The large U.S. banks are well-capitalized and have strong liquidity. However, this didn’t stop investors from dumping their shares following the failure of SVB Financial Group (NASDAQ:SIVB).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shares of JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Bank of America (NYSE:BAC), and Wells Fargo (NYSE:WFC) closed about 7%, 7.7%, 11.4%, and 11.7% lower over the past week.

The decline in prices of top banks comes despite the regulators like the U.S. Fed, Treasury Department, and Federal Deposit Insurance Corp. stepped up their efforts to protect customer deposits and restore confidence in the overall banking system.

Even though there are no contagion risks to these large banks from the SIVB fallout, investors’ sentiments could continue to remain weak on the sector as a whole.

Given investors’ negative sentiment, shares of First Republic Bank (NYSE:FRC) crashed in the pre-market session today despite management’s efforts to bolster liquidity in the business.

This shows that investors’ sentiments won’t change overnight. However, any sharp pullback in the shares of fundamentally strong banks could be a buying opportunity for long-term investors, as these corporations are well-capitalized and can access emergency funds under the Fed’s new Bank Term Funding Program.

Using TipRanks’ Stock Comparison tool, let’s check which of these large bank stocks could be a solid addition to investors’ portfolios.

Which Is the Best Bank Stock to Buy?

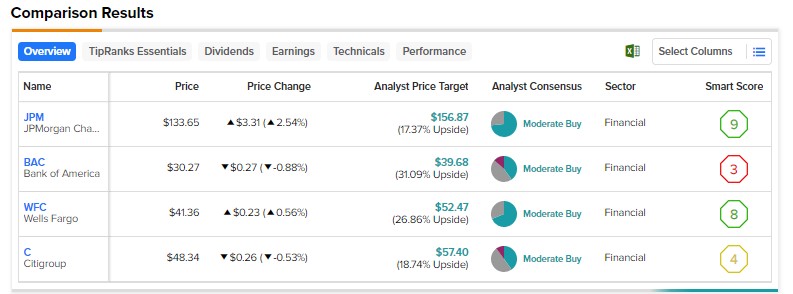

TipRanks’ Stock Comparison tool shows that analysts are cautiously optimistic about the large banks, with all these stocks sporting a Moderate Buy consensus rating.

However, JPM and WFC stocks carry a Smart Score of nine and eight, respectively, on TipRanks. This means they are more likely to beat market averages. Further, analysts’ average price targets show a decent upside in both of these stocks. On the contrary, BAC stock has an Underperform Smart Score of three. At the same time, Citigroup stock has a Neutral Smart Score of four.