The failure of SVB Financial Group and Signature Bank, and the Credit Suisse (NYSE:CS)(GB:0QP5) crisis have put the banking sector in a tight spot. This implies that retail investors should exercise caution before investing in banking stocks, including those of major financial institutions like JPMorgan Chase (NYSE:JPM) and Bank of America (NYSE:BAC).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s important to highlight here that the large U.S. banks, including JPMorgan Chase and Bank of America, have no contagion risks from the fallout of these regional banks. Moreover, these banks are very well-capitalized and have ample liquidity.

However, investors should take caution as the Department of the Treasury is reviewing the U.S. financial sector’s overall exposure to Credit Suisse. Further, the short-term negative investors’ sentiments could limit the upside in bank stocks. In addition, the expected slowdown in the economy could hurt loan growth and pressure these banks’ top and bottom lines.

Against this backdrop, let’s check how JPM and BAC stocks stack up on TipRanks’ data.

Is JPM a Buy Now?

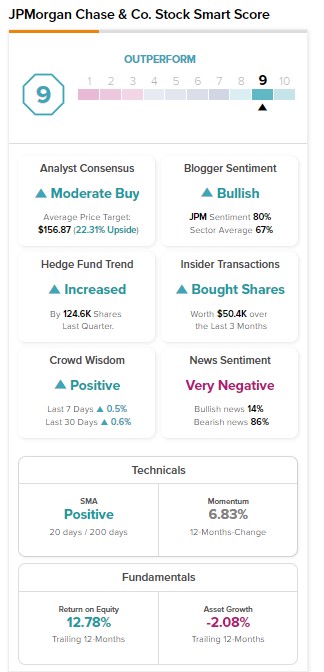

JPM’s strong capital and reserves position it well to navigate macro headwinds easily. However, JPM stock has dropped nearly 11% so far in March due to the pressure on the banking sector as a whole. At the same time, analysts are cautiously optimistic about the stock.

JPM has received 11 Buy and four Hold recommendations for a Strong Buy consensus rating. Further, these analysts’ average price target of $156.87 implies 22.31% upside potential.

While analysts are cautiously optimistic about JPM, our data shows that hedge funds and insiders have increased their exposure to the stock. Hedge funds bought 124.6K shares of JPM last quarter. Overall, JPM carries an Outperform Smart Score of nine.

Is BAC Stock a Good Buy Now?

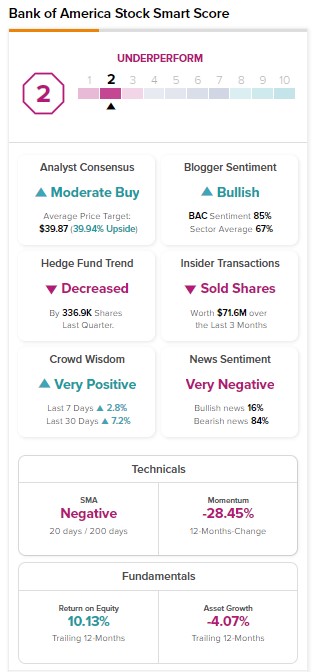

BAC stock has dropped over 16% month-to-date. However, fear of a recession, expectations of a slowdown in loan growth, and an increase in loan loss provisions could hurt its revenue and earnings and keep analysts cautiously optimistic about BAC stock.

BAC stock has a Moderate Buy consensus rating on TipRanks based on six Buy, six Hold, and two Sell recommendations. Analysts’ average price target of $39.87 implies 39.94% upside potential.

While analysts maintain a cautiously optimistic outlook, hedge funds sold 336.9K shares last quarter. Meanwhile, insiders sold BAC stock worth $71.6M. Further, BAC stock has an Underperform Smart Score of two.

Bottom Line

The expected economic slowdown and negative investor sentiment will likely play spoilsport for bank stocks. As for JPM and BAC stocks, JPM has an Outperform Smart Score and is likely to beat peers. Meanwhile, TipRanks’ data shows that BAC stock will likely underperform the broader markets.