We’re at the tail end of earnings season but the latest financial statements are still trickling in. Once the market action comes to a close on Wednesday (September 6), GameStop (NYSE:GME) will announce its fiscal 2Q23 report (July quarter).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Going by recent industry trends, Wedbush analyst Michael Pachter sees the videogame retailer delivering a top-line beat, although revenue could be impacted by a number of factors.

Positively, the June quarter saw hardware growth for both Nintendo and Sony, while Pachter calls the new software slate “compelling.” Yet on the other hand, it looks like GameStop has not only been losing market share in recent quarters, but Microsoft’s latest hardware sales have also been “underwhelming.” Furthermore, new and pre-owned software sales are being affected by the continued “digital mix shift” while on the back of a weak 1Q23, GameStop’s collectibles business is faced with a “challenging comparison.”

All the above result in Pachter expecting a “fine” Q2 showing but with several “long-term headwinds” still in place. “There is little that GameStop can do to slow unfavorable margin mix shift towards HW (hardware) and away from SW (software), nor can it slow the gradual declines of its new and pre-owned SW businesses in the face of digital, mobile, and subscription threats,” explained the analyst. “A net cash balance of around $1.3 billion should help it to remain solvent for the foreseeable future, but the long-term headwinds will likely result in cash burn growth.”

As for the dry numbers, Pachter expects net sales of $1,136 million, roughly the same as a year ago, and just below consensus at $1,141 million, while also lower than the Q1 figure of $1,237 million. On bottom-line expectations, Pachter is also below Street levels, calling for EPS of $(0.17), vs. consensus at $(0.14), and 1Q23’s $(0.14), although that is meaningfully better than the year earlier figure of $(0.35).

As for what to expect from the guide, the short answer is nothing. For the second consecutive quarter, the retailers’ favorite will skip hosting an earnings call and will not provide an outlook.

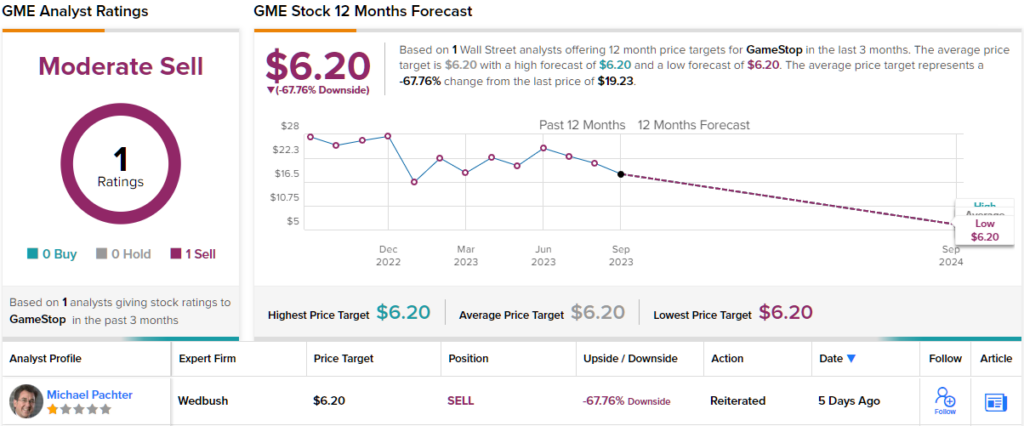

Down to business, what does it all mean for investors? Pachter sticks with an Underperform (i.e., Sell) rating, backed by a $6.20 price target. That represents a big drop of ~68% from current levels. (To watch Pachter’s track record, click here)

Pachter is currently the only one on the Street keeping a tab on GameStop’s progress, since no other analyst has posted a review over the past 3 months. (See GameStop stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.