headlines with its AI innovations (Bing and its OpenAI investment), though, don’t expect it to shut other competitors out with advancements. ChatGPT and Bing may be part of the first wave of the first generative AIs to impress consumers, but I can’t help but imagine every other tech firm licking its chops over the potential opportunities that AI opens.

In a few years, AI could become the buzzword that’s spewed ad nauseam at most firms’ quarterly conference calls as firms look to command some sort of “AI premium” on their share prices.

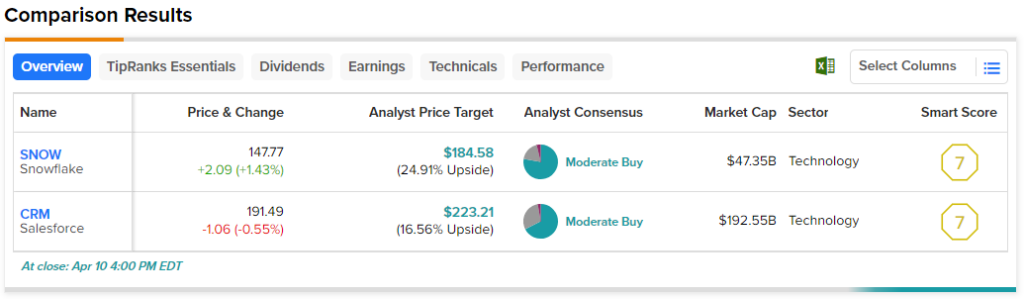

Therefore, in this piece, we’ll look at two high-growth technology companies — SNOW and CRM — that don’t get enough praise for their AI capabilities. Let’s use TipRanks’ Comparison Tool to gauge the two cloud companies that may soon be worth that sought-after “AI premium.”

Snowflake (NYSE:SNOW)

Snowflake is a data-warehousing company that’s really seen growth slow in recent quarters. Undoubtedly, high double-digit or triple-digit growth is simply not sustainable. However, despite the drastic growth slowdown, I still view Snowflake as a company that could stand to benefit a lot from the continued rise of AI. I remain bullish.

Unsurprisingly, Snowflake is a complex business to value. It’s fresh off a quarter that saw quarterly revenue growth slow to around 54%. The pace of growth deceleration seems concerning. Still, macro headwinds and its usage-based revenue-recognition model are mostly to blame. Nonetheless, secular tailwinds still seem strong enough to power many years’ worth of high double-digit growth.

Companies are not only possessing an increasing amount of data, but Snowflake is also eager to assist them in utilizing this data more effectively. As you may know, datasets are an essential input to training AIs. The more high-quality data you can train on, the better an AI’s capabilities will likely be.

Further, Snowflake has been adding to its application arsenal in recent years. Snowflake has been steadily equipping its users with more tools (like data app creator Streamlit) to make better use of their data sets.

Although the number of tools offered by Snowflake is increasing, data cloud adoption may still be relatively slow due to economic challenges, which may result in budget cuts. However, once these headwinds pass, Snowflake is well-positioned to pass even its own expectations.

Over time, I expect AI will push firms to experiment more with their data, driving usage for Snowflake’s impressive platform. In the meantime, Snowflake may be hungry for AI deals. The recent acquisition of AI-based data analysis platform Myst AI could be one of many that bolster Snowflake’s AI capabilities this year.

What is the Price Target for SNOW Stock?

Snowflake stock comes in as a Moderate Buy, with 21 Buys, five Holds, and one Sell. The average SNOW stock price target of $184.58 implies 24.9% upside potential.

Salesforce (NYSE:CRM)

Salesforce likely isn’t a tech firm you’d associate with AI. However, the firm has been investing a great deal into its AI capabilities for years now with Einstein. For those unfamiliar with the platform, it’s a platform that leverages AI to enhance the capabilities of its many cloud-based offerings.

We constantly hear about how Microsoft is rolling out Bing across its suite of software. However, I don’t think Salesforce Einstein gets as much appreciation, especially given that it was arguably early to the AI game. In any case, I remain bullish on CRM stock.

Just because the average consumer can’t interact with Einstein AI doesn’t mean it isn’t powerful and game-changing. More recently, Salesforce unveiled its CRM-focused generative AI in Einstein GPT. The AI’s promised capabilities and integrations look very intriguing.

Additionally, Salesforce’s path to AI monetization seems very impressive. Einstein AI isn’t just an application that’ll spew out funny poems or other creative content just for fun. It’s a powerful platform helping its users be more productive in the workplace. As a value-adding AI service, Einstein could be a massive needle-mover as Salesforce continues its push for profits.

At this juncture, Salesforce is trimming its workforce, but don’t expect it to come up short in the AI race. As the company finds the right balance between profitability and growth (AI could play a big part in sustaining Salesforce’s impressive double-digit percentage growth rate), CRM stock looks tough to pass up while it’s trading at 6.2 times sales. That’s well below the IT services & consulting industry average of 19.5 times.

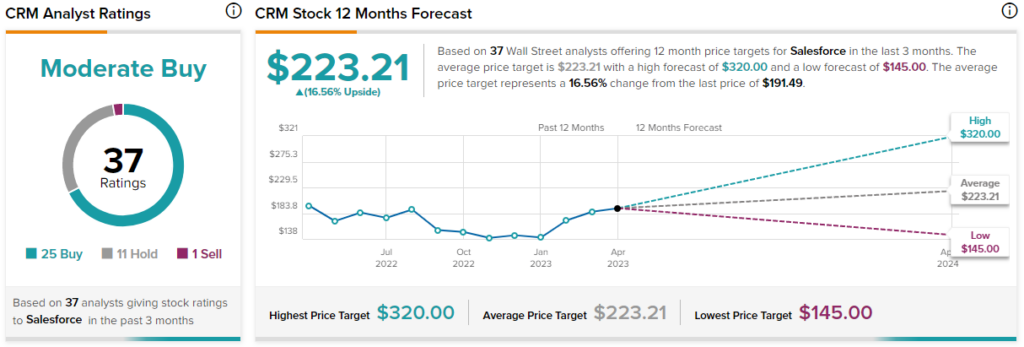

What is the Price Target for CRM Stock?

Salesforce commands a Moderate Buy rating with 25 Buys, 11 Holds, and one Sell. The average CRM stock price target of $223.21 implies 16.6% upside potential.

The Bottom Line on the Rise of AI

AI will fundamentally shift the playing field for numerous industries. It’s sure to be a profoundly disruptive force such that regulators may need innovators to pull the brakes with some sort of moratorium. In any case, expect more tech companies, like Snowflake and Salesforce, to be rewarded with a greater “AI premium” as they slowly but steadily emerge in the AI waters.