Senseonics Holdings, Inc. (SENS) engages in the design, development, and commercialization of implantable continuous glucose monitoring systems for people with diabetes. Its primary product is Eversense, a glucose monitoring device that includes a sensor, smart transmitter, and mobile application. The company was founded in 2014.

I am bearish on SENS stock. A rally in 2021 has delivered solid gains of approximately 212%, which is not sustainable as per my analysis. Healthcare stocks are highly volatile upon releases of trials and study results, and Senseonics Holdings is not an exception. A deeper look at its fundamentals makes this stock too risky and pricey.

Senseonics Holdings Business News

The medical technology company announced that its Eversense NOW remote monitoring App for Android users received CE Mark in Europe, and it will be available during the first quarter of 2022.

“The Eversense® XL Continuous Glucose Monitoring (CGM) System is indicated for continually measuring glucose levels in persons age 18 and older with diabetes for up to 180 days. The system is intended to complement, not replace, fingerstick blood glucose (BG) measurements for diabetes treatment decisions.”

A collaboration with the University Hospitals Accountable Care Organization (UHACO) in Cleveland, Ohio, was also announced by offering the Eversense CGM System to patients with diabetes as of early September 2021. At the same time, the active review of the Eversense® 180-day PMA supplement application by the FDA is being continued.

Recent Earnings News

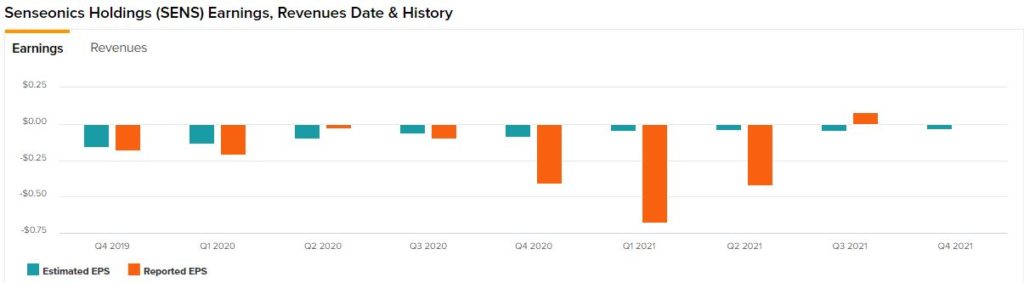

Investors looking at SENS stock earnings can easily spot a trend that is not optimistic at all. Senseonics Holdings is unprofitable. In the past eight quarters, it reported a positive figure only in the most recent quarter, with a diluted EPS figure of $0.08, beating the estimate of -$0.05.

Notable highlights for Q3 2021 were revenue of $3.5 million, compared to $0.8 million for the third quarter of 2020, an operating loss of $16 million compared to operating loss of $12.5 million in Q3 2020, and net income of $42.9 million in the third quarter of 2021, compared to a net loss of $23.4 million in the third quarter of 2020.

What makes it very interesting though this profit in Q3 2021 was that it was attributed to a very specific factor. This factor was gains of $66.3 million due to the fair value change of derivatives. In other words, it was not related to core operating activities.

Senseonics Holdings Risks

What are the key risks that make me bearish on SENS stock? First, other than the company being unprofitable, there is an unstable sales growth. In 2018, sales growth surged to 196.8%. In 2019 and 2020, sales growth was 12.6% and -76.8%, respectively.

The financial strength of the company is very poor. Senseonics Holdings has negative shareholder equity, a huge red flag. Its Altman Z-score of -5 shows the company is in a distress zone, which could lead to bankruptcy over the next two years.

Furthermore, shareholders have been substantially diluted in the past year, with total shares outstanding growing by 146% year-over-year. In Q3 2020, diluted weighted-average shares outstanding were 236.5 million. In Q3 2021, the number of shares grew to 581.8 million.

As for valuation concerns, Senseonics Holdings expects its full-year 2021 global net revenue to be in the middle of the revenue guidance range of $12.0 million to $15.0 million. With a current market capitalization of $1.22 billion, its price-to-sales ratio of 81x, taking into account the upper range of the revenue guidance, is too high.

Finally, net losses on a yearly basis have widened, which is not optimistic or supportive for the stock.

Wall Street’s Take

Senseonics Holdings has a Moderate Buy consensus rating, based on two Buys and one Hold rating assigned in the past three months. The average Senseonics Holdings forecast of $5.00 implies 83.5% upside potential.

Disclosure: At the time of publication, Stavros Georgiadis, CFA did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >