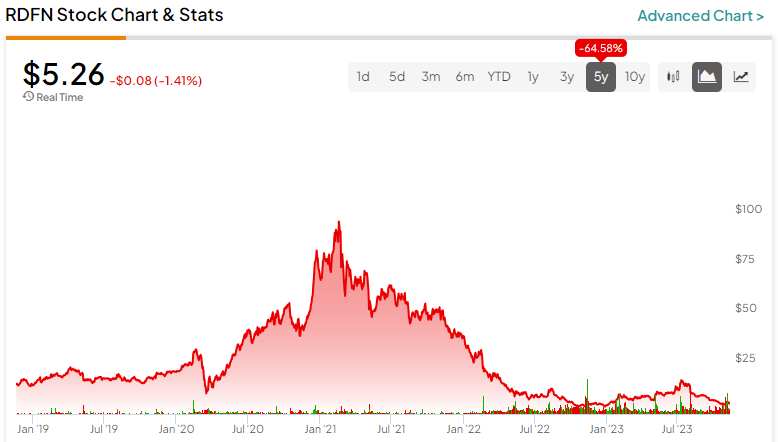

Perhaps one of the most hotly-debated topics, the trajectory of the residential real estate market dominates talk regarding sector-related players like brokerage and mortgage origination services provider Redfin (NASDAQ:RDFN). While advocates state that no one should worry about a collapse, simple math suggests that a dark cloud hangs over the industry. Therefore, I am bearish on RDFN stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Positive Side of the Argument for RDFN Stock

Read various social media and video-sharing platforms, and you’ll likely come across doom-and-gloom prognostications regarding the “imminent” collapse of the housing market (along with other sectors). As a result of the snake oil proliferation, housing advocates have punched back. Admittedly, some of their best arguments make sense.

For instance, industry experts, such as National Association of Realtors Chief Economist Lawrence Yun, stated that the “housing recession is essentially over.” Prices continue to rise steadily, especially in high-demand markets. In certain areas, inventories remain very low, leaving prospective homebuyers few options other than bidding up prices.

Further, the economy is chugging along at a solid clip. Most notably, the third-quarter U.S. GDP print came in hotter than expected. Also, while the October jobs report was a little bit softer than economists anticipated, the overall growth trajectory has been overwhelmingly positive. For the September jobs report, the results blew past estimates.

With more people enjoying full-time employment, it’s only natural for housing prices to rise. Still, the scary part is that those were some of the same arguments offered prior to the Great Recession.

In an October 2005 NBC News article, then-nominee for Federal Reserve Chair Ben Bernanke did not see a housing bubble that would go bust. At the time, housing experts cited economic growth and a strong labor market as upside catalysts. Plus, a July 2005 op-ed by The Wall Street Journal cited reduced housing inventory as being bullish for home prices.

Back then, the experts urged calm until they couldn’t. Therefore, skepticism toward RDFN stock isn’t unwarranted.

Difficult to Reconcile the Math

Fundamentally, one of the biggest concerns for RDFN stock and its ilk centers on sector viability. While housing prices have demonstrated a remarkable ascendancy, they’re unlikely to continue higher without a correction. It comes down to basic numbers.

According to primary sources compiled by the Federal Reserve Economic Data website, the average price of homes sold in 2019 came out to $379,875. In that year, the mean personal income came in at $54,130. Put another way, the ratio between home prices and personal income came out to 7.02x.

In sharp contrast, last year, the average home sales price skyrocketed to $535,500 while personal income only marched modestly to $59,540. That gives us a ratio of 9x or a magnitude increase in the ratio of 28.1%. That’s not normal, which may impede the longer-term trajectory of RDFN stock.

Back in 2017, the average housing price soared to $381,150 while personal income sat at $48,990. This pairing yielded a price-to-income ratio of 7.78x. Eventually, though, the economy improved for individual workers without escalating home prices.

However, we live in a different paradigm due to the COVID-19 disruption not too long ago. While wages accelerated higher, home prices have become unhooked from rationality. Therefore, RDFN stock presents a tricky narrative.

An Ugly Math Problem

In Q3, Redfin posted $269 million in revenue, down 12% from the year-ago period. On a trailing-12-month (TTM) basis, the company is looking at sales of $2.28 billion, a hair shy of last year’s haul. One more bad quarter and RDFN stock would look quite unattractive.

Unfortunately, a higher probability of another down quarter exists because of rising economic concerns. For example, TipRanks reporter Kailas Salunkhe mentioned that Citigroup (NYSE:C) is prepping for one of its largest reorganizations in years. Frankly, that translates to mass layoffs.

And that’s Citigroup, not some burgers-and-fries type of job. With several high-income workers at risk, reconciling this dynamic with ever-rising home prices is challenging, to say the least.

Is RDFN Stock a Buy, According to Analysts?

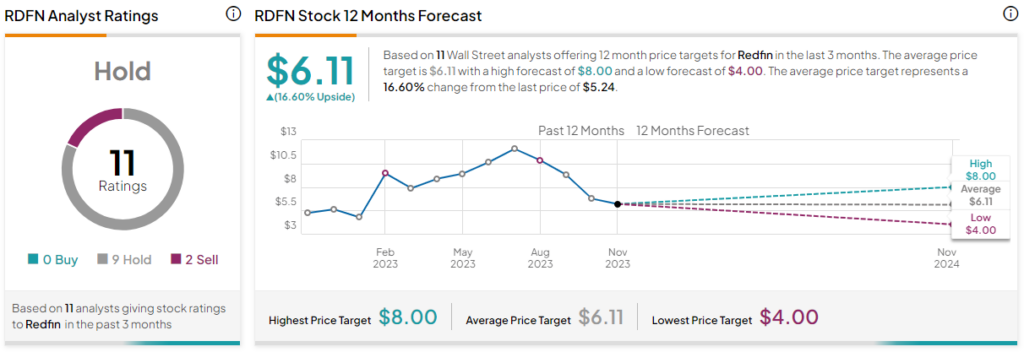

Turning to Wall Street, RDFN stock has a Hold consensus rating based on zero Buys, nine Holds, and two Sell ratings. The average RDFN stock price target is $6.11, implying 16.6% upside potential.

The Takeaway: Just Follow the Logic on RDFN Stock

While acknowledging that certain markets are more resilient and in demand than others, at a certain point, the housing sector will run out of high-income people who can afford presently elevated prices. In addition, the bullish arguments that we hear today – strong economy, robust workforce, low inventory —have been broadcasted before the Great Recession. So, skepticism toward RDFN stock is well warranted.