Investors seem to have greeted the new year with a sense of optimism. The general direction has so far been up; after all, things can’t really get much worse than they were in 2022, can they?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Well, not so fast, seems to be one financial expert’s take on the matter. Anna Han, equity strategist at Wells Fargo, finds the upbeat mood “odd,” claiming the only reason for the risk-off sentiment is based on the sense things are not as terrible as we were told they would be and comes off the back of seriously depressed sentiment. “Seeing that not as bad as feared sort of tone is helping equities rally,” she says, before cautiously adding, “I think this risk appetite is more likely to be fleeting than long-lasting.”

Is Wall Street in for a major reality check, then? With so much uncertainty hanging in the balance, it’s hard to know for sure, but that’s not to say investors should start playing the waiting game.

Wells Fargo stock analysts argue that a select few stocks actually stand to gain, pointing to two names in particular that represent exciting opportunities. We’ve used TipRanks’ database to find out what makes them interesting Buys. Here are the details.

Corteva, Inc. (CTVA)

A financial market storm might be brewing, but for pure-play agriculture companies, a real one could come to good use. Corteva is a manufacturer of commercial seeds and agricultural chemicals. Previously a part of DowDuPont, the agricultural sciences division was spun off in 2019 as a separate public company. With its large selection of high-yield seed brands and comprehensive line of crop protection agents, such as insecticides, herbicides, fungicides, Corteva’s offerings help farmers enhance output and productivity. With a market cap of $45.6 billion, the company is an Ag industry giant.

Corteva will release 4Q22 earnings later this week (Thursday, Feb 2), but we can look at the Q3 results to get a picture of the company’s finances. In the September quarter, revenue climbed by 17.3% year-over-year to $2.78 billion, beating the Street’s forecast by $200 million. Adj. EPS of -$0.12 also came in some distance ahead of the -$0.22 forecast.

For the outlook, the company reiterated its FY 2022 guidance for revenue between $17.2 billion to $17.5 billion (consensus had $17.31 billion) and said it now anticipates operating EBITDA will be in the $3.00 billion to $3.10 billion range compared to the previous forecast of $2.95 billion to $3.10 billion.

Plenty of stocks suffered badly in 2022’s bear but Corteva was not one of them, the shares saw out the year 24% into the green.

That is hardly a surprise to Wells Fargo’s Richard Garchitorena, who rates Corteva as a ‘top pick’ in the Ag sector, with a “clear path to double-digit earnings growth through 2025, an innovative growth pipeline, and positive Ag sector fundamentals.”

Expounding further, Garchitorena said, “We expect strong grain prices through the next few years supported by strong Ag fundamentals. CTVA is the only diversified pure-play company in Ag offering investors both seed and crop protection (CP) exposure without non-related businesses (i.e., healthcare) or cyclical fertilizer exposure, providing attractive exposure to investors in a difficult Industrials and Materials outlook for 2023.”

Garchitorena didn’t just write up an upbeat outlook on CTVA; he backed it up with an Overweight (i.e., Buy) rating and a $78 price target that showed his confidence in ~22% upside for the year ahead.

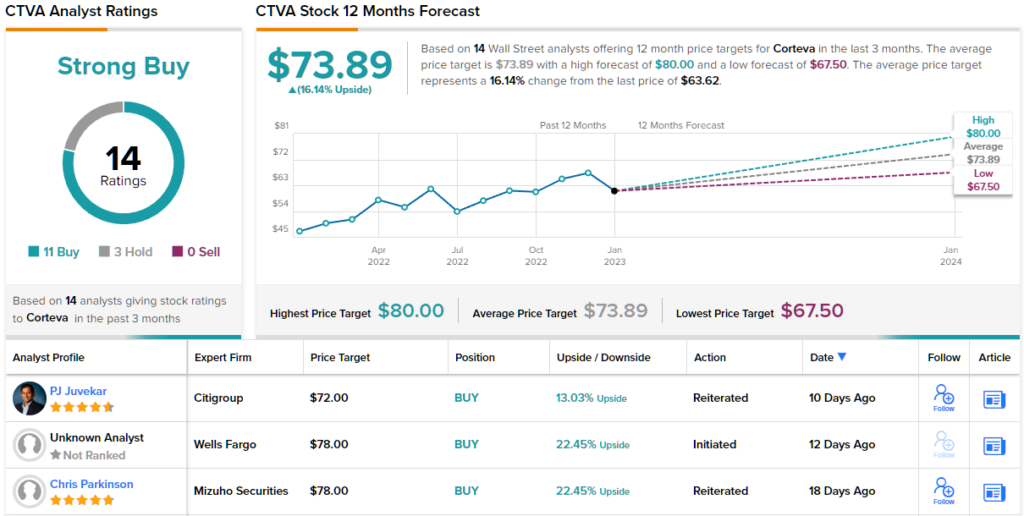

It looks like most of Garchitorena’s colleagues agree with his stance; the stock claims a Strong Buy consensus rating, based on 11 Buys vs. 3 Holds. The average target stands at $73.89, suggesting the shares will rise by 16% over the coming year. (See CTVA stock forecast)

Caesars Entertainment (CZR)

Formed in July 2020 as a result of the merger of Caesars Entertainment and Eldorado Resorts, Caesars Entertainment is a leading US gaming operator. Based in Reno, Nevada, the business is firmly established in Las Vegas and a big player in regional gaming too. In addition to its portfolio of hotels, casinos and entertainment venues, the company provides online sports betting, and iGaming services. Leading brands include Caesars Palace, Harrah’s, Eldorado, and Tropicana, amongst a host of others.

In its latest quarterly report, revenue clocked in at $2.9 billion for a 7.8 year-over-year increase and coming in $70 million above consensus while EPS of $0.24 just edged ahead of the $0.23 forecast. Same-store Adjusted EBITDA of $1 billion improved on the $880 million delivered in the same period a year ago.

More recently, the company said it expects to beat consensus revenue expectations for Q4. The company sees revenue coming in between $2.811 billion and $2.831 billion – higher than Street expectations of $2.776 billion. Caesars will release the full Q4 results on February 21.

The update has helped the stock push ahead in January, and the shares have already notched year-to-date returns of 26%. Wells Fargo’s Daniel Politzer thinks there are more on the way and highlights why investors should get on board.

“Regional EBITDA and margins have been resilient, and while macro fears remain, we believe that CZR has company-specific growth drivers for 2023 that should offset a regional slowdown (Danville, Columbus NE, Hoosier Park, etc.). We like the setup for 2023, as CZR is executing well across land-based, Digital EBITDA losses should further moderate (and inflect during the year), and sentiment is still mixed,” he explained. “CZR trades at a discount to peers, with a current cash flow yield of ~18% in 2024E is cheap on a historical and relative basis. We believe it is a good bet for investors looking for broad gaming exposure in the US.”

To this end, Politzer rates CZR an Overweight (i.e. Buy) to go alongside a $74 price target. This target conveys his confidence in CZR’s ability to climb ~42% from current levels. (To watch Politzer’s track record, click here)

Overall, CZR gets robust support from the rest of the Street, too. The stock claims a Strong Buy consensus rating based on 6 Buys vs. 2 Holds. At $62.38, the average target is set to yield returns of 19% in the year ahead. (See CZR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.