Shares of ZIM Integrated Shipping Services Ltd. (NYSE: ZIM) are trading higher so far today. However, the stock has lost more than 17% of its market capitalization over the past month due to weak demand and a drop in pricing. Investors may want to take a position in the stock, especially to make the most of the potentially higher Q4 dividend payout.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company is scheduled to release its Q3 results on November 16. Let’s take a closer look at ZIM stock, which stands out for its stellar dividend payouts.

ZIM’s Impressive Dividend Payments

Based in Israel, Zim Integrated Shipping Services is an international cargo shipping company that offers tailored services, including land transportation and logistical services and specialized shipping solutions.

Based on current share prices, ZIM’s TTM dividend yield is 110.5%, much higher than its peer group.

What’s more impressive is that ZIM has consistently grown its quarterly dividend payouts despite a tough FY2022. Its Q1 dividend of $2.85 was 20% of net income, while its Q2 dividend of $4.75 represented 30% of net income.

Notably, according to the company’s payout policy, the Q1, Q2, and Q3 dividends were 30% of net income. Interestingly, for Q4, the company may pay in the range of 30% to 50% of net income.

Besides ZIM, see which other stocks have an ex-dividend date in October 2022. Investors can also take advantage of TipRanks’ Dividend Yield Calculator.

Is ZIM Stock a Buy?

Given the dull demand and challenges facing the shipping industry, ZIM Integrated Shipping Services stock has received five Holds and one Sell recommendation for a Hold consensus rating, according to TipRanks. ZIM’s average price forecast of $31.12 implies 31.75% upside potential.

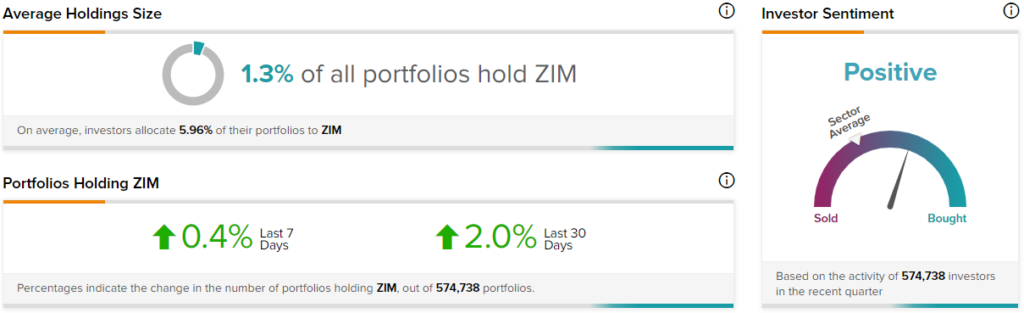

On a positive note, TipRanks’ Stock Investors tool shows that investors currently have a Positive stance on ZIM Integrated Shipping Services, with 2% of investors on TipRanks increasing their exposure to ZIM stock over the past 30 days.

Conclusion: Consider Buying ZIM Stock

ZIM Integrated Shipping Services stock has underperformed the market, mainly due to weak demand and lowered ocean spot rates. While Wall Street is concerned that shipping rates may decline further due to a weak macro environment and demand, the current valuation levels likely present a good buying opportunity for long-term investors as well as short-term investors looking to benefit from the dividends.