Shares of SFL Corporation (NYSE:SFL) have declined notably since mid-February, pushing the stock’s dividend yield to a massive 10.5% (on a forward basis). While such a high yield could indicate that the underlying dividend is risky, this is hardly the case for SFL. Not only is the company’s dividend highly protected by its multi-year charter backlog, but SFL’s successive dividend increases should also dispel any concerns investors might previously have regarding its coverage.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

SFL is a shipping company that owns, operates, charters, purchases, and sells a fleet of vessels and offshore-related assets. Its impressive charter backlog and substantial yield act as a potent countermeasure to the current market volatility.

The charter backlog provides a high degree of cash-flow visibility several years into the future, while the 10.5% yield offers investors a predictable and hefty tangible return to shareholders. Both factors reduce ambiguity in the stock’s investment prospects. Consequently, I am bullish on SFL stock.

How Does SFL’s Fleet Produce Stable Cash Flows?

SFL’s ability to generate remarkably consistent results is attributable to two primary factors: the diversity of its fleet and management’s long-term charter approach. Together, these pillars make it possible for the company to uphold its substantial dividend.

The Benefits of Fleet Diversity

SFL boasts a fleet that stands out in the shipping industry due to its diversity. Unlike most shipping companies that tend to concentrate on a particular type of vessel, such as containerships or oil tankers, SFL’s fleet spans various asset classes. The company owns a remarkable mix of vessels, including 17 oil tankers, 15 dry bulk carriers, 36 container vessels, seven car carriers, and two ultra-deepwater drilling units.

Precisely because of owning such a diverse fleet that is exposed to a multitude of asset classes, the company’s results don’t fluctuate as wildly as we usually see with its single-class vessel owner peers. For instance, a period of low demand for dry bulk vessels with below-average rates can be offset by high demand for containerships with above-average rates.

Therefore, despite the inherent volatility in each sub-industry, SFL’s diversified fleet can minimize the erratic swings experienced by each asset class.

The Benefits of SFL’s Chartering Strategy

SFL does not operate its own vessels. Instead, it opts to charter (lease) them out for extended periods, which has its advantages and disadvantages. The upside of this approach is that it ensures consistent and predictable cash flows, regardless of how drastically spot rates for various asset classes may fluctuate.

Conversely, SFL may miss out on potentially lucrative opportunities. For instance, during 2020-2021, containership rates reached exorbitant heights, but SFL’s containerships were tied up in long-term leases. This same scenario is unfolding today with SFL’s tankers, which remain locked into fixed rates while the spot market is experiencing a surge.

Therefore, while SFL’s results tend to follow long-term industry trends as charters have to eventually be renewed, the company’s performance tends to be quite stable.

Robust Results in the Face of Volatility

Last year’s results demonstrated the effectiveness of SFL’s fleet diversity and chartering strategy, even in the face of volatility within the shipping industry. The pandemic-driven surge that previously boosted containership rates had collapsed, but tanker rates skyrocketed due to sanctions on Russian energy, leading to an increase in demand for longer voyages.

Despite each individual asset class experiencing wild rate swings, SFL’s multi-year charter backlog kept providing stable cash flows in line with each contract’s agreed rates. Total revenues for the year came in at $670.4 million, 30.5% higher than fiscal 2021’s $513.4 million. The increase wasn’t impacted by swings in the spot rates. Instead, it is attributed to a larger fleet following vessel acquisitions, some of its older contracts rolling over to newer ones at higher rates, as well as higher revenues from SFL’s profit-sharing ventures.

Following higher revenues, SFL’s earnings per share grew by a significant 18.5% to $1.60 despite a higher share count due to equity issuances to fund its vessel acquisitions.

How Safe is SFL’s 10.5%-Yielding Dividend?

In my view, SFL’s 10.5%-yielding dividend is quite safe for several reasons. Firstly, the annualized dividend per share of $0.96 represents a payout ratio of approximately 60% based on Fiscal 2022’s earnings per share of $1.60. Earnings are set to grow further this year as a result of some of the company’s charters rolling over to higher rates, which should further enhance this metric.

Secondly, SFL’s current charter backlog has a weighted average term of 6.6 years, which means that cash-flow visibility is exceptional. During this period, some charters will roll over to lower rates, while others will roll over to higher rates. However, over time, these rates should average out, resulting in relatively stable results.

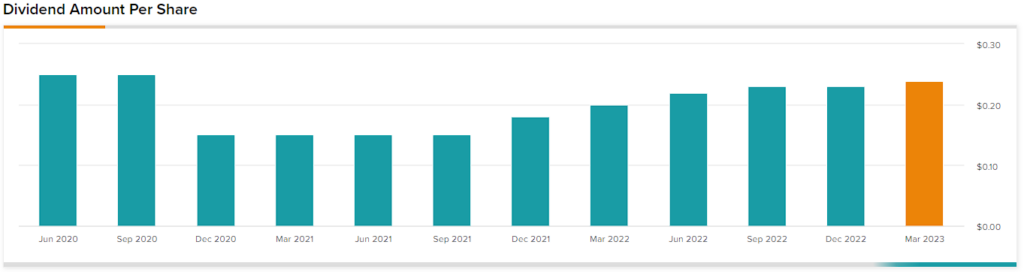

Thirdly, along with its most recent Q4 results, SFL announced a 4.3% dividend increase, which marks the fifth dividend hike in just two years. The fact that management continues to increase dividends despite the already high yield should reassure investors of the sustainability of payouts and management’s confidence in future earnings.

Is SFL Stock a Buy, According to Analysts?

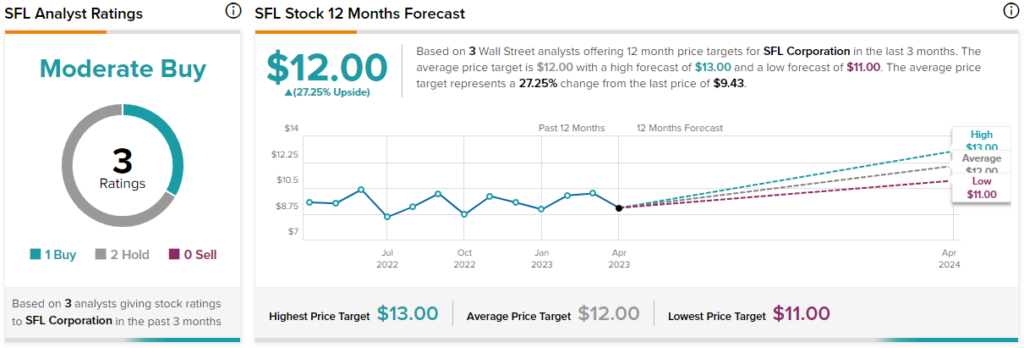

Turning to Wall Street, SFL Corporation has a Moderate Buy consensus rating based on one Buy and two Holds assigned in the past three months. At $12.00, the average SFL Corporation stock forecast implies 27.25% upside potential.

The Takeaway

Although SFL’s 10.5% yield may appear unsafe at first glance due to its magnitude, the company’s dividend is adequately covered by earnings. Moreover, earnings are expected to grow further this year, while SFL’s multi-year backlog implies continued robust performance over the medium term. Given SFL’s hefty dividend and tremendous cash-flow visibility, the stock is likely to be an ideal pick for income-oriented investors seeking exposure to an alternative industry.