Shares of top chipmakers, including Advanced Micro Devices (NASDAQ:AMD), Intel (NASDAQ:INTC), and Nvidia (NASDAQ:NVDA), have eroded investors’ wealth in 2022. The slump in consumer demand and lower average selling prices are taking a toll on their financials and stock price. Amid challenges, Robert W. Baird analyst Tristan Gerra suggests investors stay away from PC-centric companies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Gerra wrote, “We would continue to stay away from PC-centric names, which within our coverage list include AMD, INTC, and NVDA, due to a likely prolonged PC downturn into next year and continued weakness in consumer gaming.”

While Gerra remained sidelined on the shares of these chipmakers, AMD’s lackluster Q3 performance further strengthened his view. Notably, AMD announced preliminary numbers for Q3, wherein its revenue of $5.6 billion came about $1.1 billion lower than its prior expectations. AMD blamed a weaker-than-expected PC market and inventory correction actions across the PC supply chain for the underperformance.

Gerra reduced his price target to $65 from $100 on Advanced Micro Devices stock following the preliminary Q3 numbers. He maintains a Hold recommendation on AMD stock.

Earlier, Susquehanna analyst Christopher Rolland also warned investors about the prolonged weakness in the PC market. Rolland lowered his price target on AMD, NVDA, and INTC stocks.

Given the challenges, let’s see what Wall Street recommends for these chipmakers.

Is Advanced Micro Devices a Buy, Sell, or Hold?

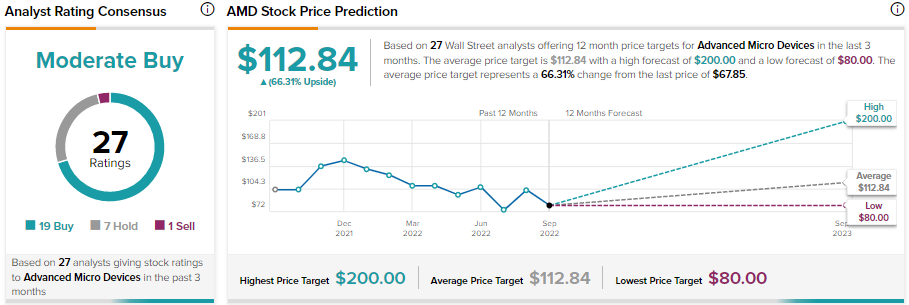

Wall Street analysts are cautiously optimistic about AMD stock. It has received 19 Buys, seven Holds, and one Sell rating for a Moderate Buy consensus rating. Further, analysts’ average AMD price target of $112.84 implies 66.3% upside potential.

Meanwhile, Advanced Micro Devices stock has a Neutral Smart Score of five out of 10 on TipRanks.

What is the Prediction for Nvidia Stock?

Similar to AMD, analysts are cautiously optimistic about Nvidia stock. NVDA commands a Moderate Buy consensus rating on TipRanks based on 24 Buys and nine Holds. Moreover, these analysts’ average price target of $206.81 implies 57.5% upside potential.

Meanwhile, Nvidia stock has an Outperform Smart Score of eight out of 10 on TipRanks due to its AI (Artificial Intelligence) capabilities and momentum in the Data Center business.

What is the Prediction for Intel Stock?

The overall weakness in the PC market is keeping analysts sidelined on Intel stock. INTC stock sports a Hold consensus rating on TipRanks based on four Buy, 16 Hold, and eight Sell ratings. Meanwhile, analysts’ average price target of $37.76 implies 38.9% upside potential.

INTC has a Neutral Smart Score of 5 out of 10.

Conclusion

The industry is in the middle of a correction following the solid demand it witnessed during the pandemic times. Prolonged weakness in demand (both from consumers and enterprises), lower selling prices, and an uncertain macro environment will likely play spoilsport in the short term.