Shopify (NYSE:SHOP), a leading global e-commerce solutions provider, has disrupted online shopping over the last decade with its innovative subscription model. However, on the back of a 107% price increase in the last 12 months, Shopify stock lacks a margin of safety today, which calls for investors to be cautious at these prices. Although the company is moving in the right direction to expand its target market, I am neutral on Shopify based on valuation concerns.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Profitable Growth: Shopify’s New Mantra

Shopify has been one of the fastest-growing tech companies in the last decade, and the company, until recently, followed a strategy of growth at any cost. Aided by this aggressive strategy, Shopify’s revenue grew from just $50.3 million in 2013 to $5.6 billion in 2022, which is a testament to how the company has grown in leaps and bounds. Despite stellar revenue growth, though, the firm has failed to maintain profitability.

Today, Shopify is changing its strategy to strike a balance between growth and profits, which is an encouraging sign.

After struggling to compete with Amazon (NASDAQ:AMZN) to gain market share in the fulfillment services sector, the company decided to sell most of its Logistics assets to Flexport last May. This deal marked the first step in Shopify’s journey to prioritize its E-Commerce business while distancing itself from unprofitable business operations.

After a major slump in operating income that pushed Shopify into losses, the company made a strong comeback in the third quarter to report just over $120 million in operating income. This marked the first positive operating income after six consecutive quarters of losses. This notable improvement was supported by a 23% year-over-year decline in operating expenses supported by a lower headcount and the sale of its Logistics business.

Shopify reported free cash flows of $276 million for the third quarter as well, or 16% of revenue, which is a testament to the company’s strong comeback. With a long runway to grow globally, Shopify’s focus on profitability is exciting, as it will pave the way for the company to grow sustainably, creating long-lasting shareholder wealth in the process.

New Partnerships to Drive Growth

After divesting its Logistics business, Shopify partnered with Amazon during the third quarter to offer fast and free Prime delivery for its merchants. Joining hands with Amazon’s Buy with Prime program, Shopify offers the best of both worlds to merchants where they get to customize their stores and maintain personalized branding while benefiting from the wide reach and industry-leading logistics network owned by Amazon.

Shopify is reportedly partnering with X, formerly Twitter, to drive sales as well. The official X Business account announced on January 10 that X and Shopify will partner to bring seamless integration of e-commerce onto the social media platform. This marks a big win for Shopify, as its merchants and products will have the opportunity to sell to a massive new audience with this collaboration.

During the third quarter, Shopify signed a commercial agreement with Flexport to offer fast, affordable, and reliable logistics solutions to its merchants. This new partnership will offer Shopify merchants all the benefits of a strong logistics network without the company having to bear the costs of maintaining such a network.

Overall, Shopify is making steady progress with its partnership strategy to expand into new markets while offering value-accretive solutions to its merchants. All this comes without a hit to the company’s financial health, which is the real highlight.

Keeping a Foot on the Investment Pedal

Despite focusing on managing costs, Shopify has not committed the cardinal sin of abandoning planned investments to grow the business. The company is investing in the future with a few key focus areas.

First, Shopify is enhancing its platform to provide a more personalized experience. These investments should help retain merchants in the long run, leading to long-lasting competitive advantages.

Second, the company is investing in machine learning and AI technology to improve fraud detection technology and the underwriting process, in addition to integrating these technologies to enhance Shopify Payments.

Shopify has grown rapidly in recent years to serve multi-billion-dollar enterprises, but small- and medium-sized enterprises still contribute a meaningful share of revenue and profits. Investments to improve the underlying technology stack used by Shopify will help the company retain these customers in the long run, as they are offered an unbeatable value proposition.

Third, Shopify is investing in new features to enhance the functionality of its platform. A good example is the company’s investments in building a more secure and efficient checkout experience. After launching Checkout Extensibility, an all-new checkout customization option for merchants, the company has received favorable feedback from merchants, as it can handle higher volumes of transactions seamlessly.

Is Shopify a Buy, According to Analysts?

With Shopify stock registering stellar gains in the last 12 months, some analysts have turned cautious in the last couple of months. JMP Securities analyst Andrew Boone downgraded Shopify on December 18, citing concerns about the company’s potential to improve gross margins in the coming years at a time when the bulk of GMV growth is expected to come from its Enterprise business. The analyst believes the current valuation of the company leaves little room for error.

Wedbush Securities analyst Scott Devitt also downgraded Shopify last month after raising his price target to $68 from $66, citing limited room for its earnings multiple to expand and the absence of a catalyst to drive the stock price higher. Before that, Piper Sandler analyst Clarke Jeffries downgraded Shopify in November, citing valuation concerns.

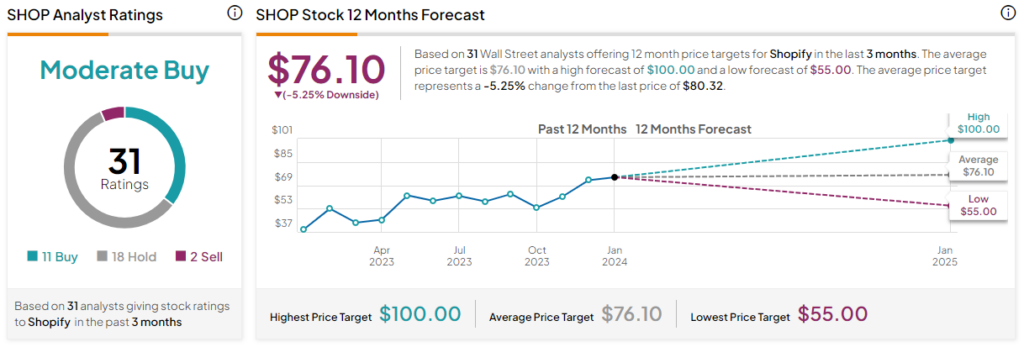

Based on the ratings of 31 Wall Street analysts, SHOP stock comes in as a Moderate Buy. The average Shopify stock price target is $76.10, which implies downside risk of 5.25% from the current market price.

The Takeaway: Shopify is Perfectly Priced

Shopify is trying to strike a balance between growth and profitability, which is encouraging. The company’s recent financial performance, on the other hand, serves as a testament to the successful execution of its cost-reduction strategy. Even more encouragingly, the company continues to focus on strategic investments to drive future growth. All that said, Shopify seems to be valued fairly in the market, which leaves no margin of safety to invest in the company today.