This week sees several of the FMAANG gang deliver their latest earnings, and so will Meta (NASDAQ:META), which will announce Q1’s financials after the close on Wednesday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to RBC analyst Brad Erickson, however, “some eyebrow-raising 11th hour channel feedback” could potentially put a spanner in the works.

Erickson notes that in the second half of March, Meta made some important platform changes regarding data processing & attribution, and in turn, since the tail end of Q1 and into early Q2, around 50% of his industry contacts have noticed “unexpected ROAS (return on ad spend) and/or CPA (cost per action) deterioration.” These issues were not evident to Erickson on his earlier checks, which took place between March 28-April 3rd.

“Thus,” says the 5-star analyst, “our suspicion is our prior checks likely captured a bit more optimism about Q2 indications than what’s transpired in the 2+ weeks since. Responses around drivers being META-specific vs. macro were mixed though our bias suggests it was more META than others.”

Although historically, Erickson says it is not unusual for Meta to exhibit some late quarter “performance volatility,” compared to those seen in the past, this disruption “seemed a bit more persistent.” Therefore, heading into the quarterly readout, Erickson’s bias “leans more cautious.”

That said, Erickson also thinks there’s a possibility the outsized under-performance maybe due to the fact the platform changes coincided with “some transitory consumer weakness” that came in the wake of the banking crisis.

Furthermore, zooming out, Erickson still sees plenty to be upbeat about when considering META’s prospects.

“We continue to like the name on critical directional improvements in conversion, campaign performance & measurement relative to last year with an upcoming acceleration/margin expansion narrative still intact,” the analyst summed up,

How does this translate to investors? Erickson reiterated an Outperform (i.e., Buy) rating to go alongside a $225 price target. Considering the shares are already up by 77% year-to-date, there’s modest upside of 6% from current levels. (To watch Erickson’s track record, click here)

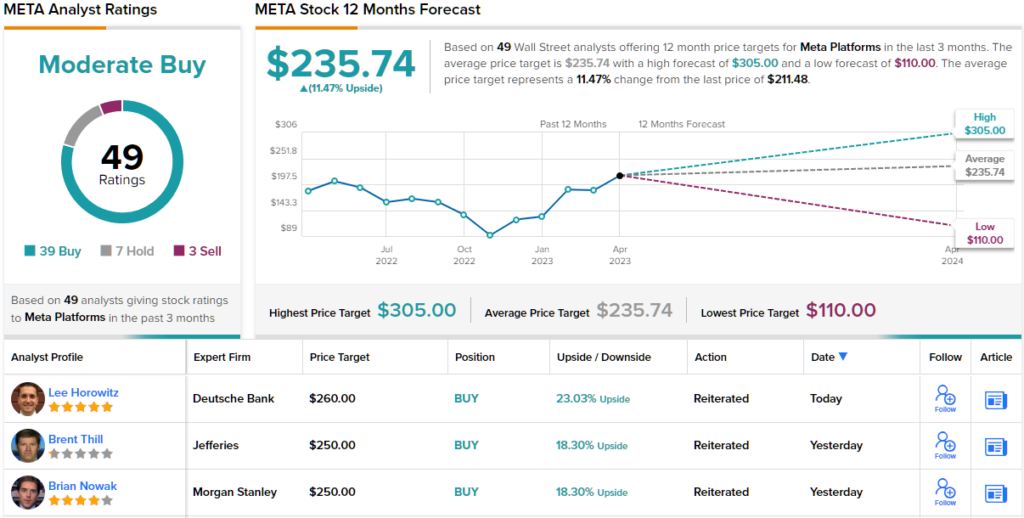

Elsewhere on the Street, the stock garners an additional 38 Buys, 7 Holds and 3 Sells, for a Moderate Buy consensus rating. The forecast calls for 12-month returns of 11.5%, given the average price target clocks in at $235.74. (See Meta stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.