Theme park businesses have been under quite a bit of pressure in recent years. From the pandemic lockdown days to scorching-hot levels of inflation, it’s about time that some of the industry’s major players joined forces to unlock big value and curb costs. For Six Flags (NYSE:SIX) and Cedar Fair (NYSE:FUN), the merger seems to be a match made in heaven that could help the combined entity put up a better fight against rivals. As such, I’m bullish on both stocks ahead of the proposed merger.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Undoubtedly, shares of Six Flags and Cedar Fair have been hovering around in limbo for a few years. At the time of writing, SIX stock is still down more than 65% from its pre-pandemic all-time high hit all the way back in mid-2018.

Though FUN stock hasn’t taken as big a hit to the chin, it’s still down a whopping 44% from its 2017 all-time high, just north of $72 per share. Even after the doors reopened from pandemic lockdowns, things have been steadily sagging over the past year. Undoubtedly, costs associated with running theme parks are elevated. And amid fluctuations in demand, their share prices have been as stomach-churning for shareholders as their most terrifying “thrill” rollercoasters.

A Historic Merger in the U.S. Theme Park Scene

The Cedar-Six merger is estimated to have an equity valuation close to $3.5 billion — still not large enough to cause Disney (NYSE:DIS) and its Parks and Resorts business to panic, but enough to put up a better fight with industry rivals.

The new entity is expected to consist of 27 amusement parks and 15 water parks across North America. Indeed, getting bigger could also help the Cedar Fair and Six Flags parks better navigate this rough environment. Post-merger, the combined entity will go by Six Flags, but adopt Cedar Fair’s “FUN” ticker symbol.

Just last week, Jefferies analyst David Katz slapped a Buy rating on Six Flags stock, noting potential merger upside. Mr. Katz is a big fan of the synergies ($200 million synergy target) to be had from the deal, also remarking on the minimal geographical overlap. Indeed, Katz is right on the money. The merger seems to be a big win, not just for shareholders but also for park attendees, given the financial flexibility to ramp up “consumer engagement opportunities.”

The merger will grant the combined entity the tools it needs to march higher, even without help from the broader economy. That said, I still expect most of the upside to be in the form of an economic rebound, as economic wounds have still yet to be fully healed.

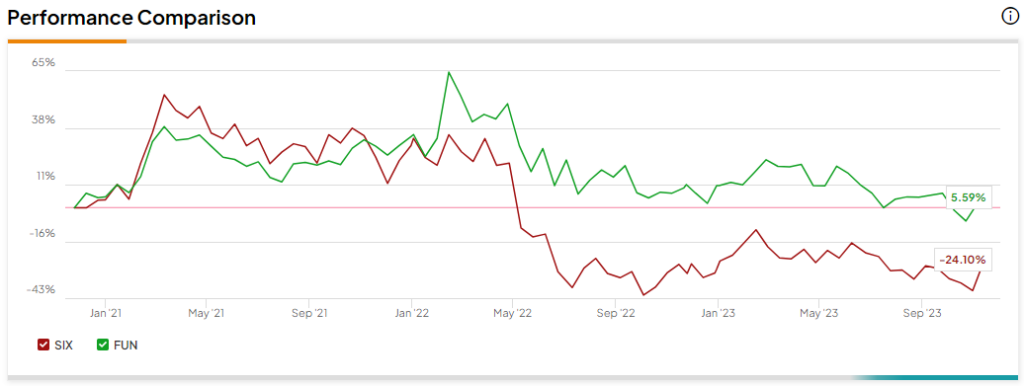

Thus far, Six Flags’ plans to offer patrons a better experience (reducing crowds and revitalization investments) for higher prices of admission haven’t really worked out too well. Indeed, the relative underperformance of SIX stock versus FUN is quite notable. Though probably not solely due to Six Flags’ perplexing plan to justify higher prices in a rougher economic climate. Indeed, customers probably want cheap thrills (pardon the pun) as their budget becomes more constrained.

Customers are speaking with their wallets, and thus far, the Six Flags management team may have overestimated the pricing power of their theme parks.

The Merger Has More to Offer Than Just Synergies

As the two major theme parks join forces, I’d look for the firm to combine expertise and find a better way to cope with what remains of the turbulent environment. This joining of expertise doesn’t seem to be captured by the raw synergy targets.

Either way, Jefferies is right to pound the table on SIX stock as it flirts with lows not seen since the depths of 2020. The stock is battered and has a lot to gain from a historic merger. Currently, 4.5-star-rated analyst David Katz has a $32.00 price target on the stock, implying 28.3% upside from current levels.

If the merger goes smoothly and expectations are on track to be met, perhaps with the help of a recovering consumer, I expect the theme park play to be on the receiving end of more price-target upgrades over the coming years.

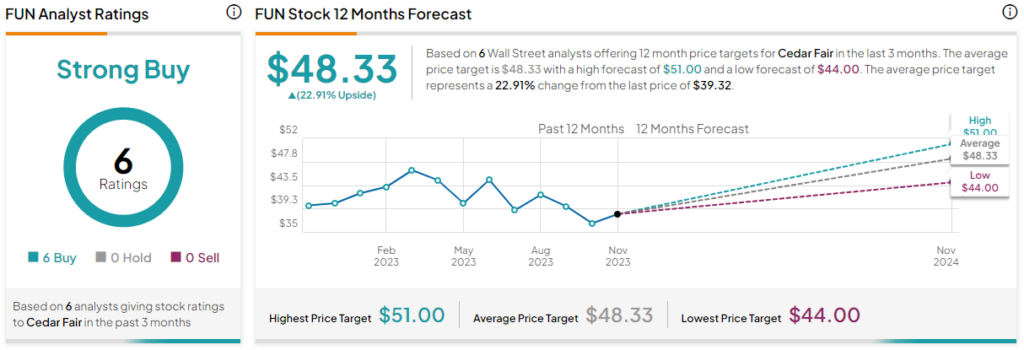

Is FUN Stock a Buy, According to Analysts?

On TipRanks, FUN stock comes in as a Strong Buy. Out of six analyst ratings, there are six unanimous Buys. The average Cedar Fair price target is $48.33, implying an upside of 22.9%. Analyst price targets range from a low of $44.00 per share to a high of $51.00 per share.

Is SIX Stock a Buy, According to Analysts?

Meanwhile, SIX stock comes in as a Moderate Buy. Out of 11 analyst ratings, there are seven Buys, three Holds, and one Sell recommendation. The average Six Flags stock price target is $27.55, implying an upside of 11.1%. Analyst price targets range from a low of $16.00 per share to a high of $35.00 per share.

The Bottom Line

The transformative deal seems to be a win for Cedar Fair and Six Flags. For now, analysts are quite upbeat on shares of both companies as they crunch the numbers to shed more light on the value to be had from the historic merger.