Investing in penny stocks poses relatively high risks (learn more about investing in Penny stocks here: Are Penny Stocks a Good Investment?). Take shares of Agrify Corporation (NASDAQ:AGFY), for example, which have tanked this year. Macro and industry-specific headwinds have weighed heavily on AGFY stock, erasing 95% of its value. Given the slump, Maxim Group analyst Anthony Vendetti finds Agrify’s valuation compelling. He has a Buy recommendation for AGFY stock with a price target of $4, implying 756.5% upside potential.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Before taking an investment call, let’s examine what is hurting AGFY stock.

Here’s Why Agrify Stock is Down

Agrify, which offers cultivation and extraction solutions for the cannabis industry through its environment-controlled VFUs (Vertical Farming Units), reported a net loss of $102.3 million in the first half of 2022, compared to a net loss of $9.4 million in the prior year. Further, management lowered its Fiscal 2022 revenue guidance to a range of $70 million to $75 million from $140 million to $142 million.

The company blamed the slump in cannabis prices, capital constraints, and the delay in license issuance for its underperformance. Moreover, supply-chain headwinds remain a drag.

Should Investors Buy or Sell Agrify Stock Right Now?

While AGFY is facing challenges, it is pivoting toward a high-margin recurring SaaS revenue stream. Further, Agrify is focusing on lowering costs by reducing its workforce, downsizing marketing activities, and consolidating its facilities.

Analyst Anthony Vendetti sees contractual commitments as a catalyst. Vendetti said that Agrify “still has contractual commitments for over 4,100 VFUs that will be powered by Agrify Insights software, with a majority of these coming from Agrify TTK solutions, which requires customers to pay production success fees and SaaS fees for up to a 10-year period.”

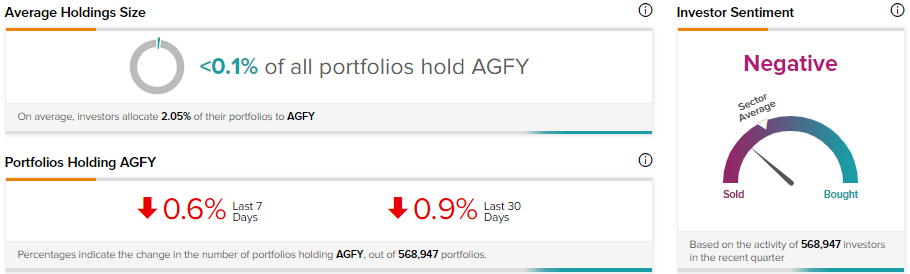

While Vendetti is bullish, Roth Capital analyst Scott Fortune recommends a Hold. Meanwhile, hedge fund managers sold 621.4K AGFY stock in the last quarter. Further, the stock has a Negative signal from TipRanks’ investors, and 0.9% of these investors reduced exposure to AGFY stock in the last 30 days.

The Bottom Line on Agrify

Agrify stock has corrected quite a lot, making it compelling on the valuation front. However, investors should be cautious and wait for the industry-specific headwinds to ease before investing in AGFY stock.

Meanwhile, investors can leverage TipRanks’ Penny Stocks Screener to find Wall Street analysts’ top-rated penny stocks.