Personal computer (PC) shipments declined sharply in the third quarter due to waning demand following the spike seen earlier in the pandemic and supply chain issues. The decline spells further trouble for semiconductor stocks like Advanced Micro Devices (AMD), Nvidia (NVDA), Micron (MU), Intel (INTC), and Qualcomm (QCOM).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to research firm Gartner, global PC shipments (preliminary results) declined 19.5% year-over-year to 68 million units in Q3. This marks the fourth straight quarter of declining PC shipments and the steepest decline since Gartner started tracking the PC market in the mid-1990s.

The report highlighted that the Q3 shipments of the top three PC vendors, Lenovo (LNVGY), HP (HPQ), and Dell (DELL), declined 15.3%, 27.9%, and 21.1%, respectively.

Semiconductor Stocks Could Continue to Feel the Heat

Gartner’s report confirms the weakness indicated by AMD’s preliminary Q3 results released last week, which significantly pulled down semiconductor stocks.

AMD expects its Q3 revenue to come in at $5.6 billion, reflecting 29% year-over-year growth. This growth rate is way below the 55% growth indicated by the midpoint of the company’s previously issued outlook. AMD cited “a weaker than expected PC market and significant inventory correction actions across the PC supply chain” as the reasons for its weak Q3 revenue. The company continues to see strength in revenue from the data center, gaming, and Embedded segments.

Previously, AMD’s rival Intel reported a sharp year-over-year Q2 revenue decline of 22% due to softness in PC demand. Meanwhile, Nvidia also missed analysts’ Q2 revenue expectations due to lower sales of graphics cards for PCs.

Additionally, chip stocks declined on Monday in reaction to new export rules by the Biden administration under which companies must apply for a license if they intend to sell certain advanced computing chips or related manufacturing equipment to China. As per Reuters, Nvidia and AMD are among the major vendors that supply advanced AI chips to China. However, last week, Nvidia issued a statement explaining that it does not expect the new U.S. export controls to materially impact its business.

Let us now look at Wall Street’s ratings for three major semiconductor stocks.

What is AMD Stock Prediction?

Wall Street is currently cautiously optimistic on Advanced Micro Devices stock, with a Moderate Buy consensus rating based on 20 Buys, eight Holds, and one Sell. The average AMD stock price target of $98.21 implies nearly 70% upside potential from current levels. Shares have plunged about 60% year-to-date.

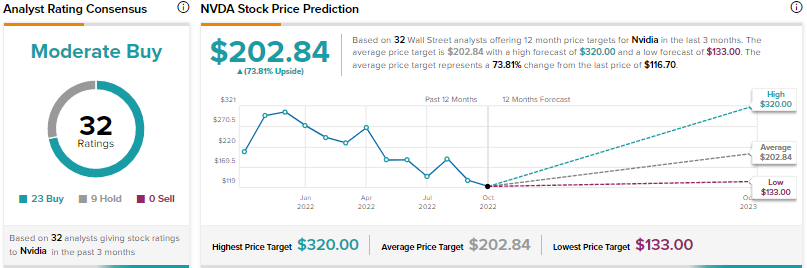

Is NVDIA Stock a Buy, Sell, or Hold?

On TipRanks, Nvidia stock scores a Moderate Buy consensus rating backed by 23 Buys and nine Holds. The average NVDA stock price prediction implies nearly 74% upside potential from current levels. Nvidia stock has tanked 60.3% so far this year.

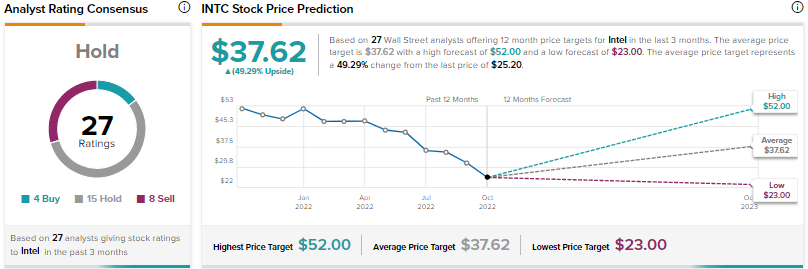

What is the Prediction for INTC Stock?

Wall Street is essentially sidelined on Intel stock. Consensus among analysts is a Hold rating based on four Buys, 15 Holds, and eight Sells. At $37.62, the average INTC stock target price suggests 49.3% upside potential. Intel stock has declined 51.1% so far this year.

Conclusion

Gartner’s Q3 PC shipment report reaffirms fears about weakness in sales of semiconductor companies even as demand in other areas like data centers remains strong amid growing digitization. Moreover, a potential recession might impact IT spending and further hurt chipmakers in the quarters ahead.