Oracle’s (NYSE:ORCL) recent earnings release drew gasps of amazement on Wall Street, with the business software giant’s bookings having gone through the roof, fueled by major multi-cloud and AI infrastructure deals. That was a signal for the stock to go parabolic, with the subsequent 36% surge representing the stock’s largest percentage gain since 1992.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

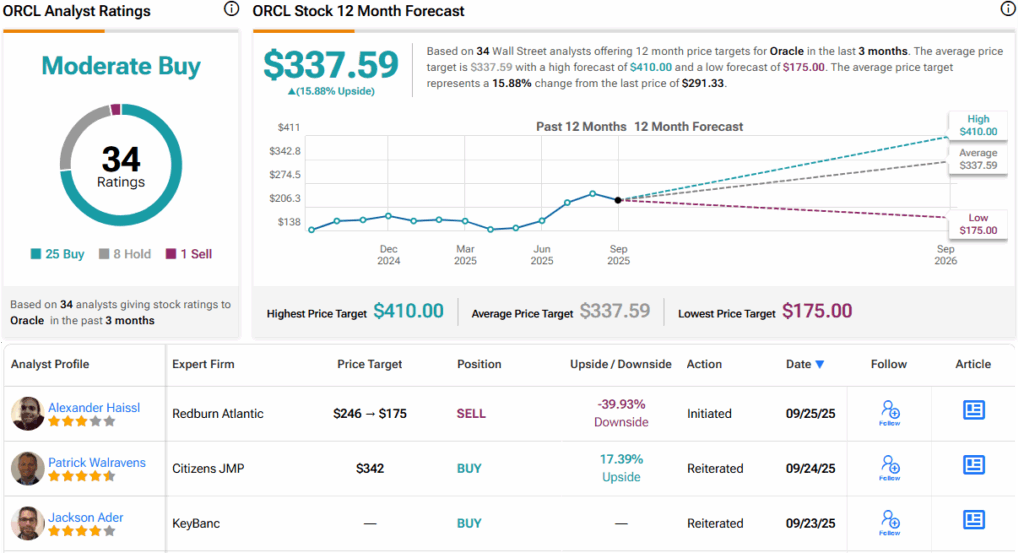

But while the print drew rounds of applause amongst plenty of Street prognosticators, one market watcher isn’t buying it. In fact, quite the opposite. Redburn Atlantic analyst Alexander Haissl has launched coverage of ORCL with a Sell rating and $175 price target, suggesting the stock will shed 40% over the next year. (To watch Haissl’s track record, click here)

Simply put, Haissl thinks the Street has got it all wrong here. “The market materially overestimates the value of Oracle’s contracted cloud revenues,” Haissl opined. “Its role in single-tenant, large-scale deployments is closer to that of a financier than a cloud provider, with economics far removed from the model investors prize.”

Haissl estimates Oracle’s five-year OCI revenue target implies about $60 billion in value, suggesting the market is already baking in a “risky blue-sky scenario” that is unlikely to play out. While investors remain focused on the “headline figures,” the analyst expects the spotlight to turn toward the “underlying economics.” Coupled with muted non-IaaS expansion – which the market seems to be discounting at present – this points to “meaningful downside risk.”

Haissl thinks it is already understood by the market that providing compute to OpenAI carries weaker margins, yet it continues to expect a Cloud 1.0-style outcome, where returns gradually improve through stronger asset utilisation and additional software layers. “That framework does not apply here,” the analyst goes on to say, “Oracle’s economics are largely fixed and contracted, with the upside accruing to OpenAI.”

Rather, this is a spread business – where profits rely on the margin between costs and pricing – and Haissl’s analysis shows this margin is thin, further constrained by OpenAI’s operational role in Stargate, which limits Oracle’s ability to “capture value.”

That’s not the only issue. Haissl says the market is also factoring in the potential upsell – Oracle positioning itself as the “platform of choice” for enterprises to deploy Generative AI applications, which could yield cloud-style economics. But for now, this remains “more narrative than reality,” as it depends on customers choosing Oracle’s cloud and on significant R&D spend to build the required tools. “At this stage,” Haissl said on the matter, “we see no evidence on either front.”

So, that’s a bear’s view, although Haissl is on his own with his negative take. The rest of the reviews split into 25 Buys and 8 Holds, for a Moderate Buy consensus rating. Going by the $337.59 average target, shares will gain 16% over the coming months. (See ORCL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.