Shares of Rivian Automotive (NASDAQ:RIVN) tumbled 5% on Thursday after the electric truck-maker updated investors on progress in building its new 400,000-truck-per year factory in Georgia. According to the company, ground is ready to be broken at the construction site in early 2024 — which sounds like good news. But coming on the heels of General Motors’ announcement that it’s slow-rolling its rollout of new electric cars in response to weak demand, and Tesla’s recent underwhelming earnings report, investors may be thinking that the EV market needs another 400,000 electric cars per year dumped into it kind of like it needs a hole in the head.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

And so they shot the messenger: Rivian Automotive.

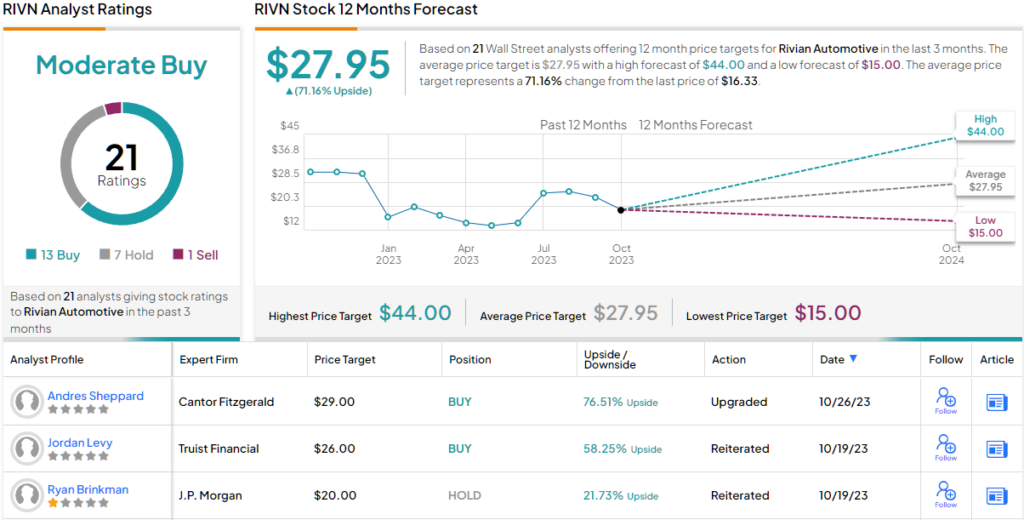

And yet, Cantor analyst Andres Sheppard had a completely different reaction to Rivian’s news that it will soon be building 400,000 EVs a year (and spending billions to build out that capacity even sooner). On Thursday, Sheppard upgraded Rivian stock from Neutral to Overweight (i.e. Buy), and put a $29 price target on the $16 stock.

What’s got Sheppard feeling so optimistic about Rivian stock? Well for one thing, in contrast to Tesla which disappointed the market with its deliveries last quarter, Sheppard notes that Rivian’s Q3 production (16,304 units) and deliveries (15,564 units) were both “above expectations.” To date, Rivian has produced just shy of 40,000 vehicles in the first three quarters of this year, and this puts the company on a clear path to outperforming its guidance for 52,000 vehicles produced through the end of the year.

Accordingly, Sheppard predicts that Rivian will beat production guidance this year, “particularly since Q4 tends to be the strongest for production/delivery given seasonality,” and probably in fact produce something on the order of 54,000 vehicles this year.

That’s one good reason for Sheppard to feel optimistic about 2023 at Rivian. A second, related reason is that Rivian promised earlier this month to produce as much as $1.33 billion in revenue in Q3 (slightly above Wall Street estimates). And seeing as we already know that the company produced and delivered more EVs than Wall Street was expecting, it stands to reason that Rivian also got paid for those vehicles — and accordingly that its revenues will be higher than predicted as well.

In other words, Rivian’s probably looking at a production beat, a deliveries beat, and a revenue beat when it reports Q3 earnings on November 7. (And maybe even an earnings beat as well).

Admittedly, not all the news surrounding Rivian is good. Earlier this month the company suffered a steep selloff in response to news that it is issuing at least $1.5 billion (and perhaps as much as $1.7 billion) in new convertible debt to refill its coffers. But even here, the news isn’t all bad

“Thanks” to investors selling off Rivian stock on this debt news, and yesterday’s production ramp news, new investors have the opportunity to buy Rivian stock for 30% less money than the shares cost on October 4. In Sheppard’s estimation, this new and improved stock price offers the potential for 79% upside in the stock.

This, in a nutshell, is why Cantor Fitzgerald thinks now is the time to buy Rivian stock.

Elsewhere on the Street, the stock claims an additional 12 Buys, 7 Holds, and a single Sell, for a Moderate Buy consensus rating. Going by the $27.95 average target, a year from now, investors will be sitting on returns of ~71%. (See RIVN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.