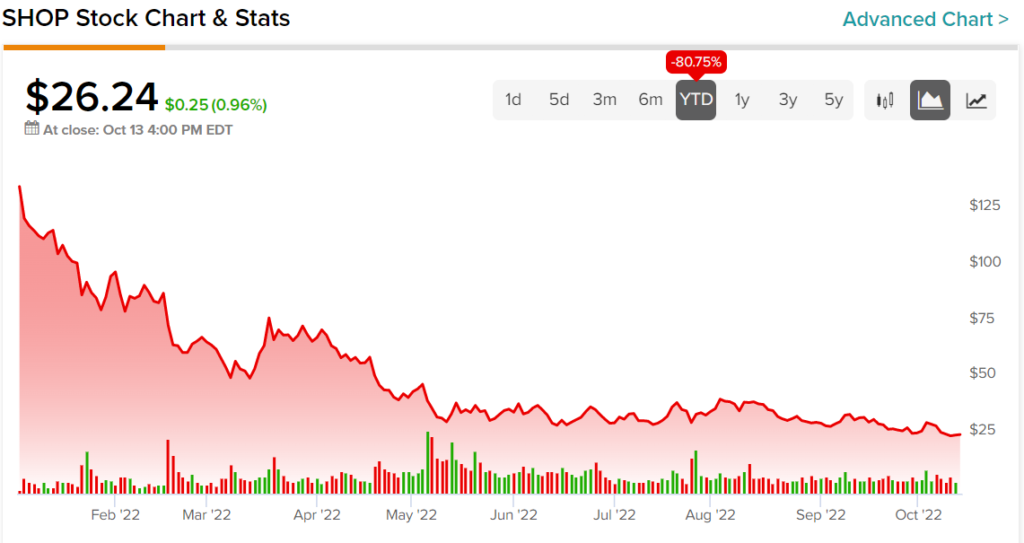

Shopify stock (NYSE:SHOP) (TSE:SHOP) has seen its gains reversed this year, as the e-commerce giant got hit by an unexpected slowdown in demand. The resulting slump in its earnings performance is one of the main reasons why its shares are down over 80% this year. Once trading at more than $150 per share, it currently hovers around the mid-$20 range. Moreover, hedge fund managers are selling off investments in SHOP stock. Hence, we are bearish on SHOP stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shopify’s outlook looks murky, with consumers choosing offline instead of online channels of late. Its former glory is long gone, and the company has fallen from its pedestal. Moreover, with growth and profitability numbers expected to be weak in the upcoming quarters, it’s best to avoid SHOP stock for now.

Shopify is changing the way people buy and sell products online. It’s a simple yet powerful platform that helps you set up your own store with all of its features, from processing payments to managing marketing campaigns without much hassle. Shopify is no longer just a platform for small businesses with niche markets but has also become popular among large businesses.

The bulls argue that the company’s expansion plan will allow it to lock in customers and grow even more. They also believe that their integrated payment system, dedicated fulfillment network, and POS systems guarantee an incredible growth runway.

However, the competitive pressures in its niche and its growth drivers in the post-pandemic world have us worried, at least for the near term. I agree with my colleague Steve Anderson that despite its relatively attractive valuation, SHOP is a dangerous proposition at this time.

Shopify’s Top-Line Growth is Declining

The growth rate of Shopify’s sales has slowed significantly of late. Although it grew at a three-year compound annual growth rate of over 50%, its growth was just 16% in its most recent quarter. The company’s management team attributes this drop in consumer spending on e-commerce to a return to more traditional shopping patterns. This is compared to the earlier phases of the pandemic that occurred throughout North America and much of Europe.

It’s been a tough year for the business, with slower growth predicted in key metrics like sales volumes and merchant enrollments, but it still expects these areas will grow over time. However, as company president Harley Finkelstein says, “We overshot our prediction.”

Shopify is in a tight spot. The company’s cash flow has turned negative, largely thanks to management’s bold bets on growth that didn’t materialize this year. Its recent $38.5 million loss in adjusted earnings is a stark contrast from last year when it pulled out a $300 million profit. The company has been cutting costs, and it’s imperative to watch for developments on this front in the upcoming quarters.

The company spent $846 million on operating expenses this year, a 76% growth from last year. Its recent layoffs will help them regain profitability, but it is still facing challenges soon. The handsome severance packages that laid-off employees received may impact a few quarters before we see any operating margin improvement. That’s not great news for investors, but it’s best to wait and see what the third quarter offers.

The future of Shopify is looking bleak. With revenue and gross margins continuing to suffer, it’s unclear how this company can bounce back from its rough year so far.

Is Shopify Stock a Buy?

Turning to Wall Street, SHOP stock maintains a Moderate Buy consensus rating. Out of 23 total analyst ratings, 11 Buys, 12 Holds, and zero Sells were assigned over the past three months. The average SHOP price target is $42.61, implying 62.4% upside potential. Analyst price targets range from a low of $30 per share to a high of $75 per share.

Takeaway: Shopify Stock Will Continue Facing Headwinds

The Shopify business model makes it difficult to stay profitable as costs are growing faster than gross profits. Shopify’s revenue growth could potentially be reignited, and they may achieve higher gross margins on their existing revenues. However, the company faces strong headwinds in its e-commerce business, making the scenario difficult.

The future of Shopify is cloudy, with its competitors looming large. For instance, e-commerce player MercadoLibre has been growing significantly quicker than Shopify but trades at just four times this year’s sales.

It’s true that SHOP stock has shed a ton of value as of late and appears more attractive than ever. However, it still trades at over six times forward sales, significantly higher than its peers. Given its murky outlook, it will likely fall a fair bit more before it can mount a comeback. Investors will have to wait a while before seeing positive earnings and cash flow with Shopify. It’s best to wait until shares drop even further before wagering on SHOP stock.