Simon Property Group Stock (NYSE:SPG) appears well-positioned to capitalize on strong property tenant demand, suggesting the stock has further upside potential. The retail REIT, boasting a portfolio of 195 income-generating properties and an 84% stake in Taubman Centers, keeps posting growing occupancy levels and record base minimum rent levels. The stock’s dividend yield remains compelling as well. Thus, despite SPG’s 21% rally over the past six months, I remain bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Unpacking Simon Properties’ Q3 Results

Simon Properties’ Q3 results were once again excellent, in my view. The company’s most recent report showcased a notable increase in occupancy levels and set a new record for minimum base rent levels. This positive momentum was fueled by vigorous leasing activity, driven by high tenant demand for its retail properties. Let’s take a deeper look at the numbers.

In its Fiscal Q3 results, Simon recorded revenues of $1.41 billion, up 6.8% compared to last year. This result reflects SPG’s sustained rebound from the pandemic, fueled by a combination of robust leasing momentum and heightened occupancy levels.

Year-to-date, SPG has inked over 3,500 leases, covering a substantial 15 million square feet, with an anticipated revenue potential surpassing $1 billion. Although individual lease details remain undisclosed, clear signs of progress are evident, as the company posted a base minimum rent per square foot at $56.41 – a noteworthy 2.9% uptick from the previous year. Concurrently, SPG’s occupancy rates have surged to an impressive 95.2%, marking a 0.7% increase from the 94.5% recorded last year.

The substantial growth in both the company’s base minimum rent and occupancy levels underscores the robust tenant demand for Simon’s retail properties, showcasing a resilient post-pandemic recovery trajectory. Interestingly, the quarterly revenues of $1.41 billion mirror the top-line figure achieved in Q3-2019. This signals a complete turnaround for the company since the leasing revenue slump of 2020-21, a period marked by a number of its tenants temporarily being forced to close shop.

Moving to the bottom line, Simon’s portfolio NOI (net operating income), which includes its domestic and international properties, as well as the company’s investment in Taubman Realty Group, advanced by 4.3% versus Q3 2022, following higher revenues. Unfortunately, a 12.9% increase in interest expenses to $212.2 million somewhat offset this benefit due to rising interest rates. Still, the company’s funds from operations per share reached $3.20, 9.2% higher from $2.93 last year.

Simon’s Dividend Yield Remains Attractive Despite Recent Rally

Another factor that should contribute to Simon retaining upside potential is its 5.8%-yielding dividend. Sure, the recent stock rally has slightly tapered the yield from its previously enticing range of 6.5%-7.0% observed during the summer and fall. However, the current dividend payouts remain substantial and are poised to contribute to the company’s overall future total returns.

Given that the Federal Reserve is likely to start cutting interest rates next year, along with the fact that SPG appears able to afford further dividend hikes in the coming quarters, I can see investors’ appetite for the current yield remaining robust.

For context, following Simon’s dividend cut during the pandemic, the company has increased its payouts eight times since. In the meantime, the midpoint ($12.20) of management’s FFO outlook range ($12.15 to $12.25) implies a forward payout ratio of 62% against the current $7.20 annual dividend rate. This indicates considerable leeway for Simon to uphold its ongoing pattern of increasing dividends.

Is SPG Stock a Buy, According to Analysts?

Taking a look at Wall Street’s view on Simon Property Group, the retail REIT currently features a Moderate Buy consensus rating based on three Buys and six Holds assigned in the past three months. At $127, the average SPG stock price target implies about 4% downside potential.

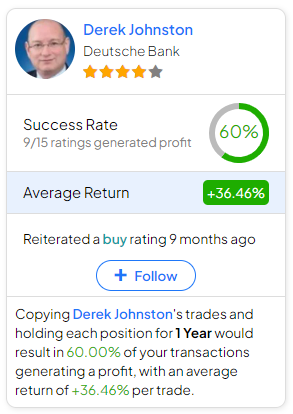

If you’re looking for the right analyst to guide your decisions in buying and selling SPG stock, look no further than Derek Johnston, who represents Deutsche Bank (NYSE:DB). Over the past year, he has consistently demonstrated exceptional performance, boasting an impressive average return of 36.46% per rating with a success rate of 60%. Click on the image below to learn more.

The Takeaway

Simon Property Group stands out as a resilient force in the real estate market, showcasing impressive recovery and growth post-pandemic. The company’s Q3 results highlight robust leasing activity, a surge in occupancy rates to 95.2%, and a noteworthy 2.9% uptick in base minimum rent per square foot.

Despite a 21% rally in the stock over the past six months, the continued growth in revenues, net operating income, and funds from operations indicates sustained momentum ahead. SPG’s dividend yield, currently at 5.8%, should also contribute notably to the stock’s future total returns. In fact, with the Federal Reserve likely to cut interest rates and SPG demonstrating the ability to afford further dividend hikes, the current yield is poised to maintain its appeal. Thus, I remain bullish on SPG stock.