Shopify (SHOP) stock has gotten off to a good start this week, with the shares pushing higher at Monday’s open. Investors appear to be applauding the Black Friday GMV (gross merchandise value) numbers, which have come in above Street expectations for Q4.

The Canadian ecommerce company delivered GMV of $3.36 billion, amounting to a 17% year-over-year uptick, while the Street’s growth expectations for Q4 GMV stand at 8.5%.

Although Deutsche Bank’s Bhavin Shah views the healthy figures as a “slight positive” and is not surprised by the positive reaction, he warns investors that while this single datapoint “suggests some upside” to Q4 GMV, they should not to get too carried away for several reasons: “(1) this is only one day from the overall weekend and BF typically represents mid-40’s percent of BFCM; (2) BF typically represents 5 to 6% of a given 4Q; (3) prior BFCM growth rates have not been the best indicator of 4Q performance; and most importantly (4) we believe this year could be facing an easier compare as last year saw holiday deals start earlier in November with many retailers/ecommerce vendors calling out an elongated selling season (last year BF growth of +21% y/y compared with 4Q21 GMV performance of +31%).”

As such, there’s no change to Shah’s Q4 GMV estimate which stays at $59.4 billion and suggests a 10% increase on the same period last year (compared with Black Friday’s 17% gain).

With Cyber Monday still at play and those figures available on Tuesday, Shah notes that the full set of numbers could provide a slightly better indication of the quarter’s performance, although he does add that the previous 3 years’ Black Friday year-over-year growth has more or less been the same as the BFCM y/y growth.

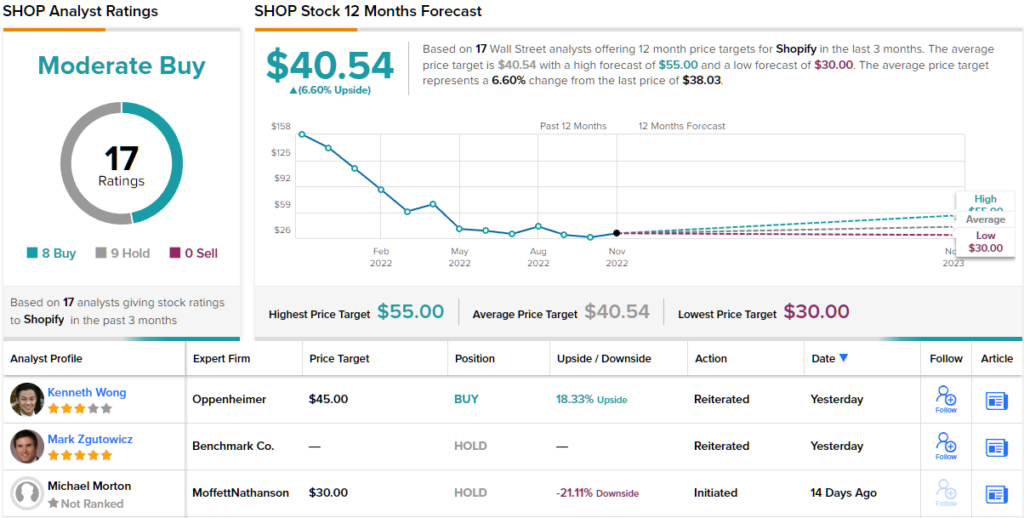

Down to business, then, what does it all mean for investors? Shah remains on the sidelines for now, rating SHOP a Hold (i.e., Neutral), along with a $40 price target. (To watch Shah’s track record, click here)

Overall, the Street is evenly split on this one; the stock claims a matching 8 Buys and Holds, each, to claim a Moderate Buy consensus rating. The forecast calls for one-year gains of ~7%, considering the average target stands at $40.54. (See Shopify stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.