For those not interested in extreme bets on Wall Street, ChargePoint (NYSE:CHPT) will almost certainly fail to impress. Incurring a catastrophic loss of value this year, the EV charging infrastructure provider appears shell-shocked. Nevertheless, the business – while incredibly flawed – still offers much relevance. And in a counterintuitive manner, the negative sentiment could be a positive. I am short-term bullish on CHPT stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

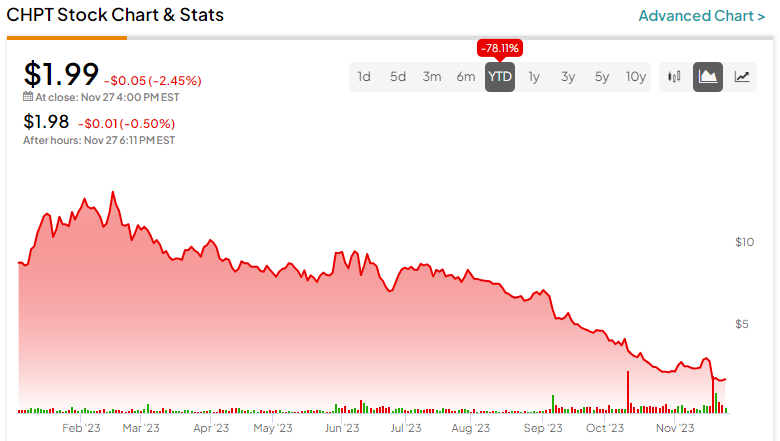

CHPT Stock Stares Into the Abyss

Indeed, it’s almost impossible to classify public security as a bullish idea following a loss of nearly 78% year-to-date. That’s the awful reality that CHPT stock stares at. Even worse, the fundamentals – troubling industry headwinds, disappointing earnings, and a C-suite shakeup – point to a bleak future for ChargePoint.

First, the company plies its trade in an economic sector clouded with demand woes. As TipRanks contributor Steve Anderson mentioned, the price war that erupted in the space led to tangible consequences. While that might sound great from a consumer perspective, lower prices also imply difficulty sparking the combustion-to-electric conversion.

Second, CHPT stock tanked heavily following the underlying company’s second quarter of Fiscal Year 2024 earnings report. As TipRanks reporter Vince Condarcuri stated, the EV infrastructure specialist posted a loss per share of 35 cents, missing the consensus view of a loss of 13 cents. And while revenue popped 39% year-over-year to $150.49 million, this tally also missed expectations by $2.3 million.

Third, ChargePoint suffered what could only be described as a distracting organizational shift. Abruptly, the company announced the departure of Pasquale Romano from the CEO role. Also, former CFO Rex Jackson departed the company. ChargePoint announced the appointment of Rick Wilmer and Mansi Khetani as replacements for the respective roles.

As if the news wasn’t enough of a shocker, the charging firm also stated that it will miss Q3 sales expectations due to slowing demand in its core markets of North America and Europe. Subsequently, CHPT stock fell by over 35% on the painful earnings report.

Options Speculation Could Help Boost ChargePoint

In an ironic twist, it’s ChargePoint that could desperately use a jolt of energy not to necessarily enliven the business but to keep it from flatlining. Part of the problem is the dominance of Tesla (NASDAQ:TSLA). Commanding a massive charging network and winning the charge plug format war (there are two different types of plug formats, and many companies are adopting Tesla’s charging format), it’s no wonder that CHPT stock struggled.

Unfortunately, the plug format conflict implies that ChargePoint must adapt to the times. Nevertheless, the company still offers tremendous relevance. By integrating charging posts or stations at workplaces and residences, ChargePoint can easily cover gaps that Tesla can’t or won’t. Frankly, Tesla can’t be omnipresent.

As a result, it’s not entirely out of the question for speculative bulls to bid up CHPT stock. One factor that makes this setup intriguing is that CHPT prints a short interest of 20.56% of its float. Generally, anything above 20% represents an extremely high benchmark. Plus, with so much interest in put options – especially the Dec 15 ’23 1.50 put – an unexpected price surge can potentially panic the bears.

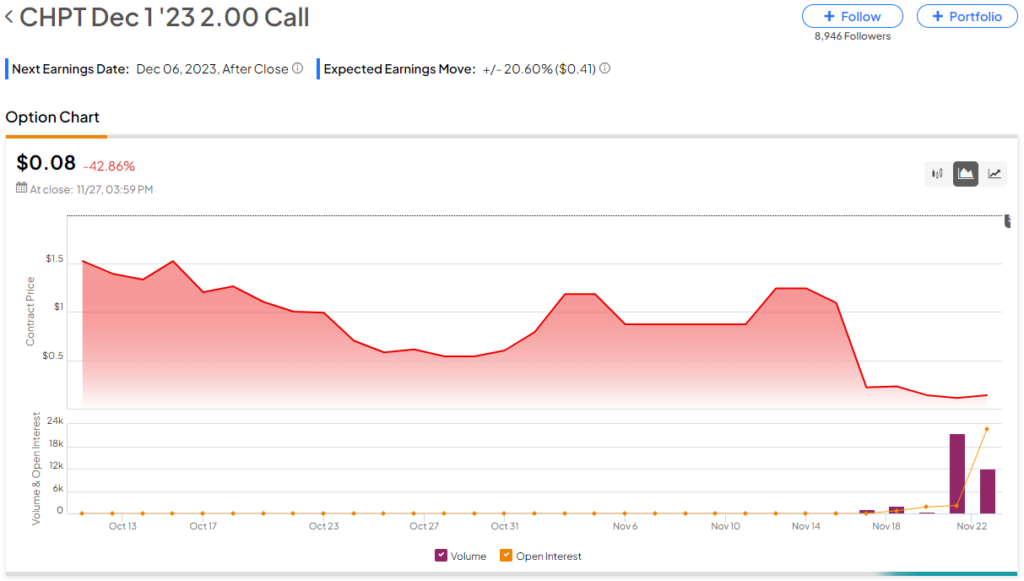

What really should capture interest is the sold calls. According to options flow data – which filters exclusively for big block trades likely made by institutions – major entities sold 10,681 contracts of the Jan 19 ’24 2.00 call on November 21. A day later, they sold 20,062 contracts of the Dec 1 ’23 2.00 call.

These transactions are significant because they represent wagers that CHPT stock won’t materially rise above the $2 strike price. But with such a narrow margin of error – CHPT closed at $1.99 today – any upside catalyst could trigger a short-covering rally.

Undervalued? It’s All Relative

Adding to the possible upside narrative for CHPT stock is the valuation. Is it undervalued? If we’re comparing value against trailing sales, it appears that way. Specifically, CHPT trades at 1.3x revenue. In contrast, rivals EVgo (NASDAQ:EVGO) and Blink Charging (NASDAQ:BLNK) trade at 1.9x and 1.8x, respectively.

However, before you dive into CHPT stock, let’s be crystal clear about something. This undervalued argument only makes sense if you believe that ChargePoint will regain its mojo. If it doesn’t, a seemingly good deal can easily turn into a value trap.

Is CHPT Stock a Buy, According to Analysts?

Turning to Wall Street, CHPT stock has a Moderate Buy consensus rating based on eight Buys, 10 Holds, and zero Sell ratings. The average CHPT stock price target is $5.98, implying about 200% upside potential.

The Takeaway: CHPT Stock Offers a Somewhat Rational Gamble

If you’re interested in buying securities because they’re “cheap,” you’ll probably lose a lot of money. While that largely describes CHPT stock, the underlying enterprise distinguishes itself from the also-rans with a relevant business. If EVs continue to roll out and grab automotive market share, charging infrastructure demand should increase. That’s a major catalyst for CHPT’s wildly contrarian narrative. Plus, given its high short interest, the stock can potentially benefit from a short squeeze.