It’s been a devastating year for many high-growth software companies, especially those lacking in profits. This is all thanks to the Federal Reserve and a handful of lofty rate hikes, with the promise of more in the near future to fight inflation. Nonetheless, for investors, the real value lies in one’s ability to spot the survivors in the rubble. In this piece, we’ll look at Twilio (NYSE: TWLO) and Zoom Video (NASDAQ: ZM), two fallen firms with plenty of innovation left in the tank. Though the tides are turned against them, neither will go down without a fight.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Undoubtedly, higher interest rates make it harder to stay afloat as a small, innovation-driven company with hefty capital expenditures and not much to show in the way of profitability hopes.

Peering into the future is hard, especially for innovative companies, all of which have their own vision of the future. Indeed, it can be tempting as a growth-focused investor to put on your rose-colored glasses. However, doing so could cloud the valuation process and leave many in the haze once market dynamics shift violently.

Certainly, it seems like we just experienced the second coming of the 2000 dot-com bust. The average speculative technology stock has shed more value than the S&P 500 (it’s off around 25% from its high). Some of the more “exciting” ones have lost more than 80%, with a few former darlings shedding north of 90% of their value.

It’s difficult to gauge where the bottom is for such heavily-imploded stocks as they continue to fall into greater depths of a seemingly bottomless pit. Though a shift of tone (from hawk to dove) may be enough to reignite the speculative tech rally, nobody should expect another boom. Many fallen growth stars will never see their highs again. Others may not be listed on public markets as their debt loads and rising interest payments get the better of them.

Still, TWLO and ZM have potential. Let’s take a look at each company.

Twilio (TWLO)

Twilio is a communication platform software company that imploded almost as quickly as it rose. Despite the more than 85% implosion in the stock from peak to trough, Twilio is still up around 131% over the past five years. Investors got way too excited in 2020 and 2021 as they bid the stock into the sky, only to pave the way for a historic crash.

Unlike many other unprofitable growth companies, Twilio has many exciting innovations behind the scenes. By shunning all fallen tech stars, you may miss out on Twilio’s growing roster of leading CPaaS (Communication-Platform-as-a-Service) products.

With a cautious guide (calling for around 30% revenue growth) for the third quarter, investors seem to be bracing for more pain. It’s hard to believe that Twilio can fall any further from here. While 30% is respectable growth for any firm, it’s less than half of the growth it posted in 2021.

It’s been a sharp growth slowdown, and GAAP profits are still nowhere to be found. A recession-induced dip in ad spending could continue to weigh on growth. Regardless, those with faith in Twilio’s tech should give the name a second look at 4.1x sales before recession fears peak. Twilio’s price-to-sales multiple is far less than most so-called “value” stocks with zero growth!

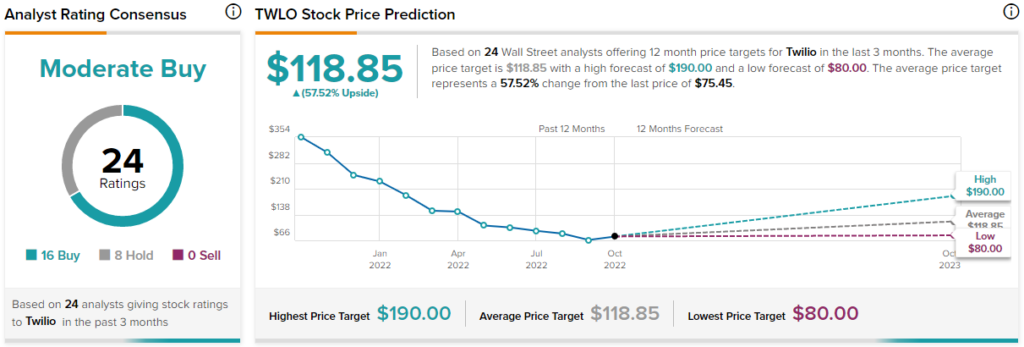

Is TWLO Stock a Buy, According to Analysts?

Turning to Wall Street, TWLO stock comes in as a Moderate Buy based on 16 Buys and eight Hold ratings assigned in the past three months. The average TWLO stock price target of $118.85 implies 57.5% upside potential.

Zoom Video Communications (ZM)

Zoom Video is crashed stock with a great product many of us still use today. Zoom and its video-conferencing platform helped many of us stay connected during lockdowns. Though offices have reopened, many workforces continue to operate remotely or with a hybrid work model.

The real opportunity for Zoom lies in creating parallel offerings (email and digital calendars) that it can upsell to enterprise customers. Down 86% from its all-time high of $588.84 per share, investors seem to doubt that Zoom has anything that the competition can’t replicate.

The collaboration software scene is crowded, and as a smaller player, Zoom feels more of the impact of higher interest rates and the strong U.S. Dollar. Zoom may still be a massive part of our work lives, but as corporate budgets tighten, I expect Zoom may have few options to reignite the hype.

After such a vicious plunge, Zoom stock trades at 5.6x sales and 23.1x trailing earnings. As macro headwinds intensify, it’s tough to gauge how much each multiple can expand. Regardless, I do think most of the damage has been done. When Zoom stock will come zooming back, though, remains unclear.

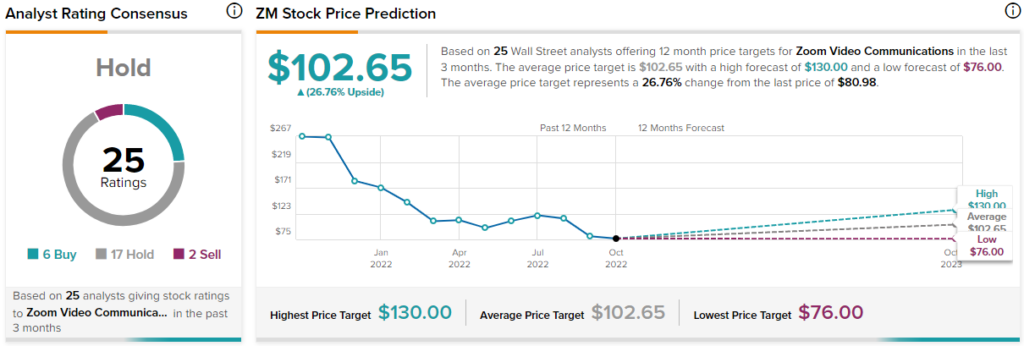

Is ZM Stock a Buy, According to Analysts?

Overall, ZM stock has a Hold consensus rating based on six Buys, 17 Holds, and two Sells assigned in the past three months. The average ZM stock price target of $102.65 implies 26.8% upside potential.

Conclusion: TWLO and ZM Have Solid Potential

Twilio and Zoom stocks are two intriguing plays in the tech wreck that aren’t going anywhere. Both companies face tremendous challenges as we enter a recession, but at such bargain-basement multiples, there’s a good possibility that the risk/reward favors the dip buyer.