Semiconductor stocks are taking the market by storm as investors salivate over the long-term potential of AI, and the VanEck Semiconductor ETF (NASDAQ:SMH) is up 67.9% over the past year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But SMH isn’t simply a flash in the pan. The ETF has produced stellar, market-beating results for a long time. I’m bullish on this $14.6 billion ETF from VanEck based on its strong long-term performance, its concentrated portfolio of top semiconductor stocks with Outperform-equivalent Smart Scores, and the long-term growth of the semiconductor industry.

What Is the SMH ETF’s Strategy?

VanEck explains, “Rather than attempting to pick individual stock winners in this ever-evolving sector, the VanEck Semiconductor ETF provides exposure to the top 25 most liquid U.S.-listed semiconductor companies, spanning the entire industry value chain from chip design and fabrication to manufacturing machinery.”

Long-Term Growth Potential

Recent advances in artificial intelligence have ignited investor excitement about semiconductor stocks, and rightfully so, as this is a huge market. Deutsche Bank Research just reported that it expects the AI semiconductor market to climb to $119.4 billion by 2027.

The firm stated, “Powerful trends like data growth, machine learning, and smart devices ensure AI adoption spreads across industries. AI tech giants like Nvidia (NASDAQ:NVDA), Advanced Micro Devices (NASDAQ:AMD), Marvell Technology (NASDAQ:MRVL) and Broadcom (NASDAQ:AVGO) still hold significant competitive advantages. They remain positioned for expanding AI opportunities through development in autonomous systems, healthcare applications, and more.”

And while this use case is exciting in its own right, it’s important to remember that semiconductors are also crucial to other areas with considerable growth potential, like electric vehicles and cloud computing.

Interestingly, the same Deutsche Bank Research note illustrates a good reason for approaching the space through ETFs like SMH, suggesting that instead of relying on one company, “Diversification of solutions provides a healthier growth path” because of the still-evolving nature of the industry.

SMH’s Portfolio

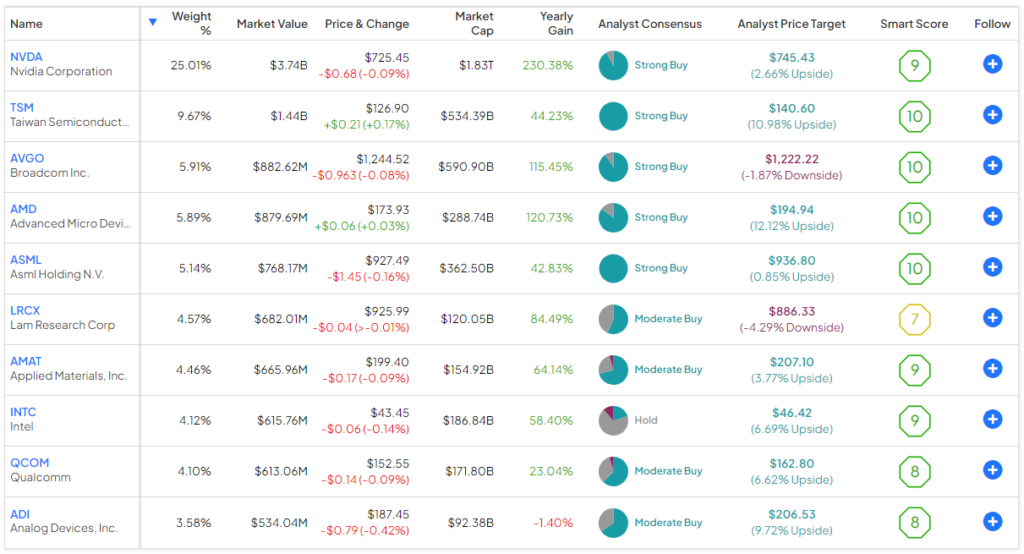

As a directional bet on the semiconductor industry, SMH’s portfolio isn’t particularly diversified. It holds just 25 stocks, and its top 10 holdings make up a massive 72.3% of the fund. Still, if you want targeted exposure to a group of top semiconductor stocks that are leading the AI revolution, SMH gives you plenty of that. Below is an overview of SMH’s top 10 holdings using TipRanks’ holdings tool.

Thanks to NVDA’s stellar run over the past year, in which it has soared over 220%, the stock now accounts for one-quarter of the fund.

Nvidia is by far the fund’s top holding, but Taiwan Semiconductor (NYSE:TSM), which manufactures semiconductors for Nvidia and many of the other companies on this list, is also a significant holding, with a weighting of 9.7%.

The fund’s strategy is to invest across the semiconductor value chain, and as such, it is also invested in the likes of Lam Research (NASDAQ:LRCX), Applied Materials (NASDAQ:AMAT), and ASML Holding N.V. (NASDAQ:ASML), which manufacture, service, and sell the complex machinery and equipment used in the semiconductor manufacturing process.

Other notable top 10 holdings include additional top semiconductor names like Advanced Micro Devices, Broadcom, and Intel (NASDAQ:INTC).

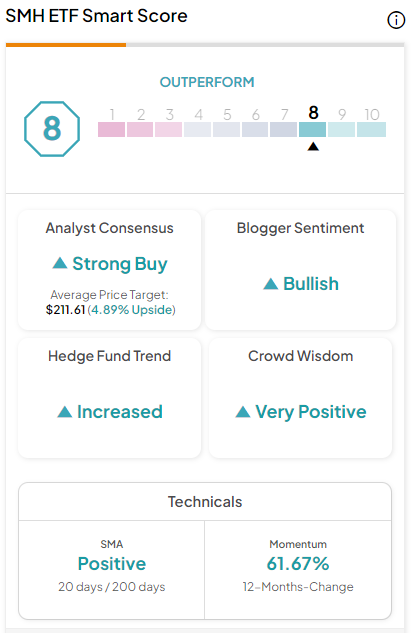

These stocks collectively feature a strong set of Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. An incredible nine out of SMH’s top 10 holdings earn Outperform-equivalent Smart Scores of 8 or better.

SMH itself boasts an Outperform-equivalent ETF Smart Score of 8 out of 10.

Scintillating Performance

While semiconductors have really captured the investing public’s imagination over the last year, and SMH is up 67.9% over the past year, it’s important to note that SMH has been a star performer for a long time.

The semiconductor industry has a reputation for being cyclical, and while it certainly has its ups and downs (for example, the fund lost 33.5% during 2022 when tech stocks more broadly entered a bear market), long-term investors have been rewarded with spectacular results over the years.

As of January 31, SMH generated a three-year annualized return of 18.8%. But this already impressive performance is eclipsed by its stunning five-year annualized return of 32.1%.

Additionally, SMH has posted an incredible 10-year annualized return of 26.1% and an annualized return of 24.7% since its inception in 2011.

These results trounced the performance of the broader market S&P 500 (SPX), as well as the high-flying, tech-centric Nasdaq (NDX).

For example, as of January 31, the Vanguard S&P 500 (NYSEARCA:VOO) has returned an annualized 11.7% on a three-year basis, 14.2% on a five-year basis, and 12.6% on a 10-year basis. These are great returns, but they don’t come close to those of SMH.

Meanwhile, as of January 31, the Invesco QQQ Trust (NASDAQ:QQQ), which invests in the Nasdaq 100, returned 10.6% on a three-year basis, 20.7% over a five-year basis, and 18.1% on a 10-year basis. Again, these are great results, but they’re still not even close to topping those of SMH.

Looking at things on a cumulative basis, SMH has produced an incredible amount of wealth for long-term holders. An investor who put $10,000 into the fund 10 years ago would have an investment worth over $105,000 just a decade later (as of January 31). An investor who allocated $10,000 to SMH at its inception in December 2011 would have a stake worth nearly $160,000 as of January 3).

What Is SMH’s Expense Ratio?

SMH has an expense ratio of 0.35%, meaning that an investor will pay $35 annually on a $10,000 investment. While this isn’t cheap, it’s more middle-of-the-road and not excessively expensive either. It’s probably no coincidence that SMH’s 0.35% expense ratio is identical to that of two of the other largest semiconductor ETFs, the iShares Semiconductor ETF (NASDAQ:SOXX) and the SPDR S&P Semiconductor ETF (NYSEARCA:XSD), as these funds compete for the same investment dollars.

Is SMH Stock a Buy, According to Analysts?

Turning to Wall Street, SMH earns a Strong Buy consensus rating based on 21 Buys, five Holds, and zero Sell ratings assigned in the past three months. The average SMH stock price target of $211.61 implies 4.9% upside potential from current levels.

Looking Ahead

SMH has had quite a year, but its strong performance goes back further than that. I’m bullish on this ETF based on its stellar long-term performance, which has soundly beaten that of both the S&P 500 and Nasdaq over the past three, five, and 10 years, despite some volatility.

I also like SMH’s strong portfolio of top semiconductor stocks with fantastic Smart Scores. The semiconductor industry harbors considerable long-term potential, and this concentrated, thematic ETF is an effective way to gain exposure to it.