Only time will tell if it’s too late in the game to buy semiconductor stocks as we roll into the spring season. The tech-focused sell-off was most unkind to the many semiconductor leaders last year. I guess you could say the tech wreck of 2022 really “chipped” away at chip stock valuations!

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In any case, the ensuing relief rally proved fast and furious for many top chip plays such that nervous dip buyers may not have been able to load up the truck as much as they would have liked.

Therefore, in this piece, we’ll look at three semiconductor stocks that still boast Strong Buys from Wall Street analysts. As they also have the potential to receive analyst upgrades, the following three names — NVDA, TSM, and AVGO — may not be too late to nibble away at.

Nvidia (NASDAQ:NVDA)

Nvidia is one of the hottest stocks in the market right now. Not even the gravitational force of higher interest rates has been able to keep Nvidia suppressed for too long a duration. As the company continues showcasing its latest and greatest artificial intelligence (AI) innovations, I think it’s tough to bet against the firm, even as its valuation swells to the moon again. Though I wish the stock was much cheaper, it’s hard to be anything but bullish.

The company has exposure to plenty of emerging tech fields (think AI and the Metaverse) and will help power new trends that may yet be on our radars. When it comes to such companies that find ways to expand their circle of competencies, a premium multiple can be expected. Just how much of a premium Nvidia deserves right here is the main question on the minds of many forward-focused investors.

Currently, many believe Nvidia can keep delivering as it rides the latest wave of AI innovation. With the generative AI platform Picasso and the cutting-edge hardware featured in advanced supercomputers, there’s a strong appeal in owning a part of NVDA’s generational growth story.

As more firms pull the curtain on their AI offerings, it’s conceivable that a significant portion of the market will invest in the latest AI-focused chips. Even at a lofty 159 times trailing price-to-earnings (P/E) ratio, accurately predicting the extent of demand over the next decade remains uncertain. Given this, I do believe Nvidia is one of the “expensive” stocks that’s worth averaging into over time.

Also, HSBC recently rewarded Nvidia stock with a double upgrade, helping power shares to a 2.5% gain on Tuesday. While I’m not a fan of chasing, I do think bullish analysts have no choice but to chase or be left out in the cold.

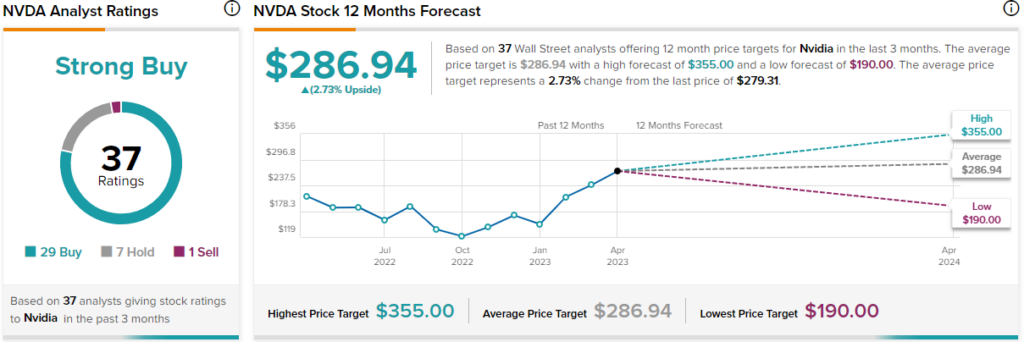

What is the Price Target for NVDA Stock?

Nvidia stock’s still a Strong Buy, with 29 Buys, seven Holds, and one Sell. The average NVDA stock price target of $286.94 implies 2.7% upside potential.

Taiwan Semiconductor (NYSE:TSM)

For those feeling woozy by Nvidia’s sky-high multiple, Taiwan Semiconductor stands out as a more palatable value play at this juncture. Shares of TSM trade at just 13.7 times trailing price/earnings, well below the semiconductor industry average of 61.4 times. Though Warren Buffett recently noted that he sees “better places” to invest than Taiwan Semi after selling off most of his stake many months ago, I still see many reasons to stay bullish.

First, Taiwan Semi stock already seems to have ripped the band-aid off amid the chaos hitting the chip space. The stock’s sitting down more than 37% off its all-time high of around $140 and change per share. Though shares have recovered modestly, they’re still in a bit of a rut, with macro headwinds and geopolitical risks weighing heavily.

Susquehanna analyst Mehdi Hosseini thinks a sluggish (or L-shaped) semiconductor recovery is “dialed into TSM’s share price.” I think Mr. Hosseini is right.

Second, Taiwan Semi still boasts a pretty sizeable moat. The company plans to expand rapidly over time, even in the face of macro headwinds. As the firm continues investing heavily in capacity, it’ll be hard for up-and-coming rivals to catch up. If anything, TSM may be in a spot to pull further ahead on the other side of a potential recession.

Mr. Hosseini thinks top rivals are “years away” from catching up to the likes of Taiwan Semi. At this rate, I’d argue such rivals may struggle to catch up even in a few years.

What is the Price Target for TSM Stock?

Taiwan Semi boasts a Strong Buy rating from analysts based on four unanimous Buys. The average TSM stock price target is $118.67, suggesting 36% upside potential from here.

Broadcom (NASDAQ:AVGO)

Broadcom is a yield-heavy semiconductor play that’s less than 7% off all-time highs. Indeed, Broadcom stock could be the first of the trio to break through to new heights as investors continue gaining confidence. With a dividend yield that’s still bountiful (near 3%) and intriguing AI offerings of its own, I remain bullish.

Shares of Broadcom are up more than 50% from their May 2022 lows. Looking back, macro fears got a tad out of hand. Though shares aren’t the same bargain as they were several months ago, shares are still attractively valued at 21.3 times trailing price-to-earnings, well below their five-year historical average P/E of 35.4.

More recently, Broadcom stock’s been riding high on news of a new chip called Jerich3-AI to help bring together AI networks. Looking ahead, I’d look for Broadcom to add to its AI arsenal as it looks to continue taking advantage of M&A opportunities. Combined with Broadcom’s software push, I view the stock as worthy of further multiple expansion.

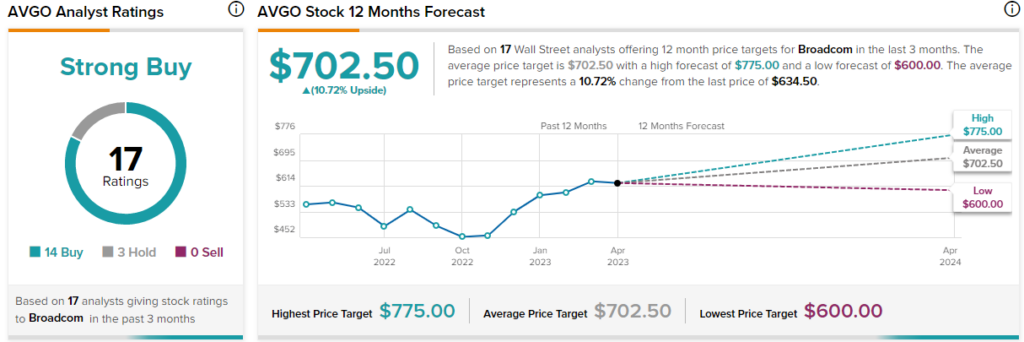

What is the Price Target for AVGO Stock?

Even after the hot run, analysts remain very upbeat about the stock. AVGO has a Strong Buy rating comprised of 14 Buys and three Holds. The average AVGO stock price target of $702.50 implies 10.7% upside potential.

Conclusion

It may not be too late to buy the chip dip, according to analysts. Currently, TSM stock boasts the most upside potential, with nearly 36% gains expected over the year ahead.